At what age did you start investing and in which instruments? How much did you invest then?

I started investing during my college years, mainly in initial public offerings (IPOs), as more of a fun experiment, rather than a serious financial decision. The amounts were very small, but it happened to coincide with the Harshad Mehta bull run, where even a modest investment yielded strong returns. That early experience triggered a deep and lasting interest in investing, which eventually led me to pursue it professionally, despite coming from an engineering background.

Which is your favourite investing instrument and why?

Equity mutual funds are my preferred investment vehicle due to their transparency, cost and tax efficiency, and solid risk-adjusted performance. Strong regulatory oversight and healthy industry competition make them a well-diversified and efficient option for long-term wealth creation.

Equity mutual funds are my preferred investment vehicle due to their transparency, cost and tax efficiency, and solid risk-adjusted performance

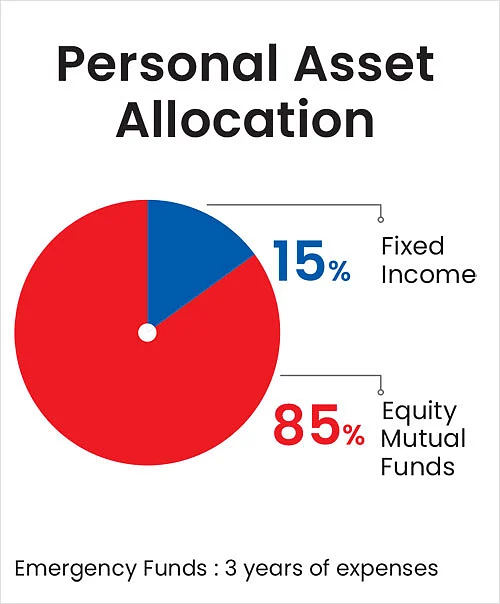

Could you share with us a rough breakup of your total asset allocation?

Around 85 per cent of my portfolio is allocated to equity mutual funds, with the balance in fixed income instruments. I believe in keeping at least three years’ worth of expenses in non-equity and low-volatility assets like fixed income, to ensure more stability and liquidity for near-term requirements.

Did you change your asset allocation after the recent market volatility?

No, I did not make any changes in my asset allocation after the recent volatility. In fact, I see volatility as an opportunity rather than a threat—it often improves long-term outcomes. I usually revisit my asset allocation when valuations seem extremely stretched or frothy, which is not the case currently.

Do you have an emergency fund and where do you park it?

Yes, I maintain an emergency fund that covers about three years of expenses. It’s primarily invested in fixed income and arbitrage funds, offering both liquidity and capital preservation for unforeseen events.

What is your view of the market for this year?

Despite the external shocks like ongoing tariffs, the market outlook remains stable, as valuations are now reasonable. Factors such as soft oil prices, accommodative fiscal and monetary policy, likely revival in mass consumption, and India’s growing strength in manufacturing/services are positives. While short-term returns are unpredictable, I expect approximately 12-14 per cent annualised returns over a 3-5-year horizon.

What has been your biggest investing mistake and what learnings did you gain from it?

My biggest mistakes have, typically, been stock-specific, especially during my fund management years. I would classify most under category of errors of omission, i.e., selling strong growth stocks too early due to a conservative stance. These instances taught me the importance of assessing the full size of the opportunity when investing in growth businesses, and to hold on to them as long as the thesis remains intact.

What has been your biggest investing achievement so far? Does it reflect in your portfolio?

One of my most significant achievements has been maintaining a high equity allocation consistently over the past two decades. This long-term discipline and conviction in equities have been key drivers of my portfolio’s performance.

How important is it for retail investors to consult a financial advisor? With so many kinds of advisors in the market, how should one choose?

It’s quite important. A good financial advisor helps reinforce core principles like long-term thinking, disciplined asset allocation, and diversification. Investors should look for advisors who are aligned with these values and can guide them through market cycles without deviating from the plan.

What are the top 3 tips you would like to give to investors in general?

My core investing advice would be:

1. Invest Early

The earlier you start, the more you benefit from compounding.

2. Stay Disciplined

Stick to your asset allocation and avoid reacting to market noise.

3. Focus on Quality

Always choose fundamentally strong companies for reliable long-term performance.

letters@outlookmoney.com