Summary of this article

EPFO has begun payments of EPS-95 pension arrears starting July 2025 using the Centralised Pension Payment System (CPPS)

Only pensioners with Aadhaar, KYC, and UAN verified can receive arrears and revised pension amounts

Subscribers are advised to regularly check the PPO status to ensure pension receipt

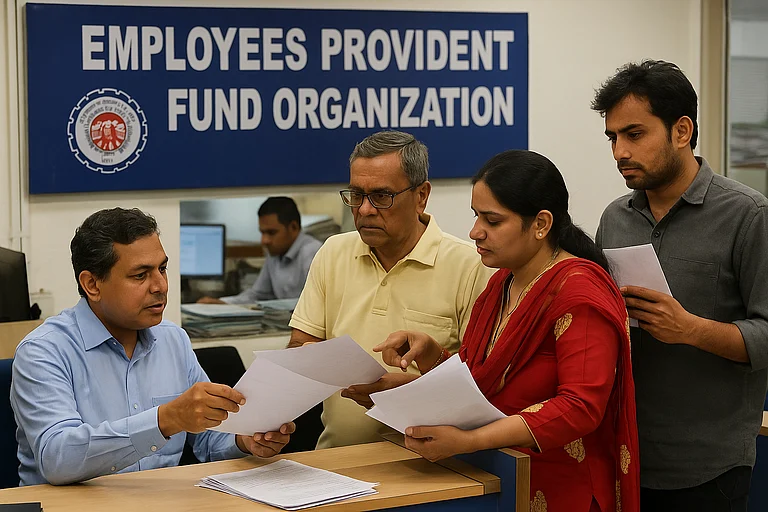

The Employees’ Pension Fund Organisation (EPFO) has started releasing the long-pending pension arrears under the Employee Pension Scheme (EPS-95). Following the Supreme Court’s direction regarding higher pension to eligible employees in November 2022, EPFO offered the options to eligible employees and pensioners, and now, based on the revised pension amount, is disbursing arrears to the eligible employees. EPFO began such payments this year in a phased manner, with the first phase payments made in July 2025.

EPFO is using its new Centralised Pension Payment System (CPPS) for this purpose, per a Zee News report. The system automates the monthly pension calculations, making the settlement of arrears easier. The combination of CPPS and improved digital verification is expected to streamline and strengthen the pension payment system in the future. The automated processing has led to a rise in monthly disbursements.

Reportedly, around Rs 2,819 crore was disbursed in July. The amount includes both arrears and the regular pension amount. Compared to this, Rs 3,050 crore was disbursed in August 2025. The disbursement amount further rose to Rs 4,010 crore in September 2025, reflecting a faster settlement of pending cases.

Who Is Benefiting From The Higher Payouts?

The arrears are for those who were previously receiving a minimum pension and, following the order of the Court, opted for a higher pension. Eligible retirees are also receiving these payments.

However, to receive the arrears, such subscribers must have their Aadhaar, KYC, and universal account number (UAN) verified, because only then can the payment be processed.

Lately, the EPFO has undergone several measures for digital upgradation, including Aadhaar Face Authentication Technology (FAT) for faster creation and verification of UAN, and linking of Aadhaar with UAN on the member portal, etc., with minimal errors.

EPFO grappled with lots of issues in operations due to slower processing, no response to subscribers’ queries, and a delay in claim settlements for a long time. With the overhaul of its IT infrastructure and focus on improving subscribers’ experience, EPFO is revising its rules as well.

For pension arrear payments and to clear the existing backlog, the workflow for EPF account transfer and final settlement has also been eased. The processing rules are uniform for all states.

Advice For Pensioners

While EPFO disburses pension arrears in phases, it advises all EPS-95 pensioners to take proactive steps and ensure they receive the adjusted amount. For this, it suggests that subscribers check their Pension Payment Order (PPO) status and pension details regularly. Subscriber need to keep their personal details, such as Aadhaar, bank account, mobile number, and KYC information updated. In case the pension amount is not reflected, pensioners need to contact the local EPFO field office.