Finance Minister Nirmala Sitharaman presented the Union Budget for 2025 in the Parliament on February 1. Key announcements made as a part of the Union Budget include a revision of tax slabs under the new tax regime and an increased limit for rebates under Section 87A.

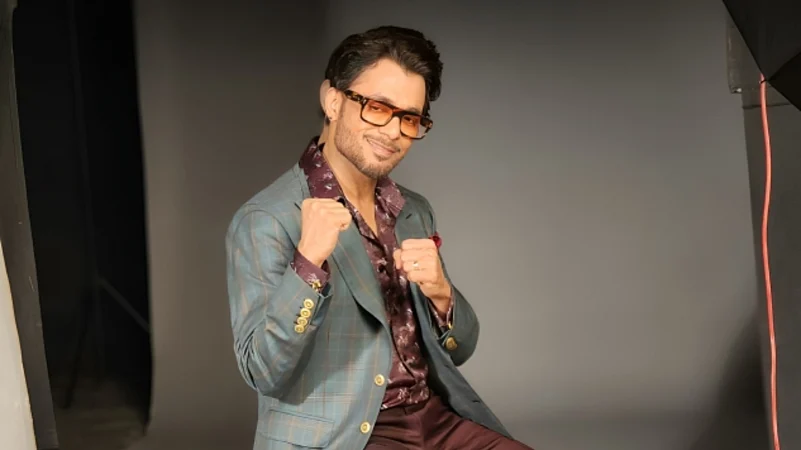

The announcements made in the Union Budget have received praise from people of all walks of life. Notably Shark Tank judge Anupam Mittal also praised the revision of tax slabs in a post on Linkedin. Mittal is the founder and CEO of the People Group and matrimonial website Shaadi.com.

Mittal called middle-class taxpayers India’s ‘punching bag’. He added that even as middle-class taxpayers were taxed, the ultra-rich found loopholes.

“For years, middle-class professionals have been India’s punching bag Taxed at every turn, squeezed for every rupee, while the ultra-rich found loopholes and businesses got tax breaks,” Mittal wrote.

Mittal added that while most budgets raise expectations the Budget 2025 has actually come with a big shift.

“Every Budget, same story > Hope builds up. Expectations rise. Then—another “Sorry, no relief for you.” But Budget 2025 has come with a big shift,” Mittal said.

Mittal termed the government’s decision to make income up to Rs 12.75 lakh tax-free a ‘systemic correction’.

“No income tax up to ₹12.75 lakh under the New Tax Regime. I call this a systemic correction, not just a tax cut,” Mittal wrote.

Mittal added that strong economies are built on thriving middle classes. He also mentioned that after the Second World War America bet on its working class and China also did the same in the 2000s. However, he added that India has been squeezing the salaried class.

“History tells us, that strong economies are built on thriving middle classes, not overburdened ones. Post-WWII America bet on its working class → Boom in manufacturing, housing, and consumer spending. China in the 2000s focused on the middle class → Higher incomes, rapid economic expansion, and massive global influence. India? For years, we got it backwards. Instead of fueling spending and investment, we kept squeezing our most productive taxpayers—the salaried class,” Mittal wrote.

Mittal added that disposable incomes result in more consumption which in turn boosts economic growth. He added that economies are not built by making people feel ‘gareeb’ but by making them wealthier.

“More disposable income = More consumption = More economic growth. You don’t build an economy by making people feel gareeb. You build it by making them wealthier,” Mittal wrote.