Summary of this article

Consumer forum penalises insurer Rs 30,000 for delayed motor insurance policy transfer

Motor insurance transfer delays can create claim uncertainty after used-car purchase

Commission says timely policy endorsement is essential for customer protection

Ruling highlights service lapses and accountability in motor insurance claim readiness

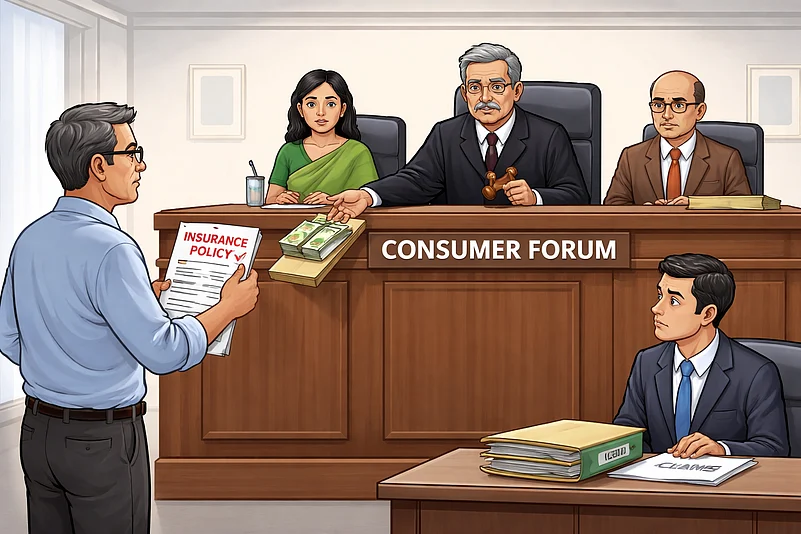

A consumer disputes redressal commission has asked an insurance company to pay Rs 30,000 to a policyholder after it took an unusually long time to transfer a motor insurance policy despite the paperwork being complete, according to a recent report by the Times of India. The panel said such delays cannot be brushed aside as routine when they leave customers unsure about their insurance cover.

Used-Car Buyer Ran From Pillar To Post

The dispute started after the purchase of a pre-owned car. Once the ownership transfer was done, the buyer applied to have the existing motor insurance policy endorsed in his name since the policy was still valid. Documents were submitted and the required charges paid, but the policy did not get updated for quite some time.

The customer kept checking in with the insurer for updates, but nothing moved. After waiting for a response that never really came, he eventually sent a legal notice. With the situation dragging on, he eventually approached the consumer forum, arguing that the delay had caused avoidable stress and uncertainty.

The commission noted that policy transfer after a vehicle sale is not an unusual request. Once documentation is in place, insurers are expected to complete the process without unnecessary delay. Leaving a policy in the previous owner’s name, it said, could create complications if a claim situation arises in the meantime.

Insurer Asked To Compensate

During the hearing, the insurer went ahead and completed the policy transfer. However, the commission made it clear that a delayed correction does not erase the inconvenience already caused. The commission asked the insurer to pay Rs 25,000 to the customer as compensation and Rs 5,000 towards legal expenses, which together come to Rs 30,000.

For people buying second-hand vehicles, the case is a reminder not to leave insurance paperwork pending. Even if the policy hasn’t expired, having it in the previous owner’s name can create avoidable trouble if there is ever a claim.

The ruling also highlights something insurers often overlook — servicing a policy after it is sold matters as much as issuing it. What may look like a small internal delay can quickly turn into a complaint if the customer keeps waiting without clear answers.