The market has been volatile for the last 4-5 months. What’s driving that and how has it affected investors’ behaviour and money?

Actually, markets are always uncertain and volatile. Sometimes there’s volatility with an upward bias, and sometimes with a downward bias. Right now, it’s with a downward bias, which people call a bear market.

But we saw tremendous rise in the market in the last three years, particularly post Covid. From around 7,000-8,000 points, the Nifty is now at 22,000 levels, rising almost three times, which has been an unprecedented and fantastic run. In this period, people have created Rs 300-400 lakh crore of wealth, across promoters and investors.

In the last three-four months, there is a little bit of volatility, but that’s the nature of the market, and it will continue like that.

But things will settle down with the New Year (financial year) starting, new promises, new credit flow, new earnings, projections, business outlooks, (changed) geopolitical conditions and other factors. The New Year opens up with a lot of hopes and it has just begun.

I am an optimist. So I hope that FY2025-26 is going to be better than FY2024-25 in terms of corporate earnings, which is like a market salary. Say, if my salary is Rs 20 lakh per month, I expect Rs 20 lakh to, say, go up to Rs 22-24 lakh. Just like that, corporate earnings will go up. The Nifty EPS (earnings per share) was around Rs 1,050 last year though it was expected at Rs 1,150. Now we expect it to go to Rs 1,200. Now let’s see how things shape up, and that will decide where the market goes.

There’s no fear within me, though my portfolio is also down like everybody else’s. But it’s natural. It’s like you cannot just do anulom (breathing in) anulom (breathing exercise anulom vilom, that is part of yoga), you also need to do vilom (breathing out) to complete the asana. And that’s what is happening right now.

Where do you think markets will go from here in the next five years?

Right now, what we see is a corrected market. It is not at the top at 25,000-26,000, it is around 22,000-23,000 (Nifty figures). I would think that in five-six years, markets should double, if the economy does very well, to 45,000-46,000 levels. But it depends, it could take five-seven years.

I started buying stocks in 1980, so I’m the granddaddy of this market, so mereko koi dar nahi lagta hai (I am not fearful at all). I have seen in the last 40-45 years that the Sensex has gone up from 100 to 78,000 points, a growth of 780 times. It’s like a running car. If your car is running at 60 km/hr and it’s a good car, is fuelled properly and the road is good, there is no reason to believe that the speed will come down to 20-30 km/hr.

The Indian economic growth road is very good, corporates make money and there are entrepreneurs. So I have no reason to believe that the future is going to be any less promising than the recent past.

We have recently seen a lot of debate on the investing strategy for small- and mid-caps. What is your view on these categories going forward?

Out of around 3,000 listed or active companies, only 150 are large caps. This means that 2,850 or 96-97 per cent of the companies are mid- and small. So how can you ignore them?

You are not some pension fund, but an individual investor, so you need to find the opportunity. Don’t bother about the cap—small-cap, mid-cap or large-cap. Jidhar opportunity hai udhar jao (Go where the opportunity lies). And opportunities don’t come on their own. So, if there is a solar pump boom, it will not happen in some mega company. It is going to be (driven by) some Rs 3,000-5,000 crore company. It’s a brand new industry. So you have to go and find that because stocks will be found based on the theme, not based on stocks. I love this and that stock, par arre bhai kuch nahi ho raha to kya karun (but what do I do if nothing is happening). So you have to see where the business opportunity is. If the opportunity is in telecom, then I have to go and buy large caps. But if the opportunity is in solar pump, toh udhar to aapko choti companies milengi (there you will get small companies). Opportunities in both big and small companies will always be there.

What happened in the last two-three years was excessive build-up of valuations in these companies (small- and mid-caps). Looking at the past, they are still trading at a higher premium than large-caps. There is no reason why they should be trading at that much premium, but since the investor interest in them is high, they can maintain those premiums for a pretty long time.

My suggestion is that don’t bother about the valuation per se. Go and find your own company. There are enough companies—large, mid and small—in the market that are reasonably priced. There are enough investible candidates which you can include in your portfolio for five, 10, or more years.

We saw the number of equity investors rising after Covid. For these new investors, this may have been the first major market downturn. How do you think these investors dealt with it or will they need to mature more?

Of course, they will mature over a period of time. I started investing in 1990. Till about 1994, I didn’t know what I was doing. I thought I was very smart. It was only when I first read the Warren Buffett letters that I realised that I had to go to KG (kindergarten) for market investing.

Investors realise (the reality) when more challenging times come. In fact, I met a couple of rich novice investors, whose portfolio went up wildly—from Rs 7-8 crore to, say, Rs 20 crore. When market fell, they asked me how much of a hit did my portfolio take. I said, the index went down 16 per cent, and I am down 16.5 per cent. They said their portfolio was down half, but then they also grew too much. My portfolio went up about 30-35 per cent, whereas their portfolio went up by a 100 per cent. But then the volatility in their portfolio is very high, because they buy low-quality companies which are in the momentum. They have collected 200-300 companies. So now they will start maturing and will not have 200 companies. They will realise that there’s a lot of junk in the market.

Out of the 3,000 listed companies, at least 2,500 are not worth investing. And I am being liberal, the numbers are even smaller. In our mutual funds, we manage about Rs 1.25 lakh crore, but how many companies do we have? About 95 per cent of the portfolio will be 65-75 companies. They struggle to find new ideas where they can put close to Rs 1,000 crore, even with all the research.

So, you have to be very careful as an investor to see what is working for you and what is not, even if you are a brilliant investor. You have to narrow down and find your style.

What is your investing style?

My biggest achievement in the last more than 40 years is what we call “Buy Right: Sit Tight”. It’s an annual wealth business study. I have written 23-24 of these studies since 1998. In that we said, our investment philosophy is QGLP—quality, growth, longevity and reasonable price. All the 49 studies are available on the website.

How investors mature? How Raamdeo matured as an investor? It takes a lot and you have to keep learning.

This (stock investing) is a beautiful field, in the sense that you don’t have to hang up the boots at all. Even if you are 100 years old, you can be investing with your style.

You are a chartered accountant (CA) professional. How did you enter the world of investing and what were some of the early challenges that you faced?

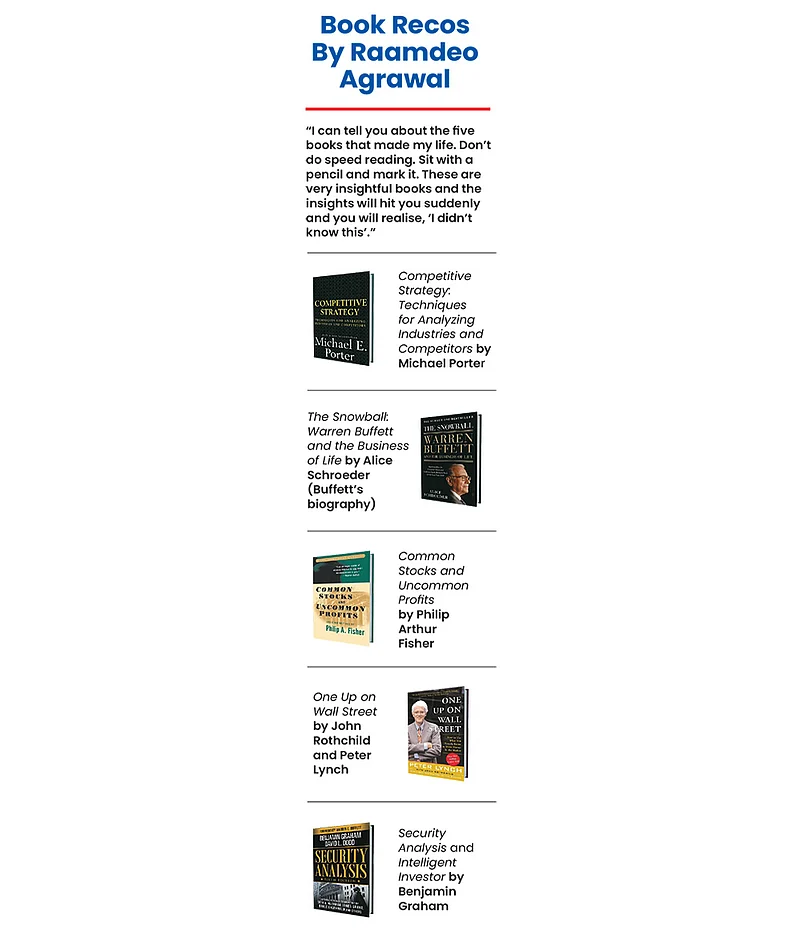

The first thing is my reading habit. You’ve got to have a reading habit if you want to become anything in any field, but more particularly in the stock market. Reading gives you newer frameworks. For everything , you need frameworks—it helps you figure out how to think about growth, good business, good management, and valuation.

When I started, I was a CA. I was comfortable with balance sheets, and I used to collect balance sheets. When I got my first job, I went with 200 balance sheets; even my employer didn’t have that many. So you’ve got to be passionate. Ab yeh passion kahan se aaya, mat poocha mujhse (don’t ask where my passion came from). Maybe because of my accounting background, but I got hooked to it.

But the moment I learned about the stock market, I fell in love with it. It was love at first sight. Whatever I would have become, it would have something to do with the stock market—maybe an analyst, fund manager, owner, or something similar.

That was my calling, but I had to streamline to get into business and then model the business in some way.

So, the journey continues, but you have to decide the destination. It could be a 30-50-year journey, but if I know the goal, I will go on, whether by air, train, road or walking. I don’t think I can do anything else other than stock markets.

Could you tell us about your experience of meeting Buffett years ago? And what are your main learnings from him?

I heard about him in 1994, when I read his balance sheet and that was love at first sight. And that made me replan my entire strategy on the stock market. That pulled me to Omaha.

It was in 1995 or 1996 that I attended his annual general meeting (of Berkshire Hathway). That time it was not streamed, so we had to go physically. It took 30-32 hours to reach there. It was very simple and around 5,000 people used to come. The AGM is, typically, on a Saturday, so on Friday evening they hold a free dinner on the eve of the AGM at Borsheims, their luxury jewellery store. You will find all kinds people there. Billions of dollars of market capital standing there and rubbing shoulders with you, and you can go talk to anybody.

Small guys like us (like I was in 1994) are also welcome and I enjoyed every moment of it. He used to sit under a tree at a table, and sign dollar bills. So you shake hands, take the signature and walk out. I still have the dollar bill on which I took Buffett’s signature.

We are carried away by his net worth, aura and so on, but the whole thing is about (what he conveys about) how to think about investing. He has become a trillionaire in one lifetime. I think he is going to live for another 20-25 years and he could become a $10 trillion guy.

Yeh kaise ho sakta hai (how can this happen)? There are quotes after quotes (by Buffett). On understanding the power of compounding, what is a good business, how to pick up a good management, how to look at valuation, how not to be greedy. What is the difference with price and value? Price is what you pay, and value is what you get. So keep your purchase price so good that even a mediocre sale gives you good return. So a lot of such concepts are internalised. Yeh hamari gurudakshina hai.

What is the investing mantra you would like to share with younger investors?

Investing means you have to understand price and value. Price is known to everybody, but nobody knows value. So aapko CA kyun banne ka hai, ya aapko research kyun karne ka hai (so why do you want to become a CA or why do you want to research)? For that, you have to understand value. Price is quoted every day, but value is not quoted at all. In good times, where there is too much pressure from investors, the price goes through the roof, but value doesn’t. In a market, a thing that costs Rs 10 can be sold for Rs 100, and an item worth Rs 100 can be bought for Rs 10. What you need is to have a good fix on the underlying value. Yahi aapki journey hai poori (this is what an investor’s journey is). If you get the value right, then you are a master.

So how do you get the value of a company right?

That is where the hard work comes in. There is no one book (that will tell you that). So you have to learn. We have tried to give a formula—good business, good management, and reasonable price. It’s a perfect triangle. Go to page 6 and 7 of the 2007 annual letter of Buffett, where he has talked about “great, good, gruesome”. I think it is the best letter he ever wrote. Read it at least 50 times. Even now, when I read it, I get something (to learn). That will help you understand good and bad businesses.

Then comes management. Have an eye on Virat Kohli or Rohit Sharma, or Kapil Sharma, who are all heroes, (of the management). If you have a terrific management, you will have a terrific business. You’re not going to lose money, unless you pay 200-300-times the price. But you will know how much to pay because there will be some benchmarks. There is enough research (to indicate the value) to refer to.

nidhi@outlookindia.com

What is your view on mid- and small-caps?

Out of 3,000 listed companies, only 150 are large caps. This means that 2,850 or 96-97 per cent of the companies are mid- and small-caps. So, how can you ignore them? Opportunities in both big and small companies will always be there