In recent times, the regulators have at least acknowledged the issue of mis-selling at banks, but unless there is action on the ground, it’ll be too little, too late

- EDITOR'S NOTE

Having a dedicated bank relationship manager (RM) is often seen as a privilege, but mis-selling turns that privilege on its head when customers of these so-called premium services end up victims of bad financial advice. We tell you how and why it happens and what you can do about it

If you are tempted to buy a stock whose price has dropped sharply, remember that there’s still a lot of volatility left in the stock markets, and sometimes the volatility in negative news-driven stocks can persist for a long time

The market downtrend combined with a high SIP stoppage ratio has left many mutual fund investors in a quandary on whether they should continue their SIPs or not. We tell you when it makes sense to stop SIPs

FDs and MFs, two popular investment avenues, provide guaranteed and market-linked returns, respectively. From a macro lens, both play a pivotal role in the growth of the economy

Canara Rob Bluechip Equity: Consistent And All-Weather Fund

With recent changes in Budget 2025, tax planning could be simpler, but choosing between the new and old tax regimes requires careful consideration. Given that the new regime will be better for most of you, should you discontinue your tax-saving investments?

Know Your Customer (KYC) is a mandatory process that financial institutions follow to verify the identity of their customers and ensure secure banking transactions. Here’s how you can update your bank KYC details online

Vishal Kapoor, CEO, Bandhan AMC, shares what he did with his first paycheque, how it became the first real lesson on managing finances, and how he realised later that starting to save early can set you up for life. He advises new professionals to enjoy their first salary, but also start saving, however small, and be consistent about it

Having a dedicated bank relationship manager (RM) is often seen as a privilege, but mis-selling turns that privilege on its head when customers of these so-called premium services end up victims of bad financial advice. We tell you how and why it happens and what you can do about it

If you are tempted to buy a stock whose price has dropped sharply, remember that there’s still a lot of volatility left in the stock markets, and sometimes the volatility in negative news-driven stocks can persist for a long time

The market downtrend combined with a high SIP stoppage ratio has left many mutual fund investors in a quandary on whether they should continue their SIPs or not. We tell you when it makes sense to stop SIPs

FDs and MFs, two popular investment avenues, provide guaranteed and market-linked returns, respectively. From a macro lens, both play a pivotal role in the growth of the economy

Canara Rob Bluechip Equity: Consistent And All-Weather Fund

With recent changes in Budget 2025, tax planning could be simpler, but choosing between the new and old tax regimes requires careful consideration. Given that the new regime will be better for most of you, should you discontinue your tax-saving investments?

Know Your Customer (KYC) is a mandatory process that financial institutions follow to verify the identity of their customers and ensure secure banking transactions. Here’s how you can update your bank KYC details online

A few regulatory changes in March 2025, and how they will impact you

Vishal Kapoor, CEO, Bandhan AMC, shares what he did with his first paycheque, how it became the first real lesson on managing finances, and how he realised later that starting to save early can set you up for life. He advises new professionals to enjoy their first salary, but also start saving, however small, and be consistent about it

OTHER STORIES

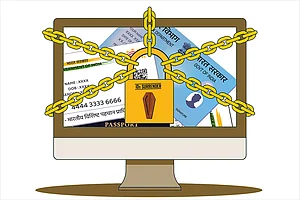

In an increasingly digitalised world, the personal IDs and documents of a deceased person face the risk of fraud. We tell you the documents you need to keep an eye on and when to cancel or surrender them

In today’s volatile financial landscape, investors are constantly seeking strategies to balance risk and reward. One of the most effective methods for achieving long-term stability and growth is multi-asset allocation, a strategy that blends different asset classes—equities, fixed income, and commodities—to optimize portfolio performance.

True value creation is often ignored in the money creation journey. Teach your children to be value creators and they would be excellent stewards of relationship and money

Invest In Liquid Funds For Emergency

Frequent Partial MF Withdrawals Negate Compounding Benefits

The Deposit Insurance and Credit Guarantee Corporation (DICGC) is a wholly-owned subsidiary of the Reserve Bank of India (RBI). It provides insurance to bank customers if a bank goes bankrupt?

A strategic approach to sector rotation based on economic cycles helps investors manage volatility and optimize returns

FMCG Sector To Benefit From Budget From Q2FY26

How Small Consistent Investments Can Unlock Long Term Wealth and Financial Freedom

A strategic asset mix helps investors manage risk, navigate market cycles, and achieve long-term financial growth.

Multi-asset funds balance growth stability and risk management ensuring smart investing even in volatile market conditions

A disciplined approach to finding undervalued stocks ignoring market noise and compounding wealth.