You would have heard about certain aspects of the mutual fund industry, such as the growth in assets under management (AUM) or how mutual funds are competing with bank deposits. But there would be certain trends which you may not be so aware of. We dissect these trends in the mutual funds industry, to assess whether there are any learnings or takeaways.

Holding Period

You would have heard so many times that investment is a long-term game, and it is boring in the sense that it does not give the thrill of, say, day trading or betting apps. When we look at investors’ average holding period, it is not encouraging. Data on investors’ holding period is available in three time horizon buckets: less than one year, one to five years, and more than five years.

As of March 2019, taking industry-wise data, in direct investments, 60 per cent of investments were held for less than one year, 39 per cent for one to five years, and only a minuscule portion was held for more than five years. Things improved thereafter. As on March 2024, 41 per cent of investments were held for less than one year, 51.30 per cent for one to five years and 7.70 per cent for more than five years. The encouraging part is the longer holding period of one to five years and more than five years has a higher proportion now. However, the fact that 41 per cent of direct investments are still held for less than one year, is a cause for concern. Part of it is explained by liquid and/or money market fund investments. That apart, in equity funds, this is opportunistic and looks like trading calls.

Coming to regular option, from March 2019-2024, the proportion of investments held for less than one year dropped from 43 per cent to 30 per cent. Investments held for one to five years improved from 47.30 per cent to 49 per cent. The most remarkable improvement was in the more-than-five-year category. It increased from 9.70 per cent to 21.20 per cent over the same period. As we observe here, in the regular option, the proportion held for more than one year is higher than in the direct option. It shows that at the cost of distribution commission, regular plan investors are receiving proper guidance. The benefit of returns from the market and compounding is reaped only over the long term. There is a discussion term, difference between ‘investment returns’ and ‘investor returns’. Since investors hold for a relatively shorter horizon, they do not reap the full benefit the investment has yielded over a long horizon.

SIP Accretion

There are more than 90 million systematic investment plan (SIP) accounts and more than Rs 26,000 crore of monthly gross SIP mobilisation. However, there is a high proportion of discontinuation of registered SIPs. As on May 2025, discontinuation of registered SIPs was 72 per cent. This is lower than 88 per cent a year ago, but still on the higher side. In 2020, 12.50 million SIP accounts were opened. By next year, 35 per cent of those were closed. In 2021, 24.30 million SIP accounts were opened, but by next year, 41 per cent of those were closed. It means, the number of accounts opened went up, but closure rate went up as well. In 2022, the number of accounts opened were 25.70 million, and closure rate by next year was 42 per cent. A year after, in 2023, 34.8 million accounts were opened, and the closure rate was 48 per cent. A part of the reason could be that investors, instead of holding too many accounts, are making their holdings reasonable. Still, it is on the higher side. Typically, SIPs should be continued for the long term; only then will you get the benefit of compounding and market returns.

Cost Averaging

When markets are down and prices are low, we psychologically tend to move away. However, we should invest more when prices are down. When we continue our purchases in a disciplined manner, say every month, we are buying cheap, which leads to a relatively lower overall average cost of acquisition. This is called rupee-cost averaging.

Typically, SIPs should be continued for the long term; only then will you get the benefit of compounding and market returns

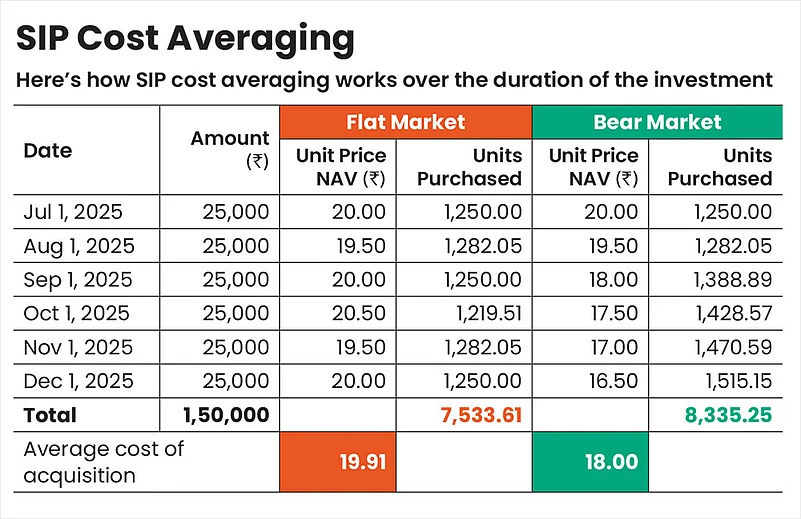

Let’s say, you have a SIP of Rs 25,000 per month, from July-December 2025. The market level varies; accordingly, the net asset value (NAV) of your fund varies as well. The number of units purchased is a function of the unit price or NAV: it is the amount, Rs 25,000 divided by Rs 20 (assumed NAV) in July 2025. In July 2025, you acquire 1,250 units of your fund, at a price of Rs 20.

In a flat market condition (see SIP Cost Averaging), the NAV fluctuates, but only so much. You acquire units every month at the given unit price. At the end of six months, you acquire a total of 7,533.61 units. Since you have invested Rs 1.50 lakh, and have 7,533.61 units at the end of six months, the average cost of acquisition is Rs 19.91. This is lower than if you would have invested a lump sum of Rs 1.50 lakh in July 2025, when the price was Rs 20.

In the bear market illustration, the NAV is coming down and you acquire a higher number of units. Your average cost of acquisition is Rs 1.50 lakh divided by 8,335.25 units, or Rs 18. The crux of the matter is, in a bear market, your cost of acquisition is lower than in a flat market and you acquire more units.

Conclusion

As we have seen in the data earlier, in regular plans, investors are better guided and the holding period is longer. Similarly, in SIPs, regular plans tend to be continued longer than direct plans. In a regular plan, there is a distributor handholding you. Or, you can avail of the inputs of a Securities and Exchange Board of India-registered investment advisor (Sebi RIA) who works for a fee and then execute the direct plan. There is merit in paying money to a professional, for the guidance and inputs, given the significance of your hard-earned money.

By Joydeep Sen, Corporate Trainer and Author