Summary of this article

GST 2.0 Reforms: The GST rates cut on soaps, dental hygiene products, bicycles, small cars and health insurance are clearly aimed at reducing the middle-class household. These are areas where savings add up month after month. However, for discretionary spending, like online food deliveries, packaged drinks or high-end vehicles, the costs either go up or remain elevated.

From beauty services to bicycles, and even soaps and shampoos, the latest round of GST rate rationalisation by the Central Board of Indirect Taxes and Customs (CBIC) promises to shift the way middle-class households spend. While personal care services like salons and gyms are set to get cheaper, ordering food online or buying luxury cars will burn a slightly bigger hole in the pocket.

Self-Care Services Get A Tax Cut

If you book a salon appointment, gym session, spa, or yoga class after September 22, expect a lighter bill to pay. CBIC has made it mandatory that such services attract 5 per cent GST without input tax credit (ITC), ending the earlier option of levying 18 per cent with ITC.

For consumers, the impact would be immediate, for instance, a Rs 2,000 salon service that otherwise would have included Rs 360 in GST will now carry just Rs 100 tax. However, businesses lose out on input credit, meaning they cannot offset the taxes they pay on their purchases. Still, for the middle-class customer, the upfront cost falls.

The catch here is that such service providers would recalibrate their pricing, the result of which will be seen once the new rates are in motion.

Food Deliveries To Cost More

On the other end, the cheer ends if you are ordering food online. Starting September 22, delivery charges from platforms like Zomato, Swiggy and Magicpin will attract 18 per cent GST. Depending on the platform, this works out to an extra (approximately) Rs 2-2.6 per order on top of rising platform fees.

The Finance Ministry, in a FAQ released on Tuesday, clarified that all local delivery services are taxable at 18 per cent, whether supplied directly by a registered provider or through an e-commerce operator. For frequent users, these incremental costs will be hard to ignore, especially in the festive season when food ordering peaks.

What Gets Cheaper At Home

The rate changes also touch upon your everyday essentials, such as:

Soaps, shampoos, face powder and shaving cream now attract just 5 per cent GST, down from higher slabs. The government says this is aimed at lowering monthly expenditure for lower- and middle-class households, even though luxury brands also benefit.

Toothpaste, toothbrushes and dental floss have moved into the 5 per cent slab, recognising their role as basic hygiene items. Mouthwash, however, has been left out.

Spectacles for correcting vision now draw only 5 per cent GST, down from 12-18 per cent earlier, easing costs for families with prescription needs.

Bicycles and their parts will also be cheaper, with the rate cut from 12 per cent to 5 per cent.

All of this directly helps households whose monthly budgets stretch across groceries, hygiene and mobility.

Food and Beverages: A Mixed Bag

Not all the news is good for consumers; the GST Council has taken steps to align rates to avoid disputes by segregating items under the same categories with different tax slabs. For instance:

Carbonated fruit drinks and juices will see higher GST, offsetting the removal of compensation cess, which means they won’t really get cheaper.

Other non-alcoholic beverages face a 40 per cent rate, part of the “similar goods, same rate” principle.

On the other hand, all Indian breads, by whatever name called, roti, parotta, naan, are now fully exempt, bringing some relief to households and eateries alike.

Natural honey retains a favourable treatment over artificial honey, intended to promote small-scale beekeepers.

Cars And Big-Ticket Purchases

For the automobile sector, the shifts are sweeping:

Small cars (petrol, LPG, CNG up to 1200cc, or diesel up to 1500cc) will now attract 18 per cent GST, down from 28 per cent.

Three-wheelers too see a cut, from 28 per cent to 18 per cent.

However, mid-size and big cars, SUVs, and MUVs will now carry a flat 40 per cent GST, with cess removed. While the headline rate looks high, the Finance Ministry clarified that the overall incidence (earlier 45 to 50 per cent, including cess) is actually being streamlined.

For middle-class buyers, the reduced tax on smaller cars and two-wheelers is a clear win, but aspirational purchases in the SUV category will still remain costly as per the new rates.

Appliances and Electronics

Households looking at big-ticket home purchases will also see some relief this festive season:

Air conditioners and dishwashers now attract 18 per cent GST, down from 28 per cent.

Televisions and monitors, regardless of size, will also be taxed at 18 per cent, simplifying earlier slabs.

Health Insurance Relief

In a significant step for families, all individual health insurance policies, including family floater and senior citizen plans, are now exempt from GST.

Reinsurance services are also exempted, ensuring the relief flows across the chain

What Stays Expensive

Not everything gets easier on the wallet. Gambling, casinos, horse racing, online gaming and lotteries are firmly in the 40 per cent GST slab, a conscious decision by the government to tax “sin goods” and activities.

The Middle-Class Equation

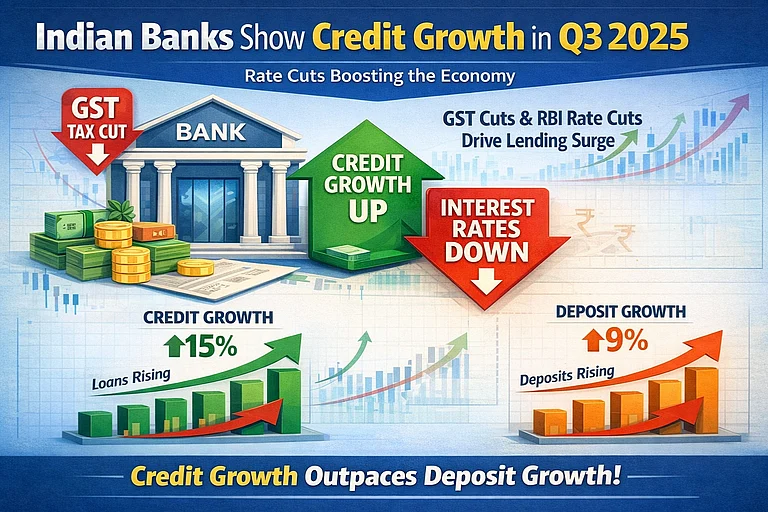

Taken together, the rate cuts on soaps, dental hygiene products, bicycles, small cars and health insurance are clearly aimed at the middle-class household. These are areas where money could be saved, and savings may add up month after month.

But for discretionary spending, like online food deliveries, packaged drinks or high-end vehicles, the costs either go up or remain elevated. The government’s rationale is to simplify the tax system, avoid misclassification disputes and remove compensation cess, while still protecting revenue.

For consumers, the bottom line is straightforward: personal care and daily essentials will now pinch less, but indulgences like convenience food or carbonated beverages will cost more.

, , gst council new gst rates, GST rate cut on daily essentials, Everyday use items GST rates