Summary of this article

RBI’s 25 bps rate cut is set to ease EMIs and improve affordability for mid-income and affordable homebuyers.

Rising prices had slowed decisions; the cut may bring fence-sitters back, boosting year-end and early-2026 demand.

Fast transmission expected, offering quick relief due to external benchmark-linked loans, supporting sales across metros and smaller cities.

Developers see liquidity gains, with lower capital costs aiding project execution and new launches.

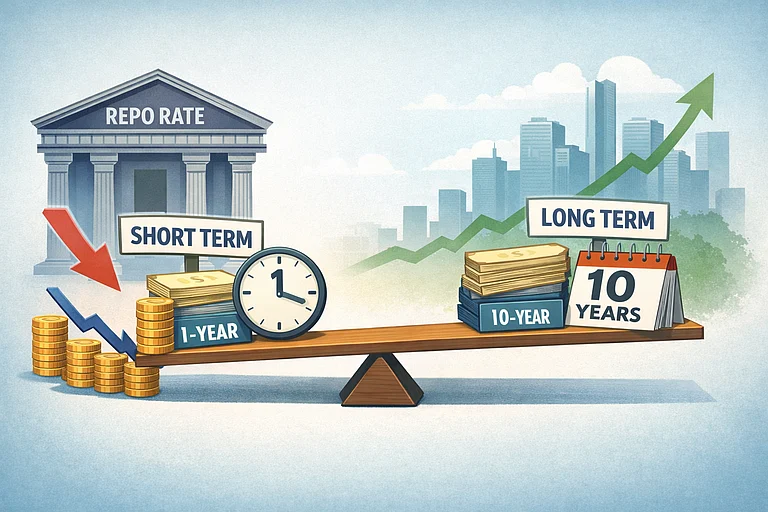

The Reserve Bank of India (RBI) cut the repo rate by 25 basis points (bps) on December 5, 2025, keeping its stance neutral, while signalling a dovish bias given the growth-related uncertainty.

According to industry experts, the RBI decision is a distinct positive for India’s real estate sector and further sweetens the value proposition for homebuyers, particularly in the affordable and mid-income segments which are highly sensitive to interest rate fluctuations.

With average housing prices across the top seven cities having risen by notable double-digits (close to 10 per cent) in 2025, according to Anarock Research, this rate cut provides a critical cushion to affordability, potentially bringing home loan interest rates to more attractive levels. This can encourage aspiring homebuyers who had paused their decisions due to price hikes to finally take the plunge. The rate cut is a distinct sentiment multiplier for year-end sales.

However, the real impact will hinge on the effective transmission of these benefits to buyers, according to Anuj Puri, chairman, Anarock Group.

“If banks swiftly pass on this rate cut to borrowers, we anticipate a renewed surge in sales velocity carrying firmly into Q1 2026. The current trends indicate that luxury homes will continue to drive residential real estate in 2026 as well,” he said.

Demand for affordable and mid-segment homes remains strong in the country, but is hamstrung by high prices impacting affordability. This rate cut can potentially bring at least some fence-sitters to the market.

Samantak Das, chief economist and head – research and REIS, India, JLL, said that for the residential sector, this is a direct boost to affordability which has been a growing concern amid rising property prices.

“We have been observing price resistance in the affordable and mid-segment housing categories, with our estimates projecting residential sales in 2025 to be 8-9 per cent down from last year’s robust 300,000-plus units (in the top seven markets of India). Given the high penetration of external benchmark-linked loans, the transmission to homebuyers is expected to be quick, providing tangible relief in equated monthly instalments (EMIs) that directly addresses this affordability challenge,” he said.

This move is expected to act as a catalyst that will revive purchasing power and activate the crucial segment of first-time affordable and mid-market homebuyers who have been waiting on the sidelines, transforming fence-sitters into active buyers. “We anticipate this will not only invigorate demand in the top metro areas, but also significantly boost the burgeoning housing markets in Tier 2 and Tier 3 cities,” Das added.

Real estate developers have also hailed the rate cut, as this move will significantly lower the cost of capital, encouraging accelerated execution of planned inventory, particularly in the affordable housing segment.

Avneesh Sood, director, Eros Group, said, “For real estate, this move is both timely and meaningful. A lower repo rate reduces banks’ cost of funds, which should translate into more attractive home loan rates, crucial when end-user demand is healthy but sensitive to borrowing costs. Developers, especially in the mid-income and affordable segments, will also benefit from better liquidity and faster credit flow.”

The RBI’s plan to inject durable liquidity through OMOs and FX swaps further strengthens confidence by ensuring smoother access to capital for ongoing and upcoming projects. “If banks pass on the cut quickly, this step can boost housing demand, support new launches, and further accelerate the sector’s formalisation and growth as we head into 2026,” he added.

Uddhav Poddar, chairman and managing director, Bhumika Group, said, “The rate cut could not have come at a more decisive moment for the housing market. Buyer sentiment typically strengthens toward year-end, and this reduction will make home loans more comfortable for buyers. In Delhi NCR, where demand for larger formats and luxury housing is already surging, we expect accelerated conversions in Q4. Looking ahead to 2026, this softer rate regime will support a healthier, more sustained growth cycle across NCR’s residential corridors.”

The RBI’s decision to maintain its policy stance, while indicating a calibrated approach toward future adjustments, reflects a balanced view of economic conditions.

“Such measures, when undertaken over time, have historically contributed to improved financial liquidity and broader market stability. From an industry perspective, a supportive interest-rate environment has the potential to positively influence housing affordability and overall sentiment. Combined with India’s ongoing focus on infrastructure development and regulatory clarity, these factors may help strengthen buyer confidence and support sustainable sectoral activity,” said Manik Malik, CEO, BPTP.