Summary of this article

D-street cheered S&P Global's credit rating upgrade for India.

India's credit rating has been upgraded to BBB by S&P Global.

The new credit rating is likely to help India in securing foreign investment and reducing borrowing costs for domestic banks.

The headline indices gained in early trade on August 18 as the Nifty 50 surged 1.58 per cent to an early high of 25,022 and the Sensex surged 1.44 per cent to 81,765.77 levels. The gains seen on D-street followed an announcement by S&P Global in which the independent ratings provider upgraded India's credit rating for the first time in nearly two decades.

Notably, this rating upgrade comes days after US President Donald Trump's statement in which he called 'India' a dead economy and imposed additional 25 per cent tariffs on India.

What Does S&P's Rating Upgrade Mean

S&P's rating upgrade is a major tail-wind for the stock market and the economy. The ratings agency has upgraded India's long-term sovereign credit rating from 'BBB-' to 'BBB'. Notably, the credit rating was last upgraded in 2007.

On the other hand, S&P Global Ratings has also upgraded India's short-term sovereign credit rating to 'A-2' from 'A-3'. The credit rating is significant as it is an indicator of India's credit-worthiness or ability to repay the loans it takes.

How Does S&P's Rating Scale Work

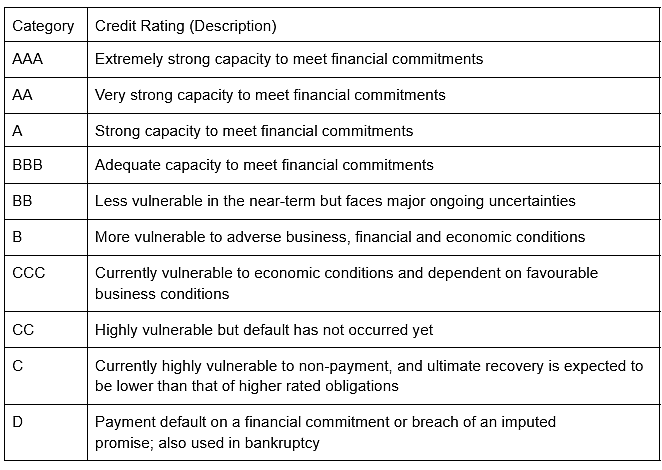

The credit rating agency uses a letter-based scale to evaluate credit-worthiness. Notably, the scale is sub-divided into investment grade and speculative grade (or non-investment grade) as per the S&P Global website. Long-term credit-worthiness ranges from AAA' (highest) to 'D' (lowest).

Often, the rating also has a negative sign accompanying it. India's credit rating getting upgraded from 'BBB-' to 'BBB' means that India has adequate capacity to repay any amount it borrows. On the other hand, the previously assigned BBB- rating indicated that while India had the capacity to repay any amount borrowed, it would be relatively more vulnerable to adverse economic conditions.

Short-term credit-worthiness is measured in ratings ranging from 'A-1' to 'D'. India's A-2 rating signifies that while India's capacity to repay its credit is satisfactory it is still susceptible to harsh economic conditions.

Why Did S&P Upgrade India's Rating

Several factors have contributed to S&P upgrading its credit rating for India. Some of the key factors include strong economic growth and robust fundamentals.

Robust Economic Expansion

India's real GDP growth has averaged around 8.8 per cent between FY22 to FY 24. Notably, this growth rate is the highest in the Asia-Pacific region. S&P expects this growth momentum to continue and aid in the moderation of the debt-to-GDP ratio.

Fiscal Prudence

According to S&P Global's report the Centre is committed to a clear and gradual path of fiscal consolidation with an emphasis on reducing the fiscal deficit. Additionally, the report also highlighted targeted public spending aimed at increasing capital expenditure on infrastructure.

Strengthened Monetary Policy

S&P also mentioned in its report that the Reserve Bank of India's (RBI) policy changes were aimed at 'inflation targeting'. So far in 2025, the RBI's Monetary Policy Committee has reduced the repo rate by 1 per cent or 100 basis points so far in 2025. The central bank deploys several monetary policy tools to curb inflation.

What the Upgrade Means for India

S&P's rating upgrade can have several benefits for India, such as reduced borrowing costs and other benefits.

Reduced Borrowing Costs

Higher ratings are an indicator of increased credit-worthiness thus the new BBB rating makes it easier for the Indian government and companies to borrow funds from international markets. Additionally an increase in credit-worthiness and a lower risk of default can also give India the upper hand in securing a loan at a relatively lower interest rate.

Greater Foreign Investment

A good credit rating makes India look more lucrative to foreign investors. The BBB rating increases their confidence in investing in India and enhancing capital inflows.

Lower Lending Rates For Banks

S&P also changed the credit rating of major Indian banks and Non-Banking Finance Companies like State Bank of India (SBI), ICICI Bank, and HDFC Bank. These enhanced ratings can lower their borrowing costs and bolster their ability to lend funds.

Future Credit Rating Upgrades

S&P Global's rating upgrade follows a rating upgrade by Morningstar DBRS. The recent credit rating upgrade can potentially trigger other global rating agencies to upgrade India's rating.