Summary of this article

Investing in stocks and mutual funds can be rewarding, but profits are subject to detailed tax rules. From July 23, 2024, short-term capital gains tax has risen to 20 per cent and long-term gains above Rs 1.25 lakh are taxed at 12.5 per cent. With these changes, investors must carefully plan sales and reinvestments to optimise their post-tax returns.

With the rise of user-friendly apps and AI-based investment platforms, investing in the stock market has become accessible to everyone and a prevalent trend. You have the option to trade in a variety of instruments, from equity to mutual funds, bonds, and derivatives. While some investors seek short-term profits through intraday trading, others view the market as a long-term investment opportunity.

However, despite your trading styles, when taking a call to sell, quantify your return on investment only after considering the tax impact.

Says Preeti Sharma, Partner, Global Employer Services, Tax & Regulatory Services, BDO India: “The taxability is dependent upon the type of securities as well as their duration of holding. Hence, a close call to hold the security for a short period may help in saving substantial tax by converting such an asset from a short-term asset to a long-term asset which is eligible for preferential tax rates and exemptions on reinvestment.”

Capital gains taxation is quite a complex matter, and despite sincere efforts of the Finance Ministry, the simplification has created many exceptions, and hence more complexity.

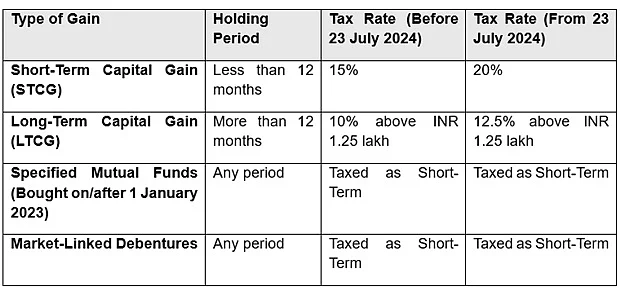

The capital gain is broadly classified into short-term or long-term capital gains. Classification is linked with the holding period and has differential rate of taxation. The same is summarised below:

From July 23, 2024, the tax rate on short-term capital gains has increased from 15 per cent to 20 per cent. Long-term capital gains above Rs 1.25 lakh are now taxed at 12.5 per cent instead of the earlier 10 per cent.

Key Aspects To Consider:

Here are some key aspects that may be overlooked sometimes, but require due consideration:

a. Any gains made from the transfer of units of specified mutual funds (acquired on or after 1 January 2023) and market-linked securities will be treated as short-term capital gains, regardless of how long you hold them.

So, “even if you keep them for more than a year, they will still be taxed like short-term gains and liable to tax at the slab rates as applicable to an individual. Hence, while taking the decision to sell, the holding period for the aforementioned securities is not relevant from a tax perspective. For others, if you hold for more than 12 months, there will be a substantial reduction in tax rates,” informs Sharma.

b. There are certain restrictions when it comes to deductions. For example, you cannot claim a deduction for the Securities Transaction Tax (STT) you pay while buying or selling shares. Also, there is no indexation benefit (adjustment for inflation) allowed for long-term capital gains from the sale of equity shares and mutual funds.

c. The Income-Tax Act provides rebate under Section 87A, under which income up to Rs 5 lakh under the Old Tax Regime and Rs 12 lakh under the New Tax Regime is not taxable. However, if you opt for the New Tax Regime, income taxed at special rates like capital gains will not be considered as part of the total income eligible for rebate, i.e., even if your total income is below the limit of Rs 12 lakh, you may still have to pay tax on capital gains.

d. There are also special rules related to surcharge, which is an additional tax charged on high-income taxpayers. The higher surcharge rates of 25 per cent or 37 per cent will not apply to capital gains from the sale of listed equity shares, equity mutual fund units, or business trust units. In such cases, the surcharge is capped at 15 per cent.

e. For non-resident individuals (NRIs), the basic exemption limit of Rs 2.5 lakh or Rs 4 lakh does not apply to gains from selling Indian shares or mutual funds. This means NRIs must pay tax on the entire capital gain, without getting the basic exemption benefit that resident Indians enjoy.

f. The government also allows a tax exemption under Section 54EE, where if you invest long-term capital gains in a government-notified fund that supports startups, you can claim a deduction up to the amount of investment in new assets or capital gains, whichever is lower, subject to a limit of Rs 50 lakh. The investment must be made within 6 months of selling the asset and must be held for at least three years.

g. Short-term capital losses can be offset against any capital gains (long-term or short-term). However, “long-term capital loss can only be offset against long-term capital gains. Unabsorbed capital losses (short-term or long-term) can be carried forward for a maximum of eight years to be offset only against future capital gains,” says Sharma.

In conclusion, while the stock market can help grow your wealth, understanding the tax rules is equally important. With recent changes in tax rates and exemptions, it's essential to plan your stock market investments carefully and use available options to reduce your tax burden.

The overall tax framework under the New Income Tax Bill, 2025, which is effective FY 2026-27 onwards, is similar to the existing law. However, its impact on the aforementioned provisions is still to be evaluated.