You’ve held your favourite stocks for years, enjoyed those dividend credits, and maybe even added some bonds, REITs, or mutual funds for steady income. Then one morning, your income credit arrives - smaller than you expected. That’s a tax deduction at the source (TDS) that is quietly at work.

It’s not an extra tax—it’s simply the government collecting part of your income tax early.

“You’ll reconcile the exact amount when you file your return. But with changes in rules - higher thresholds in some cases, new treatment of buybacks, and tweaks for different instruments - investors need to know when and how TDS applies in FY25,” says Amit Baid, Head of Tax at BTG Advaya, a law firm.

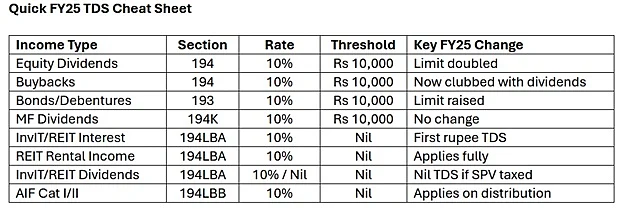

Dividends: Bigger Threshold, But Wider Net

Until last year, companies deducted TDS at 10 per cent if your annual dividend from them exceeded Rs 5,000. From FY25, that limit has doubled to Rs 10,000 per company.

Sounds good? Here’s the twist: share buybacks now count as dividend income. So, if you get Rs 9,000 in dividends and Rs 15,000 from a buyback from the same company, the total is Rs 24,000—well above the Rs 10,000 limit. TDS applies at 10 per cent on the whole excess. Miss updating your PAN, and the deduction rate jumps to 20 per cent.

Bonds & Debentures: The Quiet Deduction

Interest from listed bonds and debentures now has the same Rs 10,000-per-issuer threshold for TDS at 10 per cent—up from Rs 5,000 earlier.

“Certain government-notified tax-free bonds remain TDS-free, but they must be declared in your return. And because interest often comes quarterly or half-yearly, you might cross the threshold without realising,” informs Baid.

InvITs & REITs: The Multi-Layered Payout Puzzle

REITs and InvITs are popular for income-seeking investors, but their payouts aren’t straightforward. They may include:

Interest – TDS at 10 per cent from the first rupee.

Rental income (REITs only) – TDS at 10 per cent from the first rupee.

Dividends – TDS at 10 per cent, unless the underlying SPV has already paid tax under the old-regime (then it’s TDS-free).

Your payout advice will show the split—check it before assuming what’s taxable or not.

Mutual Fund Dividends

Mutual fund dividends face 10 per cent TDS if you get more than Rs 10,000 in a year from one AMC (limit unchanged). “Capital gains from selling units are not subject to TDS for resident investors but are taxable as per holding period rules,” says Baid.

Meet Mrs. Sharma – The FY25 Example

Mrs. Sharma, a retired teacher, has a mix of investments:

Rs 8,000 dividend from Company A – no TDS.

Rs 12,000 dividend from Company B – TDS applies.

Rs 9,000 dividend + Rs 15,000 buyback from Company C – combined, over Rs 10,000, so TDS applies.

Rs 11,000 interest from a corporate bond – TDS applies.

Rs 40,000 from a REIT: 70 per cent rental income (TDS applies) and 30 per cent dividend (TDS applies).

By the year-end, her TDS is more than her final tax bill—so she’ll claim a refund.

Avoid These Common TDS Pitfalls

TDS is only part of your tax bill – If your tax bill is bigger than TDS collected, you must pay the difference, possibly as quarterly advance tax.

Reconcile income and TDS records – Match dividends, interest, and other receipts with your AIS, TIS, and Form 26AS to ensure correct reporting and credit.

Report gross income, not net – Since payouts hit your account after TDS, adding only the net figure in your return may lead to under-reporting. Always “gross up” by including the TDS amount.

Use Form 15G/15H where eligible – Individuals and HUFs with annual income below the basic exemption limit can file these forms with the deductor to avoid or reduce TDS.

Joint holdings – TDS is deducted in the name of the first holder in the demat or bank records. If joint holders plan tax positions individually, this can cause mismatches in 26AS and AIS.

PAN errors and incomplete KYC – Even a minor mismatch in PAN or name spelling can lead to higher deduction at 20 per cent and delay in credit/refund.

Special categories like minors or estates – If shares are held in the name of a minor, the TDS credit may appear under his PAN. Filing returns correctly to claim it under the guardian is critical.

Confusing “nil” TDS with tax exemption – A nil TDS doesn’t necessarily mean the income is tax-free. You may still need to pay tax while filing your return.

The FY25 Checklist for Every Retail Investor

Keep PAN and KYC details updated to avoid higher deduction rates.

Track income from each source against the relevant threshold.

Understand the tax breakup in InvIT/REIT and mutual fund payouts.

Reconcile Form 26AS with actual receipts periodically.

“FY25’s changes give some breathing room with higher thresholds but also broaden the net—especially with buybacks now clubbed as dividends. For retail investors, the mantra is: track, reconcile, and report correctly,” says Baid.

Done right, you can avoid both surprise deductions and refund delays.