The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5 per cent. The Monetary Policy Committee (MPC) has maintained its stance ‘neutral’ on the repo rate with a majority of 4:2 for the 11th consecutive meeting.

“Monetary policy is important because it affects the lives of people, economy, big corporates, middle class, farmers. It has a wide-ranging impact on the economy,” RBI Governor Shaktikanta Das said during this announcement on Friday, December 6, 2024.

The central bank also took a key decision to cut the cash reserve ratio (CRR) by 50 basis points to 4 per cent, increasing liquidity for banks. How will these decisions affect homebuyers, developers, and the Indian real estate market at large? Let’s understand.

RBI’s Balancing Act Between Growth And Inflation

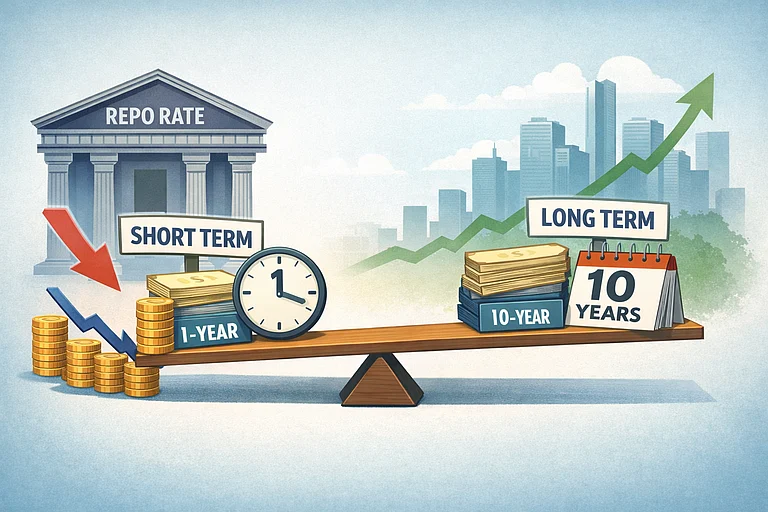

By keeping the repo rate unchanged, RBI is showing its cautious stance amid global uncertainties and domestic inflation pressures. When borrowing costs are stable, the central bank will focus on sustaining economic momentum and reigning in inflationary concerns.

For homebuyers, the unchanged rate means that home loan interest rates will likely remain stable, raking in affordability. The move is significant since housing prices have seen a significant uptick recently, increasing by an average of 23 per cent year-on-year across India’s top seven cities, according to ANANROCK Research.

Impact on Buyers: What do experts say?

Realty experts are largely optimistic about the implications of RBI’s decisions for the real estate sector. Anuj Puri, Chairman of ANAROCK Group, says that while a repo rate cut could have further pushed housing sales, stable interest rates will help maintain affordability in the real estate market.

Moreover, with housing sales declining by 11 per cent in Q3 2024 (as compared to Q3 2023), developers are now cautious with price hikes. For buyers, especially in the mid and premium housing segments, stable home loan interest rates mean predictable EMIs, boosting their confidence in property investments.

Says Nandni Garg, director at Rajdarbar Ventures, “By Keeping the repo rate unchanged, the central bank ensures that borrowing costs remain stable, which is a significant relief for homebuyers. For them, stable home loan interest rates mean enhanced affordability and the confidence to invest in their dream homes, further fueling demand in the residential market.”

Underscoring the need for future rate cuts to stimulate further demand, Ramani Sastri, Chairman and MD of Sterling Developers states, “Unchanged home loan rates will also help sustain buyer interest and preserve the positive sales momentum that we have seen in the recent past.”

“We were expecting a rate cut this time,” says Sanjay Sharma, Director of SKA Group. However, taking the neutral stance as a welcome move, Sharma hopes that the rapid growth in the real estate sector will continue. “This decision will prove beneficial for both buyers and developers. It will not only ensure stable interest rates for potential buyers but also maintain public confidence.”

Says Yash Miglani, MD of Migsun Group, “Consumption is increasing, and more people are investing in the mid, premium, and luxury residential segments not just in metro cities but also in Tier 2 and Tier 3 cities. Developers, on their part, have accelerated the pace of new launches, as reflected in reports from recent quarters. India is firmly on the path of progress, and the Reserve Bank of India's decision to keep the repo rate unchanged will further motivate the sector. This move will also provide relief to borrowers by ensuring that their EMIs do not increase."

Should Homebuyers Take A Leap?

The current scenario presents an opportune moment for homebuyers to make their move. With stable home loan rates and cautious pricing strategies coming from developers, the overall cost of property acquisition could turn favourable for the seekers.

“Given that sales were tapering in the last two quarters, developers too have been cautious about hiking prices lately. In this scenario, it makes sense for homebuyers to press the 'buy' button as the overall cost of acquisition of a property will remain relatively affordable,” Puri states.

However, homebuyers should know that while the current rate environment remains stable, any future increase in lending rates could impact EMIs significantly, especially given that housing prices saw an average yearly rise in Q3 2024.