The Reserve Bank of India (RBI) has issued the Sovereign Gold Bond (SGB) Scheme Calendar for premature redemption from April 2025 – September 2025. As per Para 13 of the Consolidated Procedural Guidelines on SGBs, premature redemption is permitted only after five years from the bond’s issue date.

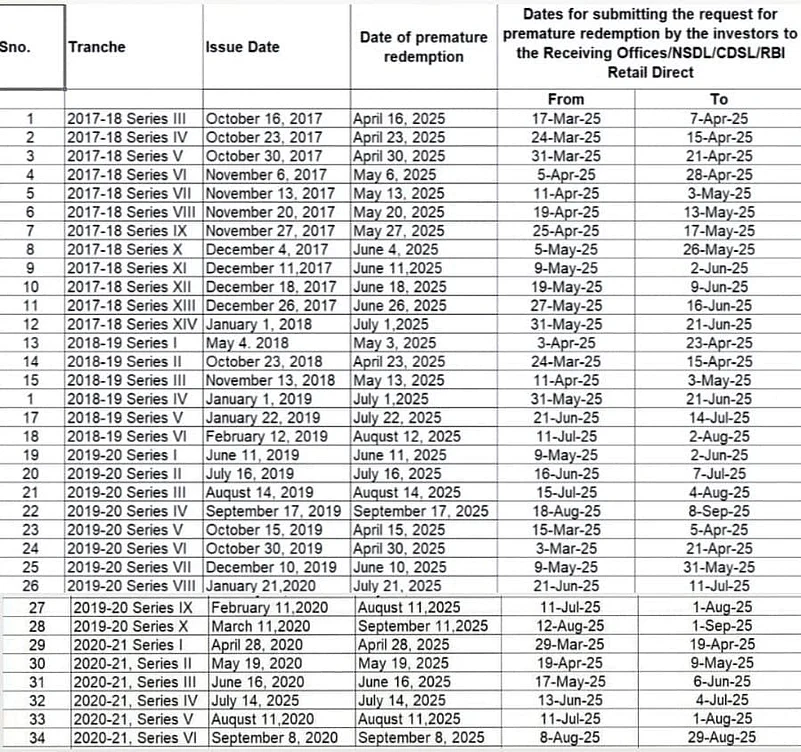

The RBI has also provided a detailed schedule for different SGB tranches that have been issued in the year 2017-2020, which will be eligible for premature redemption in this timeline. Investors need to make requests for redemption within the decided window to the bank offices specified, NSDL, CDSL, or RBI Retail Direct.

Premature Redemption Details

According to the RBI, the premature redemption schedule for SGB tranches eligible between April 1, 2025, and September 30, 2025, has been specified. Investors must submit their redemption requests within the submission period prescribed for each tranche.

The redemption schedule includes 34 tranches of SGBs, beginning with the 2017-18 Series III, which was issued on October 16, 2017, and will be redeemable on April 16, 2025. It extends up to the 2020-21 Series VIII, issued on November 3, 2020, and set for redemption on August 8, 2025.

The RBI has specified the submission period for each tranche as per the announced schedule. Investors should carefully check the submission windows to avoid delays.

Additionally, the RBI has cautioned that unscheduled holidays may lead to changes in these dates. Investors are advised to stay updated on any potential modifications.

What are Sovereign Gold Bonds?

Sovereign Gold Bonds (SGBs) are government-issued securities offered as a substitute for physical gold. The RBI issues these bonds on behalf of the Government of India. Under SGBs, investors get to buy gold in a non-physical format at a previously agreed price. At maturity, investors get paid the equivalent cash value. The SGB is open to purchase by Indian residents, such as individuals, HUFs, trusts, educational institutions, and charitable trusts.