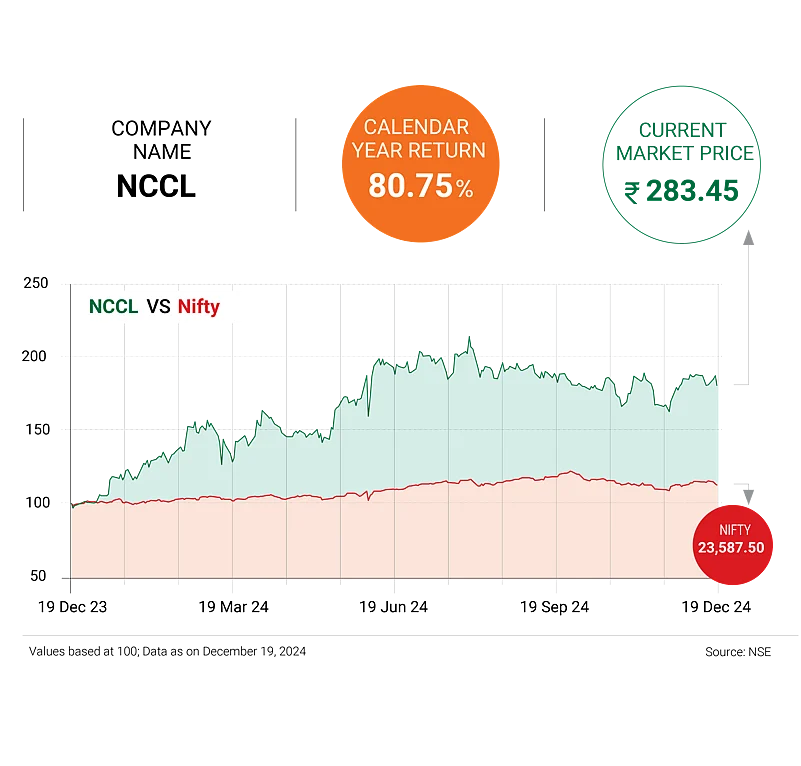

On A Strong Foundation

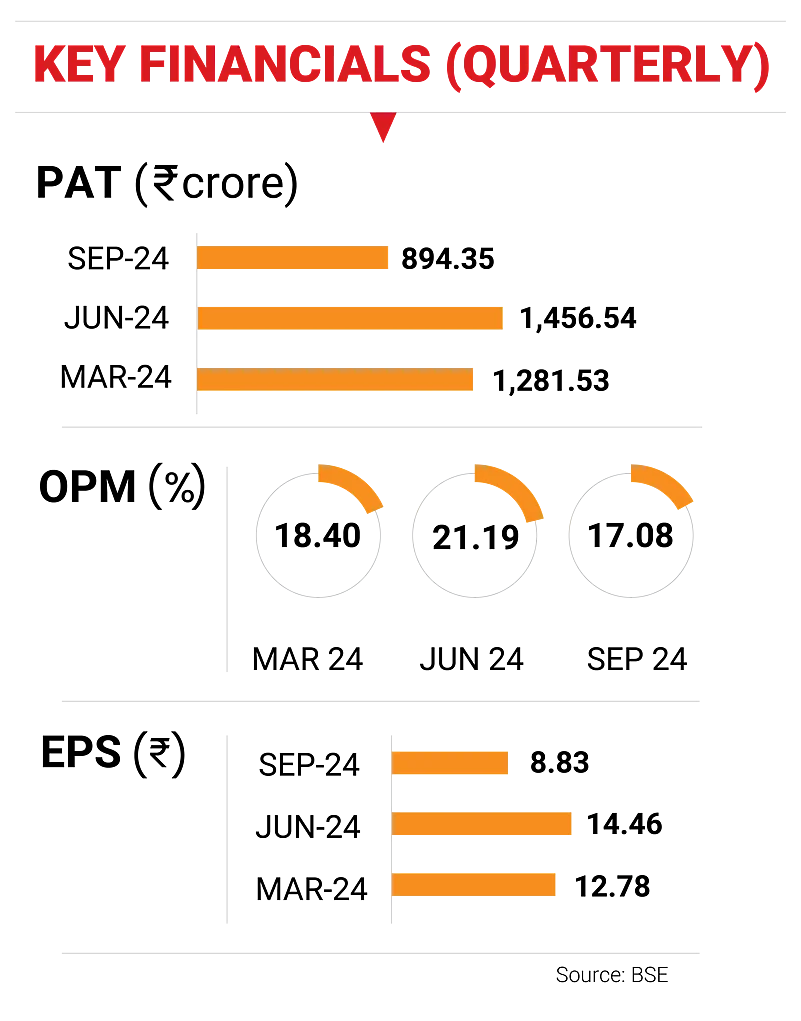

NCCL is one of India’s leading construction companies with a presence across varied verticals, such as buildings, roads, water, mining and electrical. It has a well-diversified order backlog, robust execution capabilities, and a strong focus on debt reduction and working capital management over the next few years.

It has a standalone order book of Rs 48,028 crore, representing a 2.5x trailing twelve months (TTM) book-to-bill ratio as of Q2 FY25, with an order inflow of Rs 5,168 crore in H1 FY25 and orders worth Rs 3,496 crore received in October 2024. Additionally, it has lowest bidder (L1) orders worth Rs 9,200 crore.

NCCL also expects improved order inflows from Andhra Pradesh and Bihar. It has also maintained its order booking guidance of Rs 20,000-22,000 crore and a topline growth guidance of 15 per cent for FY25, implying accelerated execution in H2 FY25. Given the robust order book, we expect a healthy revenue compounded annual growth rate (CAGR) of 15 per cent over FY24-27, reaching Rs 28,022 crore.

The earnings before interest, tax, depreciation and amortisation (Ebitda) margin guidance was maintained at 9.5-10 per cent, albeit likely at the lower end of the band, amid the competitive bidding scenario and with company focusing on revenue growth momentum in FY25 over margins. We project Ebitda margins at 9.5 per cent, 10 per cent and 10.5 per cent for FY25, FY26 and FY27, respectively, compared to 9 per cent in FY24 (approximately 10 per cent on an adjusted basis).

Healthy topline growth, coupled with stable finance costs, is expected to drive a 25.5 per cent earnings CAGR over FY24-27. The strong earnings momentum will result in an improvement in return ratios, with return on equity (RoE) likely expanding to 16.1 per cent in FY27, up from 12.3 per cent in FY24.

NCCL is a key beneficiary of the tailwinds in the buildings, roads, water, mining and electrical segments. Given the strong order book visibility, and improving balance sheet strength, it is poised for a healthy growth ahead. We value NCCL at Rs 400, at 17x multiple on the average of FY26 and FY27 earnings per share (EPS).

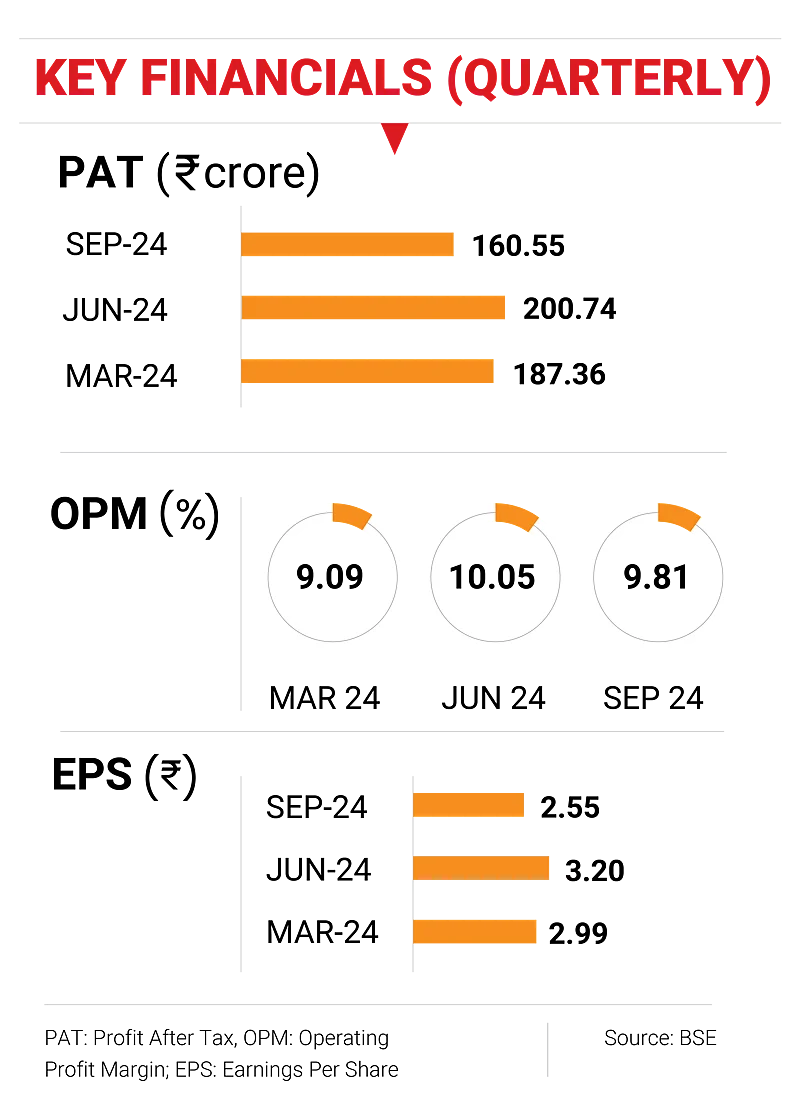

Growing Organically

PCBL, previously known as Phillips Carbon Black, is the leading manufacturer of carbon black, which is used as a reinforcing material in tyres. PCBL also derives 11 per cent of its sales volume from specialty carbon black, which fetches high margins and finds application in paints and plastics, among others. PCBL is India’s largest and the world’s seventh-largest carbon black manufacturer with an installed capacity of 770,000 tonnes.

Sensing robust demand prospects, especially in the export market, it is looking at adding an additional 90 kilo tonnes (KT) capacity through a brownfield expansion at its new plant in Tamil Nadu, and has recently received land approval from the Andhra Pradesh government for a new greenfield plant as well.

It is targeting double digit volume CAGR over the next five years and is looking at substantial export play with near-term capacity target pegged at 1 million tonnes. With carbon black volume growth on the anvil amid a thrust on exports, increasing share of high margin specialty grade carbon black, expansion in sight at its newly-acquired Aquapharm and ramp-up niche battery chemical business, the company expects to clock 5x profits after tax (PAT) in five years, about Rs 2,500 crore in FY29 as against Rs 500 crore in FY24.

Over the years, PCBL has with indigenous research and development (R&D) efforts developed grades in specialty carbon black (SCB) domain, which is a high margin product (typically 3-4x normal trye grade carbon black).

Speciality grade carbon black volumes grew 42 per cent year-on-year (y-o-y) to 57KT in FY24.

On a high base, SCB volumes are expected to grow at a CAGR of 14 per cent over FY24-27 to 85KT in FY27. This is structurally positive for Ebitda per tonne.

PCBL has entered into a joint venture with Kindia to establish Nanovace Technologies, which will focus on developing nanosilicon products for use in lithium-ion (Li-Ion) batteries. PCBL will hold over 51 per cent stake. The company expects the facility to generate Rs 2,000 crore in revenue by FY29, with Ebitda margins projected at 50 per cent.

With organic levers of growth amid changing business profile in favour of more speciality chemical play, healthy margin and RoE profile (15 per cent), robust cash flow generation, we assign a ‘buy’ rating on PCBL.

We value PCBL at Rs 600, that is 24x price-to-earnings in FY27. We believe the current correction in stock price offers a good entry point for long-term wealth generation.

-Pankaj Pandey

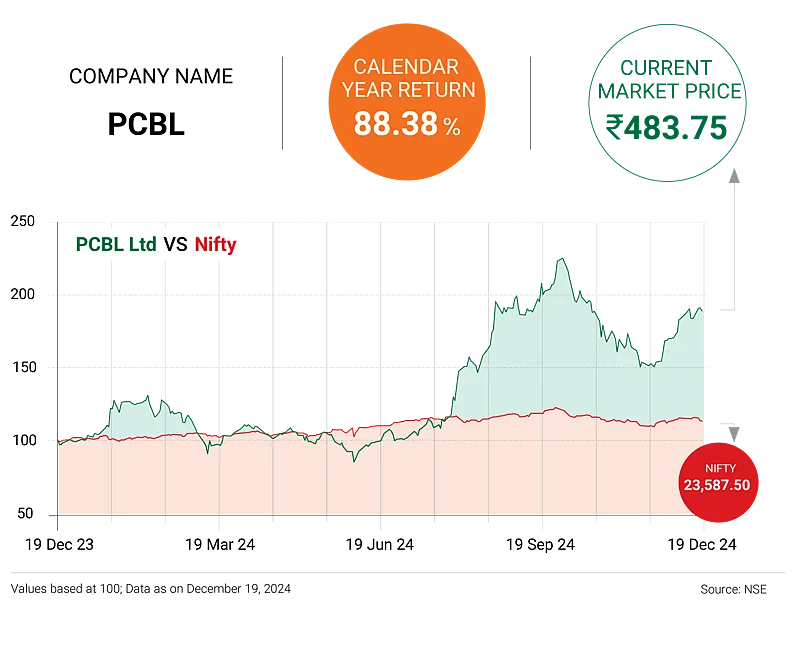

Robust Connection

Bharti Airtel is an integrated communications solutions provider in India and the second-largest mobile operator in Africa with a retail portfolio of high-speed 4G/5G mobile broadband, Airtel Xstream Fiber, on-demand streaming, digital payments, and financial services. It also offers other services, such as cloud and data centre, cyber security, internet of things (IoT), Ad Tech and cloud communication, among others.

As on March 31, 2024, it had 39 per cent share of the India revenue market, while its customer base as on September 30, 2024 across 15 countries was 563 million. Its customer base in India is 406.5 million with a subscriber share of 33 per cent. Bharti’s planned rollout of 25,000 rural towers is likely to be completed in the next few months.

It has also diversified into non-mobility businesses, such as enterprise and direct-to-home (DTH)services, and home broadband, which contributed 19 per cent to its consolidated revenue in FY24.

The company’s recent tariff hike of 11-20 per cent across mobile plans on July 3, 2024, helped it report average revenue per unit (ARPU) of Rs 233 as of September 30, 2024, up Rs 211 as of June 30, 2024, the highest among Indian telcos. This benefit of tariff rise is expected to fully accrue in the next two quarters. Bharti could further increase tariffs, including usage-based plans in the future.

The company has also prepaid over Rs 32,000 crore in high-cost spectrum dues over the last five quarters and is likely to reduce net debt to equity from 2.7x in FY23 to 0.5x in FY27. With moderation in capex, the company is likely to generate significant free cash flow, which could lead to significant deleveraging and improvement in shareholder returns.

Regulatory and technological changes, SIM consolidation, competition, and slower growth in data volumes remain key concerns.

However, higher bundling with home entertainment, partnership with content providers, and increasing data consumption could be major growth drivers.

Bharti is well poised to deliver a strong multi-year Ebitda growth on the back of innovation, tariff hike, and government relief.

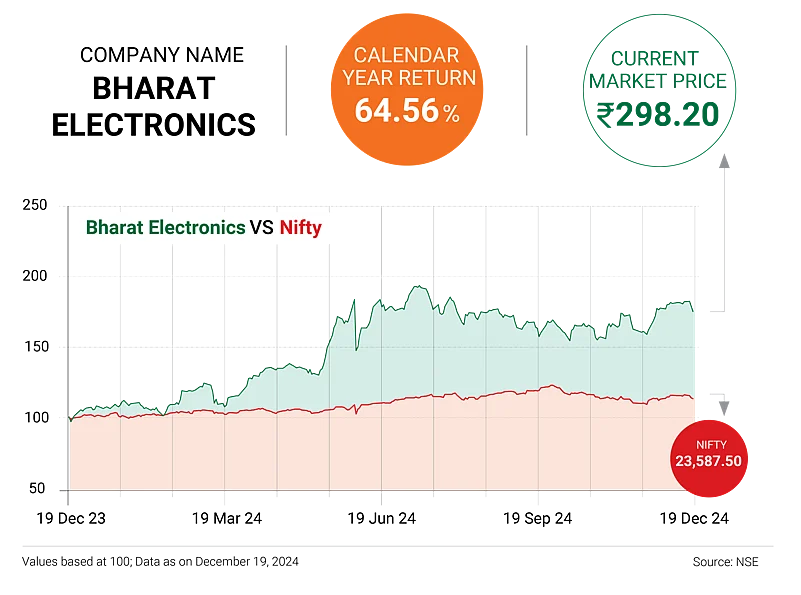

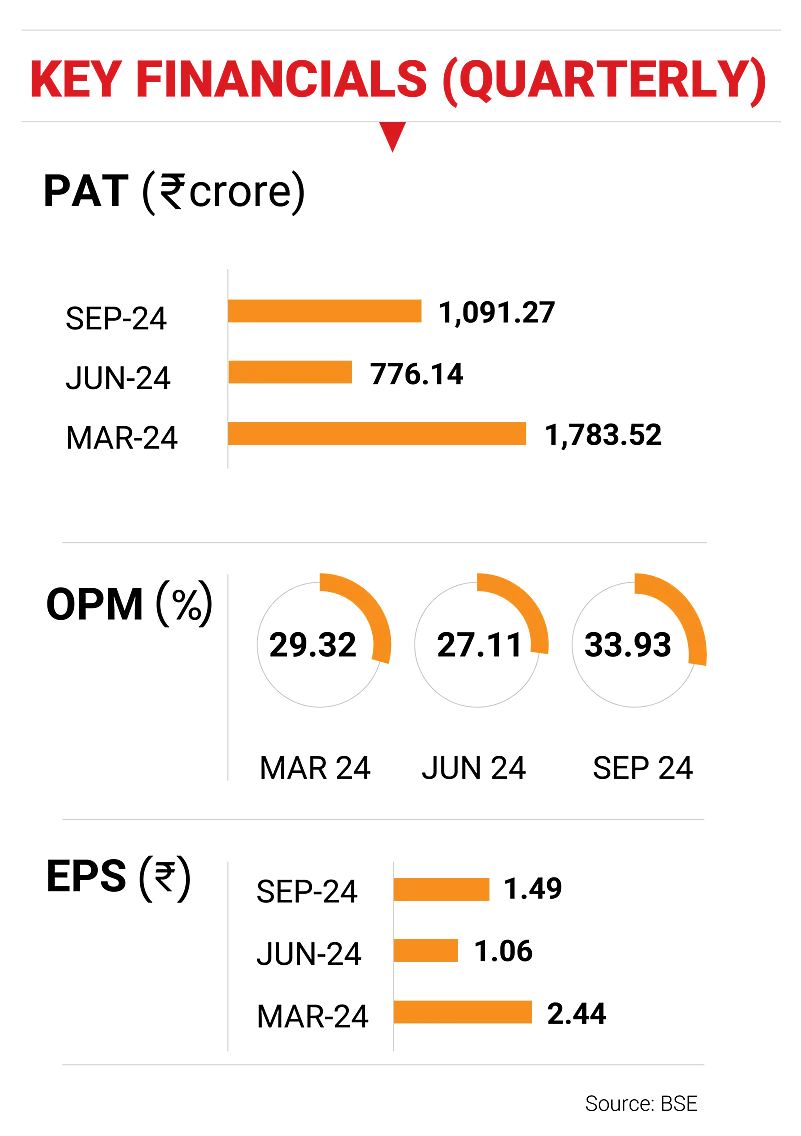

Overseas Market On radar

Bharat Electronics (BEL) is a Navaratna public sector undertaking (PSU) under the Ministry of Defence (MoD), Government of India (GoI), manufacturing electronics, communication, and defence equipment, such as radar, communication, and electronic warfare equipment for the Indian armed forces. It benefits from enhanced budgetary outlay from the government’s defence budget.

With India relying less on imports for defence equipment, BEL is expected to see greater order inflow in the medium-to-long term.

BEL’s consistent investment in R&D has helped it to create a strong competitive advantage by way of innovation and latest product development. The rise in India’s defence spending and focus on indigenisation and export could create earning opportunities for BEL.

BEL’s order book stands at Rs 74,500 crore, which is 3.6x of TTM sales, while its order inflow stood at Rs 7,500 crore year-to-date (YTD) recently. BEL has guided for order inflow of Rs 25,000 crore for FY25 and FY26.

BEL is also exploring the export potential and is opening overseas offices in five countries, including Sri Lanka, Myanmar, Oman, and Vietnam. It is targeting a 10 per cent revenue contribution from exports.

BEL is also enhancing its R&D and manufacturing capabilities through modernisation, expansion of facilities, and joint ventures with existing and emerging businesses. Large defence requirements of foreign suppliers also provide opportunities for growth over the medium-term.

Government ownership leads to a sizeable inflow of orders (around 80-90 per cent), which provides steady earning for the company. BEL is also optimistic of maintaining a minimum growth rate of 15 per cent annually over the next five years on account of a strong order book and a growing defence budget.

BEL has a strong financial profile led by healthy profit margins and return indicators, nil borrowings and a superior liquidity profile. It also enjoys a high degree of financial flexibility, allowing it to raise funds from financial intermediaries.

Competition from private players, changes in procurement policy of the defence forces, higher raw-material prices, delays in order execution, and a slower pace of fresh orders could impact its earning ability going ahead.

Considering the government’s emphasis on increased defence expenditure and indigenisation, BEL’s strong order book, and expected order inflow in the next few years, BEL is a buy for 2025.

-Deepak Jasani

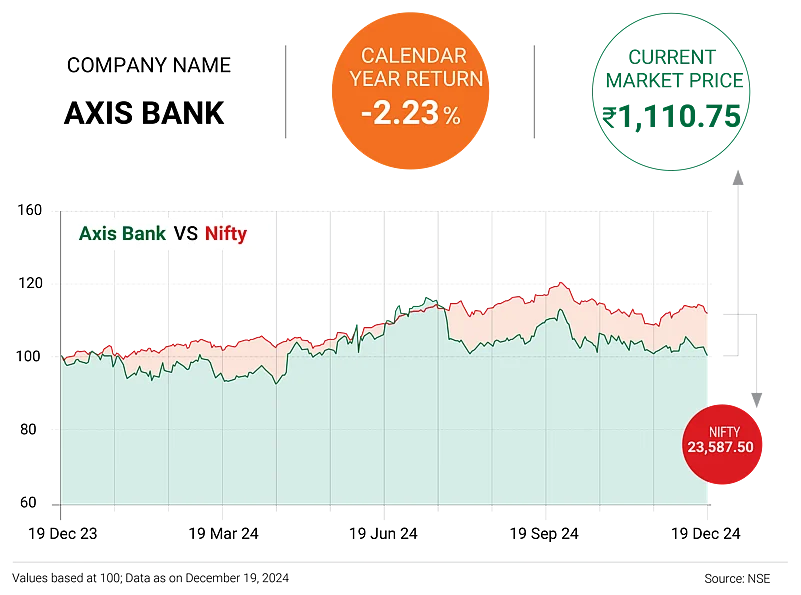

Banking On Loan Demand

Axis Bank has the third-largest network of branches among private sector banks. At present, it has a total of 5,377 branches, and 16,026 ATMs and cash recyclers. In FY24, it added 475 branches to its network.

It has 5.5 per cent market share in assets, 5 per cent in deposits, 5.9 per cent in advances, 14 per cent in credit card circulation in India, 5.2 per cent in personal loan, and 8.4 per cent, 30 per cent and 38.9 per cent in RTGS, NEFT, and IMPS market share, respectively (by volume).

Retail loans account for 60 per cent of its loan book, with corporate and small-and-medium enterprise (SME) loans accounting for 29 per cent and 11 per cent, respectively. Home loans account for 28 per cent of the retail book, followed by rural loans (16 per cent), loan-against-property (11 per cent), auto loans (10 per cent), personal loans (12 per cent), small business (10 per cent), credit cards (7 per cent), commercial equipment (2 per cent), and others (4 per cent).

The bank has valuable subsidiaries, such as Axis Asset Management (75 per cent shareholding) which has assets under management (AUM) of Rs 2,74,265 crore and holds 5 per cent of the AUM market share.

Axis Securities is the third-largest bank-led retail brokerage in terms of customer base of 5.45 million. There is also Axis Capital, which provides focused and customised solutions in investment banking and institutional equities. The bank also closed 90 investing banking deals in FY24.

Axis Bank’s ability to navigate tight liquidity conditions, moderation in operating expenditure, and control on credit costs (by maintaining provision cushion at 1.2 per cent of its loans), should help the bank sustain outperformance over its peers.

The bank’s liability franchise continues to grow, which is likely to continue in the medium term. In Q2 FY25, loans grew 11.4 per cent y-o-y and 2 per cent quarter-on-quarter (q-o-q), while deposits grew 13.7 per cent y-o-y and 2.3 per cent q-o-q.

While credit costs in H1 remained elevated, we expect H2 to see moderation given that it already holds excess provisions on its balance sheet. The bank is expected to deliver return on assets (RoA)/RoE of 1.72 per cent/16.1 per cent by FY26.

-Krishna Rao

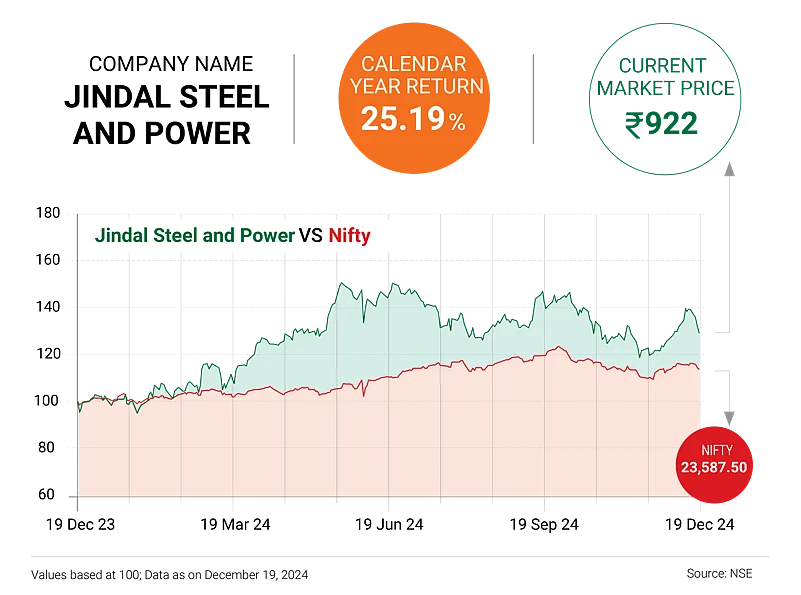

Steely Control On Resources

Jindal Steel and Power (JSPL) is one of India’s leading steel manufacturers with current capacity of 9.6 million tonnes per annum (mtpa). It is undergoing capex to expand its crude steel output by 65 per cent to 15.9 mtpa.

This will also increase its finished steel capacity by 90 per cent to 13.75 mtpa, making it India’s fourth largest steel maker by FY26. Upon capex completion, its share of flat-steel products is likely to rise to 65 per cent, which would boost margins.

Over the last decade, though JSPL raised its steel capacity from 3 mtpa to 9.6 mtpa, it was predominantly a long-steel manufacturer.

However, greater focus on flat-steel products—the latter’s share in the product mix is expected to rise to 65 per cent by FY26—augurs well for its long-term prospects, as flat-steel products command a premium to long-steel products.

JSPL also has many iron ore and coal mines in India and abroad. This aids in timely availability of raw materials and paves the way for it to be the lowest-cost domestic steel producer. The company also enjoys the edge of having many of its mines in proximity to its manufacturing plants. JSPL has 60 per cent integration of iron ore, and after commissioning of all its thermal coal mines, will have 100 per cent integration of coal.

JSPL intends to have an overal net debt/Ebitda of 1.5x. The company’s net debt and net debt to Ebitda stood at Rs 125 billion and 1.21x as on September 30, 2024 against Rs 105 billion and 1x on June 30, 2024.

The company’s steel margin is likely to improve going forward. The coking coal cost declined by $35 per tonne in Q2 FY25, and a drop of $20-25 per tonne is likely in Q3 FY25. The company has also taken a price hike of Rs 1,000 per tonne across products in Q3 FY25. Thus, the company expects steel margins to improve in H2 FY25 driven by strong seasonal demand, lower input cost and hike in steel prices.

Key risks include sharp decline in international steel price and jump in coking coal or iron ore price, which could impact margins. Delays in capacity expansion plan and economic slowdown may also impact volume and earnings growth.

However, strategic expansion, enriched product mix, and a strong raw material integration will aid margins. The valuation of 7x FY26 EV/Ebitda seems attractive given our expectation of 24 per cent Ebitda over FY24-26, improvement in RoE to 15 per cent in FY26 (versus 14 per cent in FY24) and strong balance sheet with net debt/Ebitda of 1.2x.

-Krishna Rao

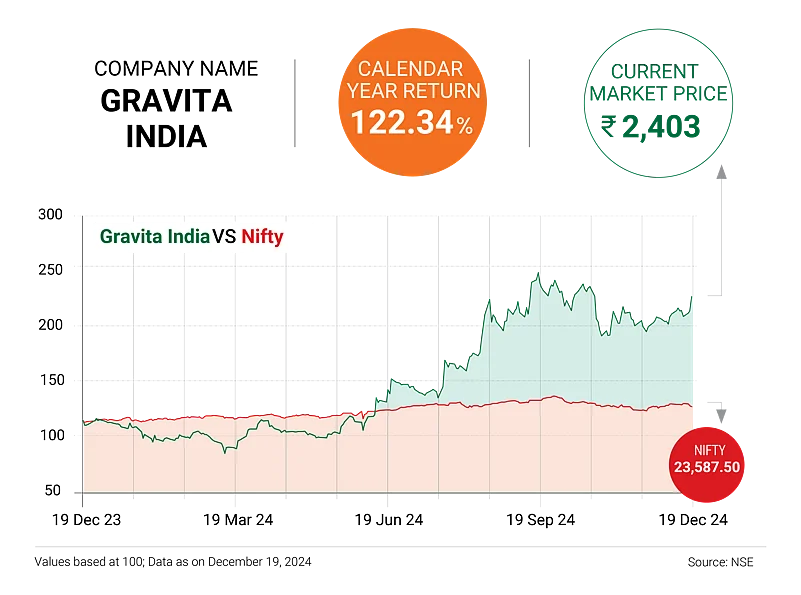

Recycling With Gravitas

Gravita India is a leading player in India’s recycling sector and is well-placed to capitalise on emerging trends as the world moves towards sustainability and ciruclar economies.

The company is at the forefront of the battery recycling industry in India, which will experience strong growth momentum over the next decade due to the rising push towards electrification of transport.

Besides, the government has taken multiple measures to formalise the recycling sector and has set recycling targets for battery producers. Being the major battery recycling player in India, Gravita is likely to be the key beneficiary of these policy changes.

While Gravita’s revenue growth is closely linked to lead prices (leading to unpredictable revenue growth), it can ensure robust Ebitda growth by entering into heading contracts for lead. The company is also likely to employ a similar contract for hedging against aluminium price variations. Additionally, the increased contribution of value-added products and foray into newer products are expected to expand the margins going ahead. Considering these factors, the company has guided Ebitda growth at a higher pace than volume growth.

Incidentally, regulatory changes have improved scrap availability, and the overall volumes for the company also continue to grow. The company is expecting a volume growth at 25 per cent CAGR and Ebitda growth at 35 per cent CAGR over the next three years. It has also planned capacity additions in newer segments such as recycling of Li-Ion battery, paper and steel. Gravita is also actively looking for inorganic growth opportunities and considering fund raising of up to Rs 1,000 crore for potentially expanding the capacity.

With planned capacity expansions and diversification into newer areas of recycling, it is likely to benefit from a growing domestic and international demand, regulatory tailwinds, and a well-spread scrap collection network.

The recycling industry presents significant growth potential, with Gravita positioned at the forefront to capitalise on this opportunity.

We expect revenue, Ebitda and EPS to grow at 26 per cent, 32 per cent and 33 per cent CAGR, respectively over FY24-FY27.

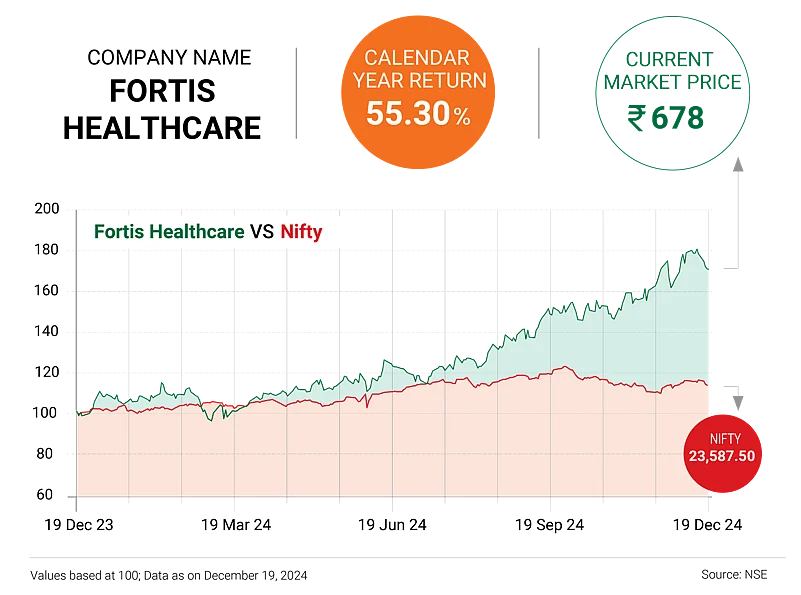

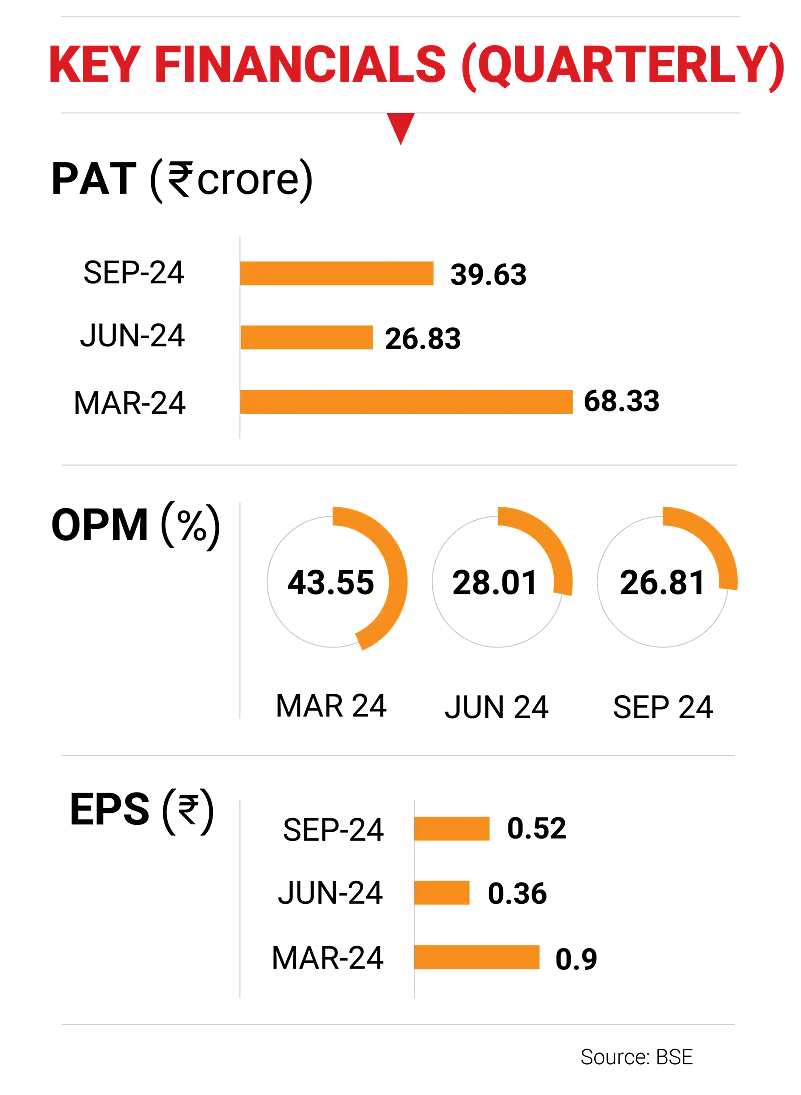

Holding Fort In Healthcare

Fortis Healthcare is a leading healthcare services provider in India, with expertise in complex medical procedures, such as cardiac surgeries, radiation therapies, and robotic surgeries. It operates 28 healthcare facilities, with over 4,500 beds and more than 400 diagnostics centres, making it one of the largest healthcare organisations in India.

Anually, it performs around 60,600 cardiac surgeries; 11,100 radiation therapies; and 3,600 robotic surgeries. Cardiac surgeries (Rs 2-5 lakh) and radiation therapies (Rs 2-3 lakh) enhance its financial position and average revenue per occupied bed (ARPOB). The Indian oncology market, which is projected to grow at 18 per cent CAGR to $1.49 billion by 2028, presents a significant opportunity, as Fortis is the largest provider of oncology services in India. The company generated Rs 813 crore in oncology revenues in FY24 and expects a revenue of Rs 1,600 crore by FY27. It also leads the cardiac healthcare market with Rs 1,010 crore in sales. The cardiac market, valued at Rs 40,000 crore and projected to grow 10 per cent annually, is expected to generate Rs 1,400 crore by FY27.

Fortis aims to add 2,000 beds over the next four years, increasing its total capacity to more than 6,000 beds through Brownfield projects. It has improved its occupancy rate from 55 per cent in FY21 to 65 per cent in FY24, with ARPOB increasing at 8.7 per cent CAGR, and reaching Rs 61,000 in FY24. By FY27, it expects occupancy rate to rise to 68 per cent and ARPOB at Rs 70,000.

New healthcare projects in Delhi NCR are expected to generate Rs 3,500 crore in annual revenue by FY27.

Fortis has significantly improved its Ebitda, reporting Rs 1,268 crore in FY24, up from Rs 225 crore in FY19. It is also aiming for a 200 basis points (bps) improvement in Ebitda margins y-o-y, with a 400 bps improvement expected from FY24 to FY27E. This will be supported by brownfield expansions, rebranding Agilus Diagnostics, divesting loss-making units, and cost optimisation.

Ebitda margins have improved, with eight facilities reporting over 20 per cent in FY24, up from 6 per cent in FY23. Fortis expects margins to exceed 12 per cent by FY27. PAT for FY24 was Rs 645 crore and is expected to reach Rs 1,421 crore by FY27.

The expected improvements in occupancy rates, along with rising ARPOB and strategic brownfield expansions, and its leadership in key therapies, such as cardiac and oncology, combined with rising insurance penetration in India, is expected to sustain strong demand for its services.

-Neeraj Chadawar

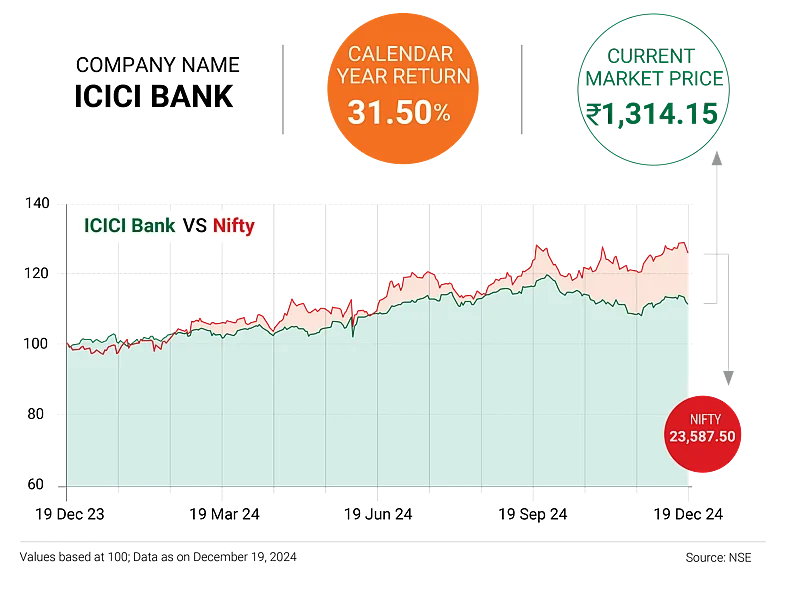

Healthy Bank Balance

ICICI Bank, one of India’s largest private sector bank has delivered a robust 17 per cent CAGR in loans from FY22-FY24, driven by retail, business, and SME segments.

The business banking segment continues to witness strong traction, even as the overall economic environment has softened. This segment has posted 30 per cent growth y-o-y in Q2 FY25.

In unsecured lending, the bank has tightened its underwriting standards, which has led to a slower growth in these segments. The bank is expected to deliver 17 per cent CAGR in its loan portfolio over FY24-27.

In terms of deposit, it continues to focus on strengthening its retail deposit base even as the current account savings account (CASA) ratio declined to 40.6 per cent in Q2 FY25. Also, net interest margin (NIM) has fallen by 27 bps to 4.27 per cent, inlcuding a 13 bps decline in H1FY25 against a 37 bps decline in H1FY24.

In terms of assets, the bank maintains a best-in-class provision coverage ratio (PCR) of 79 per cent and contingent provisions of Rs 131 billion (1 per cent of loans), which bodes favourable credit cost outlook. Over the past three years, the bank has seen a steady decline in slippages (1.8 per cent annualised) in Q2 FY25, on the back of strong underwriting and monitoring.

ICICI Bank is poised for a superior performance, driven by healthy loan growth, strong asset quality, and industry-leading return ratios.

While we anticipate margins to remain under pressure in the near-term due to a potential rate cut and rising costs of funds, its operating leverage is emerging as a key driver of earnings growth. Also, overleveraging remains a concern mainly in unsecured lending segments, which may continue to put pressure on the segment’s growth in the near term.

With robust deposit inflows and a favorable cash deposit ratio—the lowest among large private banks—the bank is well-positioned for profitable growth. Its asset quality outlook remains steady, supported by robust underwriting standards, strong PCR, and a high contingency buffer of 1 per cent of loans.

We estimate the bank to achieve a CAGR of 12-15 per cent in pre-provision operating profit.

-Siddhartha Khemka

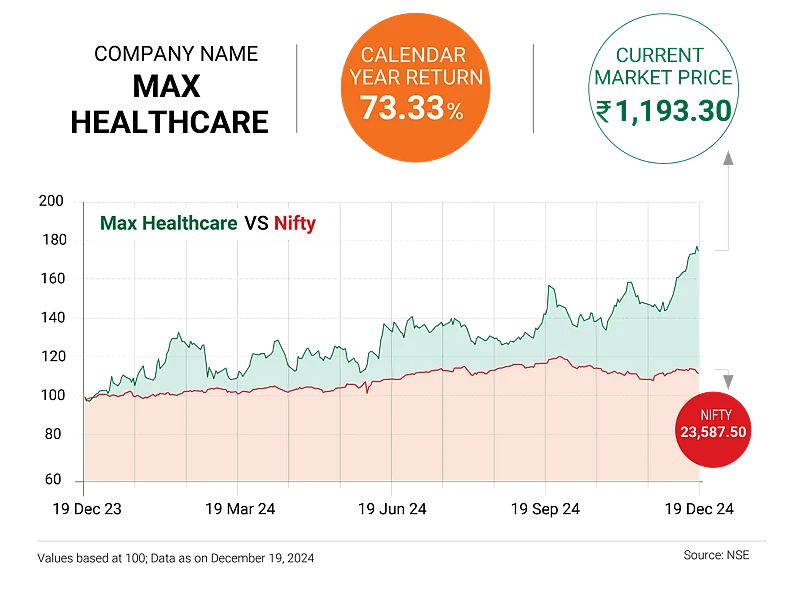

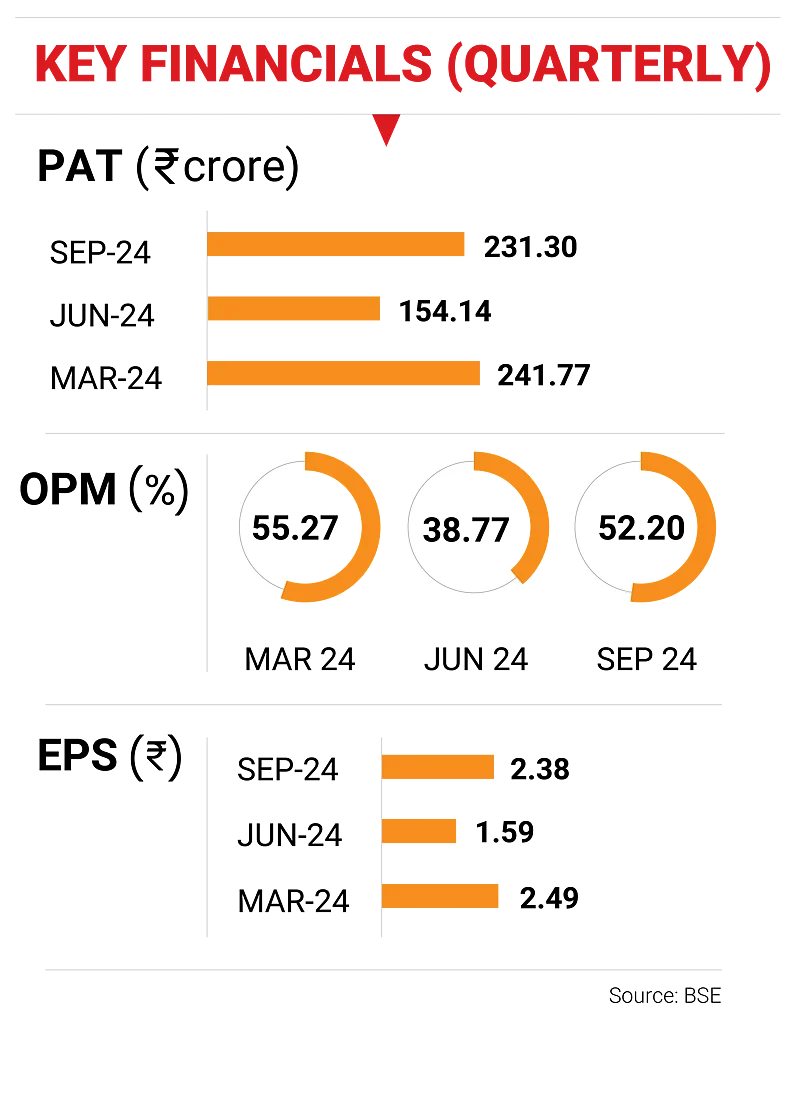

Maxing On Expansions

Max Healthcare is a market leader in Delhi-NCR and Mumbai regions, with over 3,949 beds and dominant leadership in oncology. The company plans to increase its total bed capacity by 84 per cent (3,332 beds) by FY27 through a capex of Rs 73 billion, with 70 per cent brownfield expansion ensuring efficient utilisation of existing infrastructure. A planned brownfield expansion of 70 per cent and a quicker break-even from new beds will drive higher operating leverage benefits. In H1 FY25, Max added 1,250 beds in Maharashtra, Lucknow, and Delhi. Further, the company plans to add 410 beds in Maharashtra, 880 beds in Delhi, 200 beds in UP, and 155 beds in Mohali.

Since FY22, hospitals like Max, Aster DM, and KIMS have pursued acquisitions to enter new markets, while Rainbow, Jupiter, and Medanta have focused on organic expansion.

Max plans to focus primarily on tier I cities in north India, with 82 per cent of its bed additions in this region. The remaining 18 per cent of beds will be added in western India.

The expansion in tier I cities should drive faster growth in average revenue per occupied bed (ARPOB) and profitability for Max. Considering its expansion into tier I cities, Max is expected to have the highest capex per bed of Rs 22 million against the industry average of Rs 12 million).

The company has land parcels in Delhi, Greater Noida, Lucknow, Sector-53 Gurugram, and Mohali with the potential to add 400-500 beds at each of these locations over a longer period. Moreover, despite multiple acquisitions in H1 FY25, Max had a net cash position of Rs 895 million and free cash flow (FCF) of Rs 24 billion as of September 2024. Going ahead, we expect a cumulative three-year cash balance of Rs 103 billion and FCF of Rs 50 billion, providing Max with enough headroom for bed capacity expansion.

Beyond FY27, it aims to add 4,500 beds to increase its capacity to over 11,000 beds, ensuring sustained growth, scale advantages, and robust long-term profitability through strategic expansions.

We expect revenue, Ebitda, PAT CAGR of 18.4 per cent, 16.2 per cent, and 20.5 per cent, respectively over FY25-27, driven by brownfield expansions, enhanced operating leverage, and quicker Ebitda breakeven for new beds. We remain positive on Max on the back of a robust industry outlook in its focus markets (Delhi, UP, Maharashtra, Punjab, Uttarakhand, Haryana). Further, Max is tripling its bed capacity over the next five years, thus providing strong headroom for growth.

-Siddhartha Khemka

Compiled By Kundan Kishore