Despite 2018 being a somewhat rough year in terms of investments, mutual funds seem to have done their bit. The 10-year average returns of mutual funds have been around 15%. Yes. In the last one decade, there are mutual funds that have given annualised returns of around 20%. So, how much can mutual funds generate in the next 10 years? Here’s a look:

Historical Performance of Mutual Funds

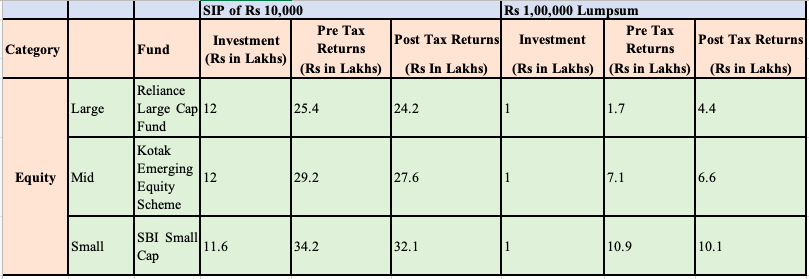

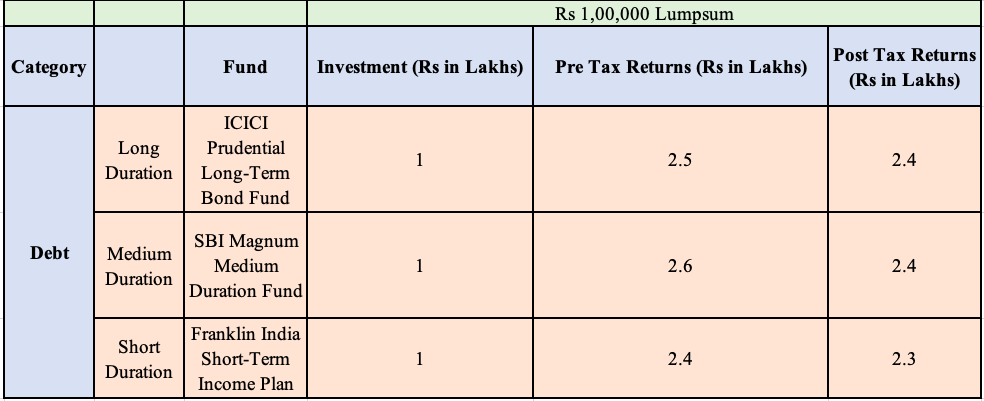

The below two tables show the pre and post-tax returns of Rs 10,000 invested through SIP 10 years ago and Rs 1,00,000 invested through lumpsum 10 years ago in both, equity and debt across different categories. The tax rate assumed for equity is 10% LTCG after exemption Rs 1,00,000 and for debt is 20% after indexation benefit.

Future Expectations of Return

While the above returns happen to be historical future return expectations are usually based on a rule of thumb.

Equity Returns = GDP Growth Rate + Inflation + 3% (equity risk premium and alpha over index)

Debt Returns = Inflation + 3%

Hybrid Returns = 60% of equity + 40% of debt

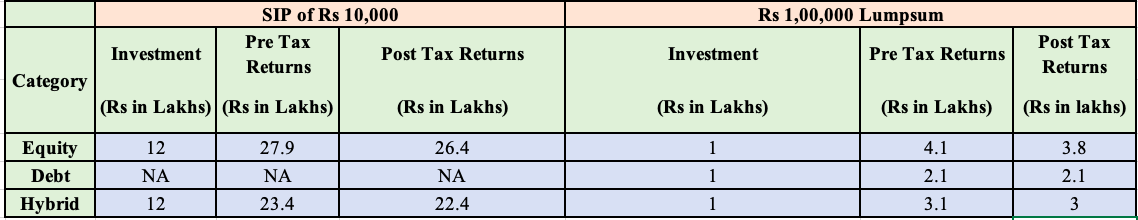

The below table shows what returns one can expect if they invest Rs 10,000 as SIP for 10 years and Rs 1,00,000 lumpsum for 10 years (SIP investment in debt is not recommended). These returns are entirely based on the above rule of thumb. The GDP growth rate assumed here is 7.3%. Inflation is 4.74%. Therefore, the return from equity funds is 15.04%, debt funds is 7.74%, and Hybrid funds is 12.12%.

Why Expectations Should be Relatively Lower?

Expectation of return from investments are based on one’s investment goals andmarket conditions. During the bull and bear market conditions, returns are interpreted in a different manner. For example, in a bear market scenario where the average drop in stocks is around 10-15%, but the fund manages a 3% profit, such a return is considered extremely well. But such a return in a positive market scenario leaves the investor dissatisfied.

Stepping Up SIPs

Stepping up your SIPs is a great tool to turbo charge your investments. A 10% yearly increase in your SIP amount goes in line with typical salary increments and thus is considered healthy.

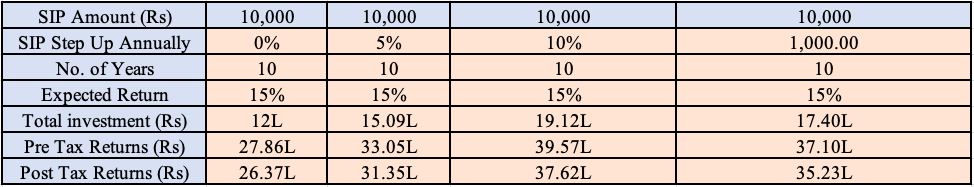

The table below shows the step-up 0%, 5%, 10% and Rs 1,000 annually on Rs 10,000 per month SIP invested for 10 years with expected returns of 15% p.a. A SIP with a step-up option earns higher returns in the same investment horizon than a SIP with no step-up option.

Also, a SIP step-up helps an investor to reach their goals faster by deriving greater benefit from compounding. Also, SIP step-up amount takes care of rising inflation. Therefore, stepping-up SIP can help an investor create more wealth.

People treat money differently. As a result, make irrational decisions. According to mental accounting, an investor makes a biased decision to liquidate a profit-making investment rather than a loss making one. While, selling the loss-making investment is a rational decision as it gives tax loss benefits. Having investments linked to goals that are short, mid and long term in nature helps the investors in better financial management.

Active Funds and Passive Funds

In an actively managed fund, the manager tries to pick investments that would outperform the market index. While in passively managed funds, the manager tries to mimic the returns of index. Index Funds and ETFs are passively managed funds.

The notion that actively-managed funds outperform the passive funds attracts investors. In the initial years, actively-managed funds do well and earn above average returns. As the asset size increases, it becomes difficult to manage, thus reducing the returns.

But, for long term investments, Index Funds and ETFs work well. Their passive nature allows for less risk and lower expenses. In these, managers’ risk is zero.

Conclusion

Equity mutual funds have given around 15-20% annualised return in the past 10 years. While historical returns give an idea of the fund manager and fund house performance, they alone cannot be taken as a parameter for predicting future returns. The fund manager for a high performing may change, the fund strategy and market conditions can change. All of them can impact the future returns of a fund.

A few of these parameters are beyond an investor’s control. Nevertheless, the investor should periodically review his portfolio and asset allocation. Combined with a small increase in SIP every year will lead the investor to a bigger corpus in the long term.

The author is the CEO and CoFounder, Upwardly.in