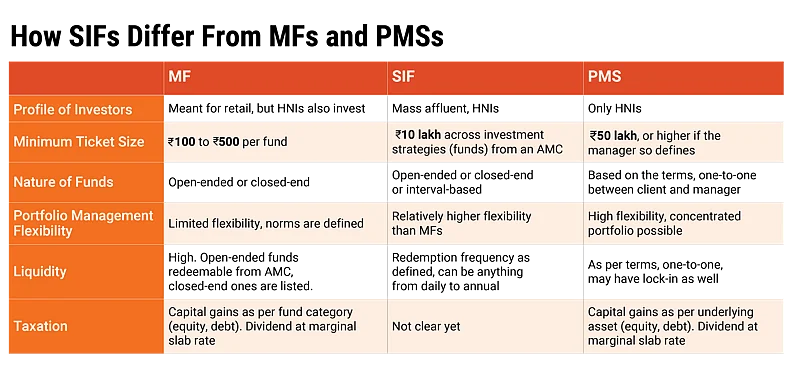

Mutual funds (MFs), due to their positioning, are typically favoured by retail investors, though high net-worth individuals (HNIs) and corporates also invest in them. However, HNIs typically use portfolio management services (PMSs) where the minimum ticket size is Rs 50 lakh, as per the regulator. The minimum quantum in PMS may be higher at the discretion of the manager, but Rs 50 lakh is the minimum as per the regulation. That leaves a space in between, which, in wealth management industry parlance, is referred to as “mass affluent”. This is currently catered to, either by MFs, or what is loosely referred to as “unregistered PMSs”. There are broking houses or wealth management outfits, which offer a basket of stocks, with a minimum ticket size of, say Rs 2 lakh or Rs 50,000 or Rs 5 lakh. This is, per se, similar to what a PMS does.

The Need for SIFs

The necessity for another product in this space arises from the fact that MFs, being meant for the masses, are subject to relatively stricter regulations from the Securities and Exchange Board of India (Sebi). The boundaries—what an MF category can do in terms of investments—are defined in a conservative manner. In contrast, PMSs are subject to relatively “light touch” regulations.

Hence, there is need for another product, with investment boundaries more flexible than MFs but stricter than PMSs and a ticket size somewhere in between. Enter specialised investment funds (SIFs), a product meant to bridge the gap. The Securities and Exchange board of India (Sebi) had issued consultation papers earlier; but the final circular was issued on February 27, 2025.

What are SIFs

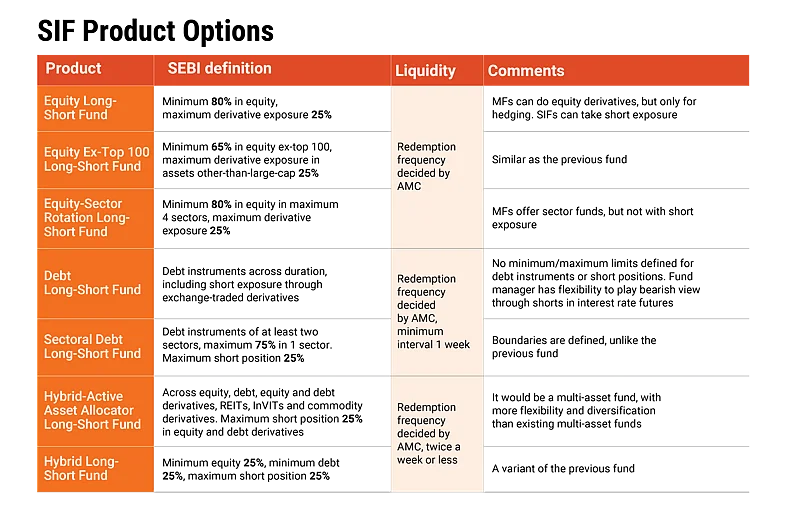

Existing fund houses, or asset management companies (AMCs) have been allowed to float SIFs, subject to certain eligibility conditions. The difference will be that, in SIFs, these AMCs will offer products that were hitherto not available earlier.

The minimum ticket size will be Rs 10 lakh across multiple SIF products that may be offered by an AMC. As of now, seven products have been allowed in this category.

This means an investor can invest a minimum Rs 10 lakh in one or across multiple funds. Investments in conventional MFs of the same AMC would not be counted for this purpose.

On the other hand, liquidity in SIFs may be lower than in conventional MFs. Open-ended MFs allow subscription and redemption every business day.

In SIFs, the regulation states that “the subscription and redemption frequency of investment strategy under SIF may be based on the nature of investments, including daily, weekly, fortnightly, monthly, quarterly, annually, fixed maturity, or other suitable intervals.

AMCs may offer systematic investment options too, such as systematic investment plan (SIP), systematic withdrawal plan (SWP) and systematic transfer plan (STP) under SIFs. However, the threshold of Rs 10 lakh will need to be maintained.

Conclusion

The risk-return profile of SIFs will be higher than that of conventional MFs and so will be the investment threshold.

As an illustration, MFs can do equity derivatives, but only for hedging. In SIFs, up to the permitted limit, the fund can go short.

Sebi’s objective is to promote an asset class with more variety and flexibility in portfolio construct but with limits on liquidity.

By Joydeep Sen, Corporate Trainer and Author