With the market in a turbulent phase, many experts recommend asset allocation, and investors seem to be paying heed to this bedrock of portfolio management.

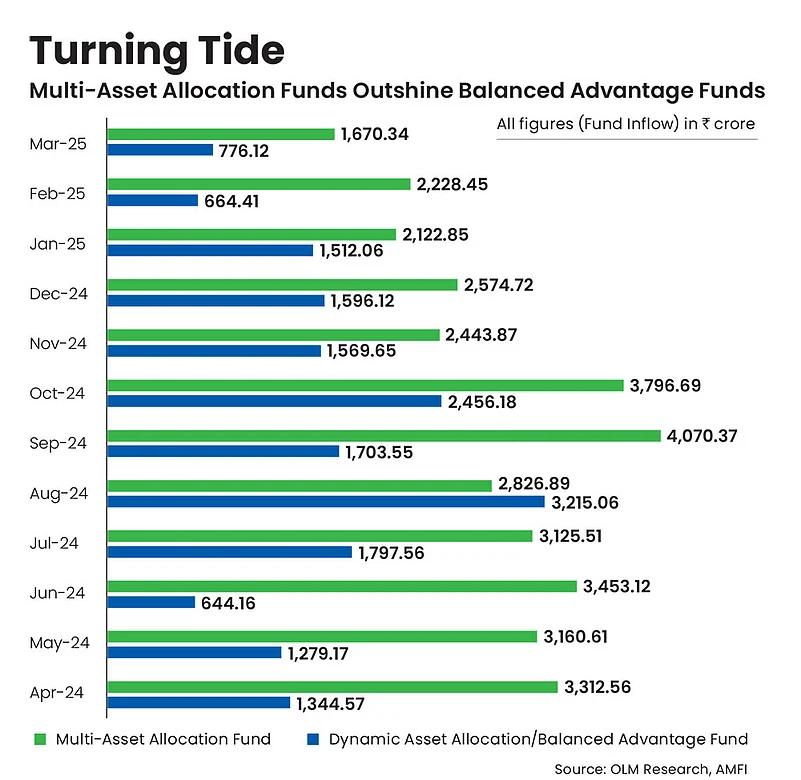

This is likely the reason behind the surge in multi-asset allocation funds (MAAFs). This category of funds has captured the spotlight in recent times, driven by consistent inflows over the past year. From April 2024 to March 2025, it received almost double the inflows of Rs 34,785 crore compared to the popular Balanced Advantage Fund (BAF) category, which saw inflows of Rs 18,558 crore during the same period. In March alone, MAAFs recorded Rs 1,670 crore in inflows—the highest among the various hybrid fund segments. It has also posted the strongest growth within the hybrid category over the same period.

Asset allocation has long been considered as a fundamental principle of smart investing. MAAFs provide a one-stop solution for your asset allocation needs. Says D.P. Singh, deputy managing director and joint chief executive officer, SBI Mutual Fund: “MAAFs can serve as a comprehensive, one-stop solution for investors by providing diversified exposure to multiple asset classes such as equities, bonds, commodities (like gold and silver), and international markets (via overseas exchange-traded funds or ETFs, infrastructure investment trusts or InvITs, and real estate investment trusts or Reits) within a single fund. This makes it particularly appealing to those seeking ease of investment, asset allocation, and professional management through one investment avenue.”

What Differentiates MAAFs?

According to capital markets regulator Securities and Exchange Board of India’s (Sebi) categorisation of mutual fund schemes, MAAFs must invest in at least three asset classes, including equity, fixed income, and commodities, along with other prescribed classes from time to time. Each asset class must have a minimum allocation of 10 per cent.

The fund manager invests in line with the investment objective of the scheme and determines the asset mix based on an in-house framework that considers factors, such as market conditions and economic outlook. This amalgamation allows investors to capitalise on the strengths of each asset class, while mitigating the risks associated with individual asset classes. The main benefit of MAAFs and the risk return framework that the category provides is that investors need not try and time the market, which in any case is a difficult task.

MAAFs bring in some objectivity to the asset allocation process on a dynamic basis. Fund managers do the asset allocation as per the market conditions. This way, your downside is limited and there is an opportunity of growth, too. “These funds not only help in automating the asset allocation, but also do it optimally, as allocation to each asset class is dynamically managed based on the fund manager’s view of the economy and market cycles,” says Singh.

He adds: “If done individually, switching between asset classes would require investors to monitor the trends of each asset class, rebalance the portfolio and be liable for taxes, etc. This is not the case when the fund manager rebalances the portfolio.”

The Emergence of MAAFs

The concept of MAAF is not new in India. They have been in existence for more than two decades and they have proved their mettle over this period. However, they did not get enough attention from investors or fund houses until recently.

This is because previously debt instruments acted like a major cushion for investors’ portfolios. Barring calendar years 2021 and 2022, they always gave returns in the range of 7-10 per cent on average. So, investors relied heavily on the combination of debt and equity for their asset allocation. This combination made BAFs, which are known for their dynamic asset allocation between debt and equity, popular among investors.

What triggered the shift to MAAFs were the tumultuous market conditions of 2022. Both equity and debt delivered muted returns, while gold outperformed with 14 per cent returns. MAAFs gained popularity as they can diversify among multiple assets, including gold and others, and are not limited to just equity and debt.

This caught the fancy of investors seeking to safeguard their investments in unfavourable market conditions. Interestingly, of the 28 schemes in this category, 19 were launched between November 2022 and January 2025.

Should You Invest?

MAAFs can play a versatile role in an investment portfolio by providing stability and income generation through investments in commodities and debt, while giving growth opportunities through investment in equities. However, you need to carefully choose between different MAAF schemes as not all of them are the same. Their returns differ, as different fund houses use different in-house models based on which they decide the broad asset allocation in different market conditions.

In terms of suitability, MAAFs clear the test for a wide range of investors. Says Singh: “First-time investors can benefit from its diversified approach, reducing the need for active management. Retirees may find it appealing for its balanced risk-return profile, providing stability and income. Experienced investors can use it to enhance diversification across different asset classes. It caters to anyone seeking a well-rounded investment strategy that adapts to changing market conditions.”

However, don’t just ride the new fund offer wave. Rather stick with a fund which has a proven track record and fits your asset allocation and risk appetite requirements.

kundan@outlookindia.com