New Year’s Eve is the time to sit back, relax and enjoy! But for social media influencer Ankush Bahuguna, 31, it turned out to be a nightmare. On January 5, 2025, he shared in detail how he underwent the “digital arrest” ordeal.

The modus operandi typically involves scamsters posing as authority figures who threaten, blackmail or induce fear among victims to extort money. The victims are then put under a “digital arrest” wherein they are psyched into cutting all communication and follow instructions of the scamster.

Ankush claimed he was digitally held hostage by scammers for a gruelling 40 hours. He received a call from an unlisted international number in which an automated voice told him that a courier delivery addressed to him was cancelled. The automated voice urged him to press ‘0’ and he unfortunately complied. Next he was put in touch with a scamster posing as a “customer support representative”. The representative claimed the package mentioned on call earlier had been seized, as it contained illegal substances.

He was also told he had just an hour to prove his innocence. The scamster transferred his call to another scamster posing as an official of the Mumbai Police. Ankush was told he was a “prime suspect” in a case involving money laundering and drug trafficking.

“They isolated me completely. I was not allowed to pick up calls, reply to messages, or even let anyone in the house know. They said if I contacted anyone, they would harm my family,” Ankush said in his Instagram video.

After spending nearly two days under digital arrest, he managed to read a message warning about “digital arrest” scams. But it was too late.

Ankush was under arrest for nearly 40 hours, and in the interim, the scammers had made him transfer an undisclosed amount of money and also put him under tremendous mental trauma.

Such instances have become quite common. The digital arrest macro data is alarming: Between January and April 2024, Indians lost Rs 120.3 crore because of digital arrest scams, according to data by the Indian Cyber Crime Coordination Centre (I4C). I4C is a dedicated wing of the cyber and information security division of the Union Ministry of Home Affairs, Government of India.

Vishal Salvi, chief executive officer, Quick Heal, an IT security and data protection solutions provider, sounds the red alert. “The rapid digitalisation of India has created more opportunities for cybercriminals to exploit unsuspecting individuals. The lack of digital literacy and awareness among many citizens makes them vulnerable to sophisticated scams. Fraudsters have become increasingly adept at using technology, employing tactics, such as deepfake videos, professional-looking documents, and realistic video calls to impersonate law enforcement officials,” he says.

According to Sudeshna Guha Roy, partner at Saraf and Partners, a full service law firm, these scams are executed by using sophisticated technology, such as digital forensics, online surveillance, and social media monitoring.

One can only imagine if this can happen with tech-savvy influencers, what fate awaits the not-so-initiated, but-24x7-digitally-logged, which is a huge cohort in itself.

Vulnerable Targets

Influencers apart, there is a clear pattern indicating that scammers are targeting senior retired defence personnel. Not without a reason—the retirement corpus is the temptation.

Consider three recent cases of defence personnel being scammed.

Earlier in August 2024, a 79-year-old retired Major General of the Indian Army, currently residing in Noida, was put under digital arrest for five days. The scamsters posed as law enforcement personnel and alleged that a courier addressed to his name containing five passports, four bank credit cards, clothes, 200 grams of a drug called MDMA, and a laptop had been seized. The scamsters duped him of Rs 2 crore, according to media reports, which cited cybercrime investigators.

Later in October 2024, retired Major General Prabodh Chander Puri, 85, was defrauded of Rs 83 lakh through a digital arrest scam. Puri, a resident of Sector 20, Panchkula, received a call from an unknown number on October 15, 2024 stating that his mobile phone was being used extensively and would be turned off permanently. After he complied with the instructions given to him to address the matter, he was entrapped by the scamsters and put under digital arrest.

In another instance of the retired being targeted, Lt. Colonel (retd) Parupkar Singh, 81, a resident of Ludhiana, received calls from scammers posing as officers from the Central Bureau of Investigation (CBI) and the police department. Singh was accused of being involved in a money laundering racket, and asked to send Rs 35.3 lakh lying in his bank account to the scamsters. The scammers promised to return the money to him once the investigation was complete. However, once they disappeared with the money, Singh promptly informed the cybercrime police who managed to nab the culprits, according to media reports. But not all digital arrest victims are so fortunate. Incidentally, even young and middle-age earners are targets for these scamsters.

How Scamsters Identify Victims: Says Manish Tewari, co-founder of Spydra Technologies, a digital asset tokenisation platform, “Scamsters access sensitive details of their victims in the guise of organisations from sectors such as healthcare, government and finance, which are digitising sensitive information.”

He says that weak IT security policies in smaller companies are also making data easily accessible to scammers. They use this data to identify vulnerable targets to prey on. They bypass traditional security issues like phishing and even zero-day exploits.

“The cross-border nature of these crimes, with many perpetrators operating from countries like Myanmar, Laos, and Cambodia, complicates efforts to track and prosecute them,” says Salvi.

Advisories Galore

In an episode of Mann Ki Baat radio programme aired on October 27, 2024, Prime Minister Narendra Modi shed light on the rising cases of “digital arrests”.

From January-April 2024, Indians lost Rs 120.3 crore in digital arrest scams, as per data by Indian Cyber Crime Coordination Centre (I4C)

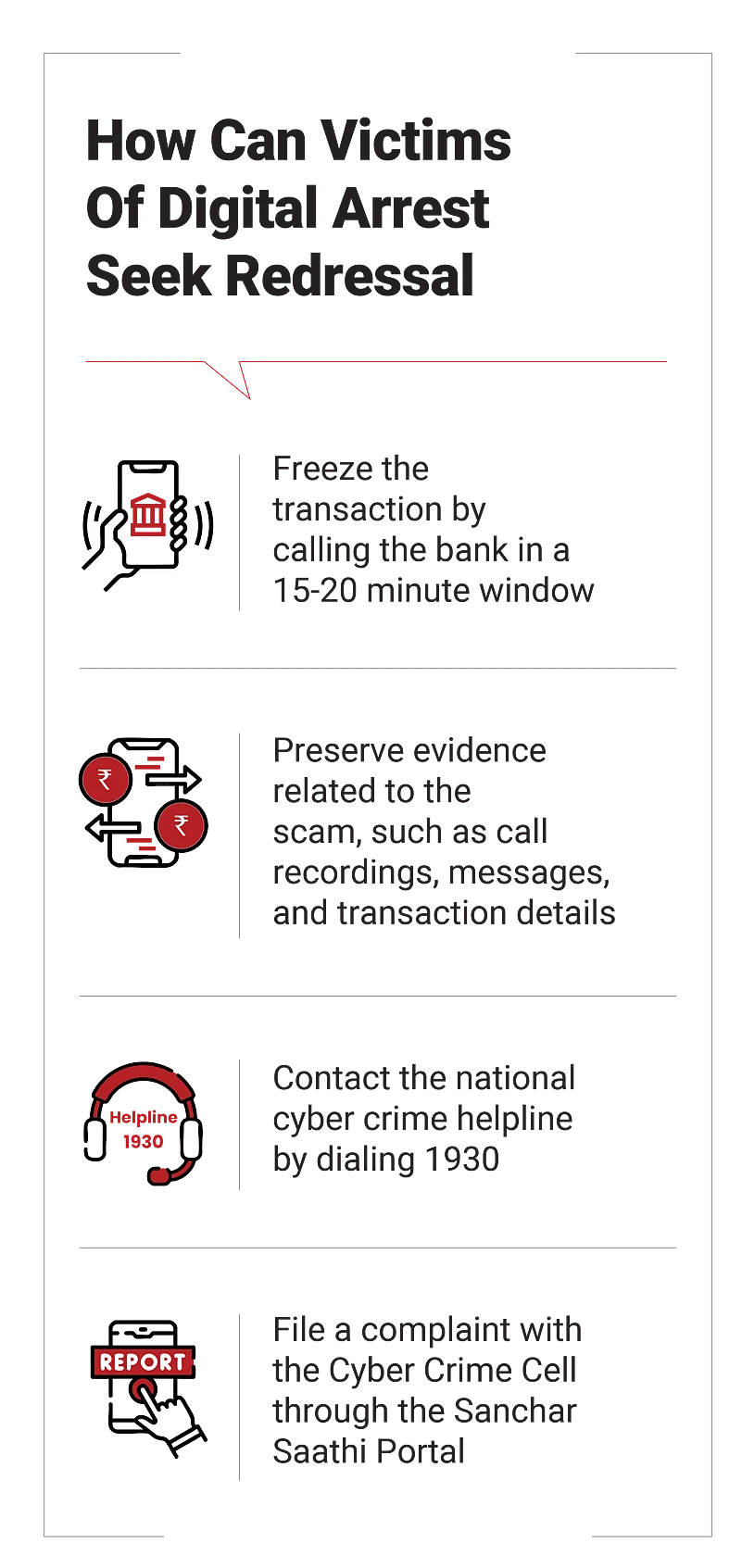

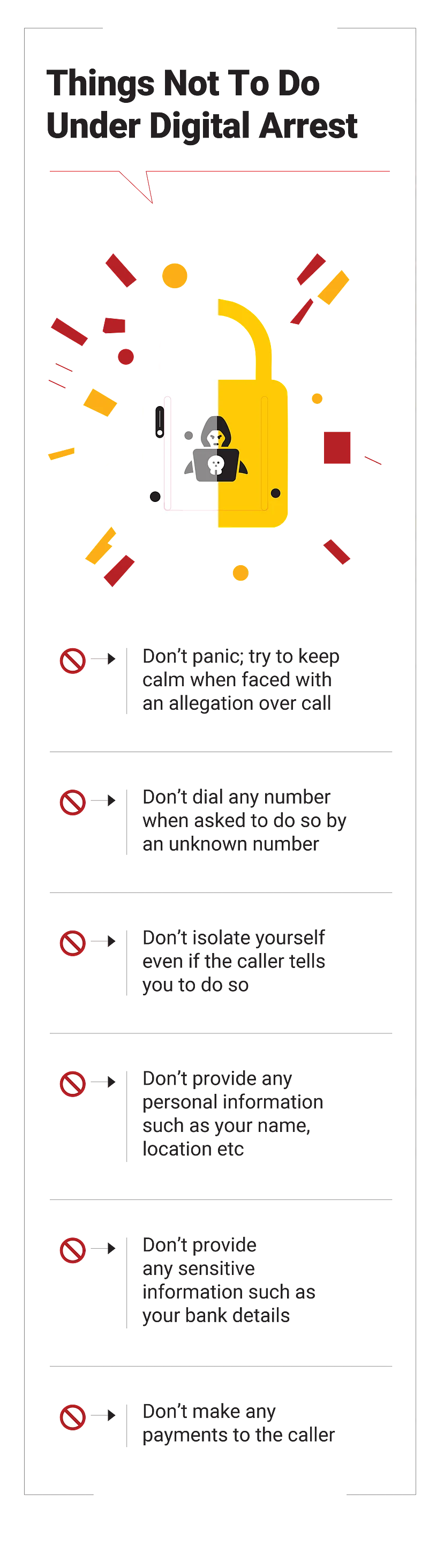

He shared an advisory on how to respond to such calls. He recommended that recipients of such calls take a three-step approach of, “Ruko, Socho Aur Action Lo” (Stop, Think and Take Action). The first step is to stop panicking, remaining calm, and not sharing any personal details or account number. The second step involves thinking and taking cognisance of the fact that legitimate agencies do not conduct investigation over calls. The third step involves taking action and reporting such incidents to the National Cyber Crime Helpline by dialling 1930 or informing family members, and recording evidence.

On December 10, 2024, the Ministry of Home Affairs (MHA) said in a release that the Centre has undertaken various measures to curb instances of digital arrests. These include increasing awareness about digital arrest scams through newspaper advertisements, regular announcements in public places, such as Delhi Metro, and a special campaign, such as the one held at the ‘Raahgiri’ Function organised in Connaught Place, New Delhi.

The Centre has also published a release alerting authorities against incidents of ‘Blackmail’ and ‘Digital Arrest’ by cyber criminals impersonating as State/Union Territory Police, Narcotics Control Bureau (NCB), CBI, Reserve Bank of India (RBI) and others.

Additionally, the I4C has proactively identified and blocked more than 1,700 Skype IDs and 59,000 WhatsApp accounts used for Digital Arrest scams.

The Centre and telecom service providers (TSPs) have also designed a system to identify and block incoming international spoofed calls displaying Indian mobile numbers which appear to be originating within India.

The ministry mentioned in the release that such international spoofed calls have been made by cybercriminals in recent cases of fake digital arrests, and impersonation as government and police officials, etc.

Directions have also been issued to the TSPs for blocking of such incoming international spoofed calls. Over 669,000 SIM cards and 132,000 international mobile equipment identity (IMEI) numbers have been blocked by the government, as on November 15, 2024.

Says Salvi, “To further combat these scams, the government may enhance international cooperation to address cross-border cybercrime, implement stricter regulations for digital platforms, and provide specialised training to law enforcement agencies to improve their ability to investigate and prosecute these cases.”

Tewari of Spydra Technologies feels the government should make regular security audits mandatory and encourage adoption of global cybersecurity standards.

What Should You Do?

Advisories and warnings abound, but the reality on the ground is that there are no specific legal definitions for criminalising digital arrest.

Says Roy: “Unfortunately, there is no specific legal definition for digital arrest in the prevalent acts or laws in the country. However, the legal framework under Bharatiya Nyaya Sanhita (BNS) and the IT Act facilitates law enforcement agencies to combat such scams.”

So, it’s best to take appropriate steps yourself. Says Guha: “Avoid providing any personal information or making payments. Scammers rely on panic and quick compliance, so taking a step back can prevent them from succeeding. In the meanwhile, one can verify calls by contacting official agencies directly or verify suspicious calls and credentials using official websites. It is advisable to not rely on regular search engines and unverified sites, as scammers often upload fake numbers online.”

Also, note genuine investigations cannot end in payments. Any such demand should raise a red flag.

Salvi urges citizens to keep their bank accounts under check.

“It is crucial to act quickly, especially if money has been transferred, as contacting the bank within 15-20 minutes may help freeze the transaction. Preserve all evidence related to the scam, including call recordings, messages, and transaction details, as these will be vital for the investigation. Victims should also monitor their credit reports for any unauthorised activities and work with credit bureaus to dispute any errors resulting from fraud,” he says.

While the government and the law agencies figure out newer methods to curb the menace of digital arrest, the reins ultimately remain in your hands to not fall into such a scam in the first place.

ayush.khar@outlookindia.com