Summary of this article

NPS is becoming more flexible and inclusive, said industry leaders

Core purpose is disciplined long-term retirement saving while maintaining balance

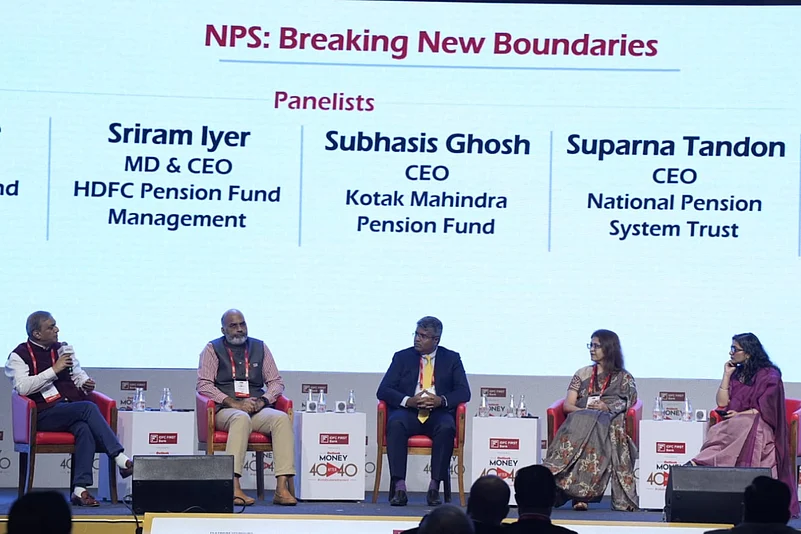

At a time when retirement planning is being reshaped by shifting work patterns, longer life expectancy and a growing demand for flexibility, the National Pension System (NPS) is quietly entering a new phase of evolution. At the Outlook Money 40After40 Retirement Expo in Mumbai, industry leaders gathered to decode how the framework is adapting and whether the latest changes reinforce or risk diluting its long term retirement focus. The session was moderated by Nidhi Sinha, Editor, Outlook Money, and included Kurian Jose, CEO of Tata Pension Fund; Sriram Iyer, MD and CEO of HDFC Pension Fund Management; Subhasis Ghosh, CEO of Kotak Mahindra Pension Fund; and Suparna Tandon, CEO of National Pension System Trust.

The conversation revolved around the recent reforms introduced by the Pension Fund Regulatory and Development Authority (PFRDA) and what they mean for savers trying to plan for retirement in an increasingly non-linear world of work.

Flexibility Versus Discipline: Can NPS Balance Both?

The panel agreed that while reforms have made NPS more accessible, the essence of retirement investing still demands discipline.

Ghosh acknowledged the inherent tension between flexibility and long-term commitment. “If you have the bar very high, people may not want to come in. If you keep the bar very low, entry and exit becomes very easy. That goes against the philosophy of staying invested over a long period.”

Drawing from his insurance industry background, he stressed on the role of annuities in ensuring income certainty. “Annuity gives you a guaranteed income for life. Many people even ensure that the spouse continues to receive it. That is a 30-year or more guaranteed stream after retirement.”

Shorter Tenures, Same Retirement Core

A major change under discussion was the emergence of options such as 15-year investment horizons, which some critics see as too short for a retirement product.

Iyer rejected the notion that NPS is drifting away from its purpose. “There is no disconnect. It may have changed in features, but in form it continues to be a retirement product.”

He argued that the product is adapting to new realities where careers are no longer defined by a single employer or a 35-year working cycle. “People are seeking to do various things. They may not work in the same job for decades. The product has adapted to these changes while retaining its retirement focus.”

The Multi Scheme Framework: Expanding the Pie

A recurring theme was the Multi Scheme Framework, or MSF, which allows pension funds to design tailored offerings within the NPS architecture.

Jose explained that the framework was created in response to four consistent objections from potential subscribers, including limited equity exposure, the long wait until retirement, discomfort with annuities, and difficulty in asset allocation decisions.

“We needed responses to each of these pushbacks. MSF allows higher equity participation, offers a 15-year structure that lets people see compounding in action, reduces the mandatory annuity component and gives professionally managed allocation options,” he said.

“If in my head I know this money is locked in and building for the time my salary stops, that discipline helps create the retirement kitty,” he added.

Iyer said MSF is also enabling entirely new segments to enter the pension ecosystem, including gig economy workers contributing small, but regular sums. The framework, he said, is “expanding the pie” rather than competing with existing investments.

Not Mutual Funds Versus NPS, But Mutual Funds And NPS

The panel firmly rejected comparisons that position NPS against mutual funds.

Tandon summed it up succinctly. “It is not a binary. I would say mutual funds and NPS,” he said.

She added that mutual funds address liquidity and varied time horizons, while NPS anchors long-term retirement income. She highlighted NPS’ structural advantages. “It is still the most cost effective product. It is transparent, portable and built on trust,” she said.

Jose reinforced the distinction, calling NPS a behavioural savings tool designed to ring fence retirement money that investors might otherwise spend.

From Retirement Corpus to Holistic Ageing Solutions

The panel also explored on integrating health related financial preparedness into retirement planning.

Jose noted that the industry is working on products that build a dedicated medical corpus alongside retirement savings to address rising healthcare inflation.

“Medical inflation is significantly higher. People often end up breaking deposits or investments to meet expenses. We want to create a separate kitty for that need,” Jose said.

He said such solutions are being designed to complement, not replace, health insurance, focusing on uncovered expenses and liquidity during emergencies.

Iyer described the broader shift as moving beyond accumulation to managing post retirement income flows. “We are not only focused on creating a retirement corpus. The industry is building solutions for deaccumulation as well,” he said.

More Choice, But With Simplicity at the Core

With new schemes, asset allocation flexibility and withdrawal options, concerns about complexity have naturally arisen. The panel maintained that while the menu has expanded, the foundational structure is simple. Lifestyle funds, active and passive choices and bundled solutions are meant to reduce, not increase, decision fatigue.

Ghosh explained that even newer asset classes are being introduced cautiously. “The journey has started gradually. The essence will still remain equity and debt oriented with measured exposure to alternatives,” he said.

The Road Ahead: A Wider, More Inclusive Pension Net

Tandon briefed on how NPS is now structured across government, corporate and individual segments, with MSF expected to drive future growth. The flexibility allowed multiple investment buckets within a single framework, making it suitable for workers with irregular incomes such as freelancers and gig workers.

“I can choose schemes depending on my age, cash flows and financial goals,” she said, highlighting how customisation is becoming central to pension adoption.

A System Reinventing Itself for a New Workforce

The discussion also explored a shared belief that retirement planning in India is entering a transition phase. The NPS is no longer positioning itself only as a distant, end of career savings vehicle, but as a lifelong financial companion that evolves with changing work and life patterns.

As Iyer put it, the aim is not to move away from retirement, but to make the journey toward it more aligned with how people actually live and earn today. In doing so, NPS appears to be shifting from a rigid pension construct to a flexible retirement ecosystem, one that still demands patience and discipline, but increasingly speaks the language of choice, accessibility and relevance.