On the morning of February 1, 2025, when Union Minister of Finance Nirmala Sitharaman posed before the gates of Parliament for the customary photographs, it was much less cold in Delhi than the same day last year. While Delhi welcomes early spring this year, the finance minister’s (FM’s) announcements also marked fresh beginnings for the middle class of India. It managed to make the new tax regime more attractive than the old tax regime for all income groups and provided relief to senior citizens and those stuck in stressed projects, among others.

Says Poorva Prakash, partner, Deloitte India, “At the heart of the Budget proposals, there is a significant easing of tax burden for the middle-class. The Budget proposes to revamp tax slabs and rates across the board, under the new tax regime, while no change has been proposed in the tax slabs and rates under the old tax regime.”

Let’s look at the main changes that matter to you.

Income Tax Relief

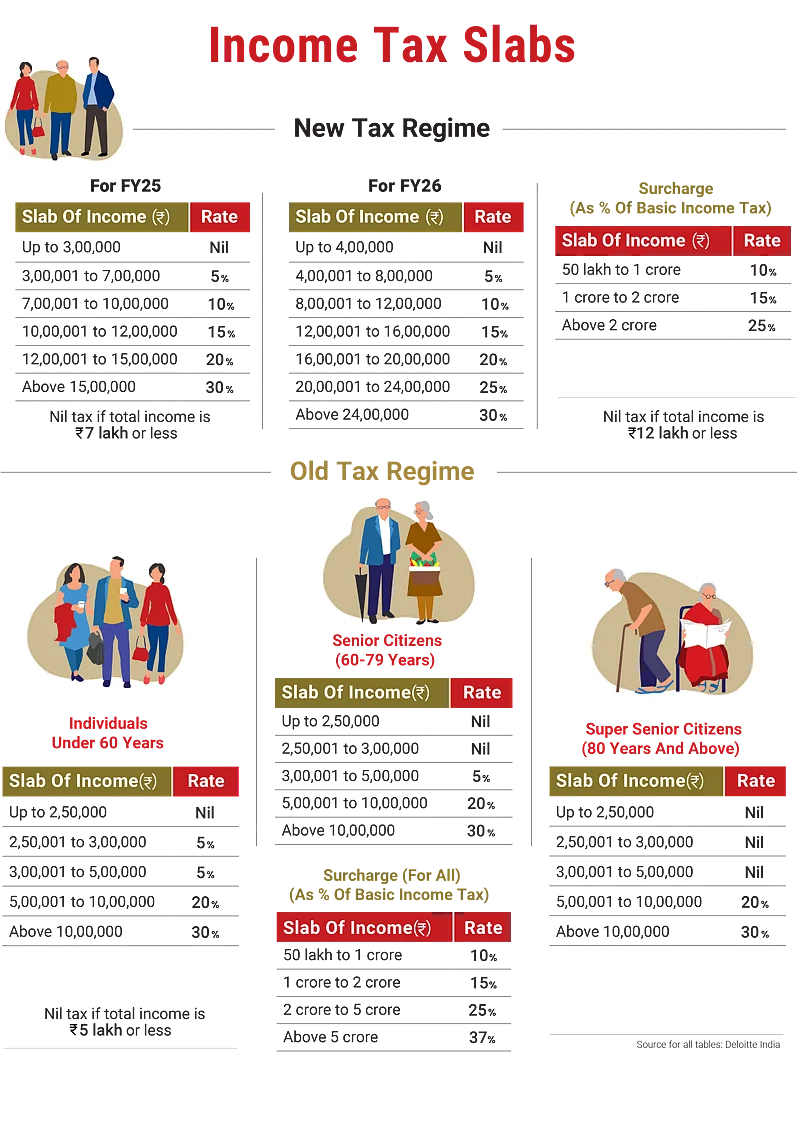

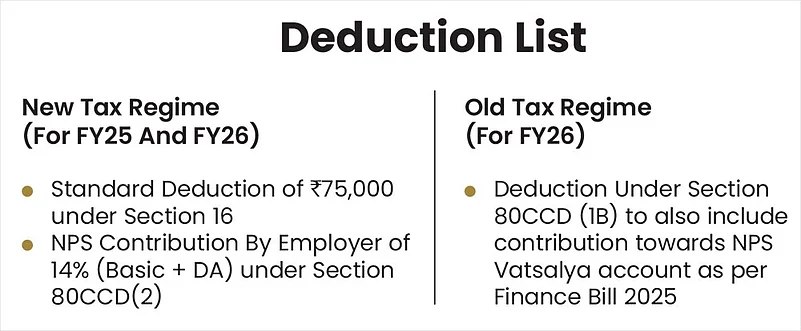

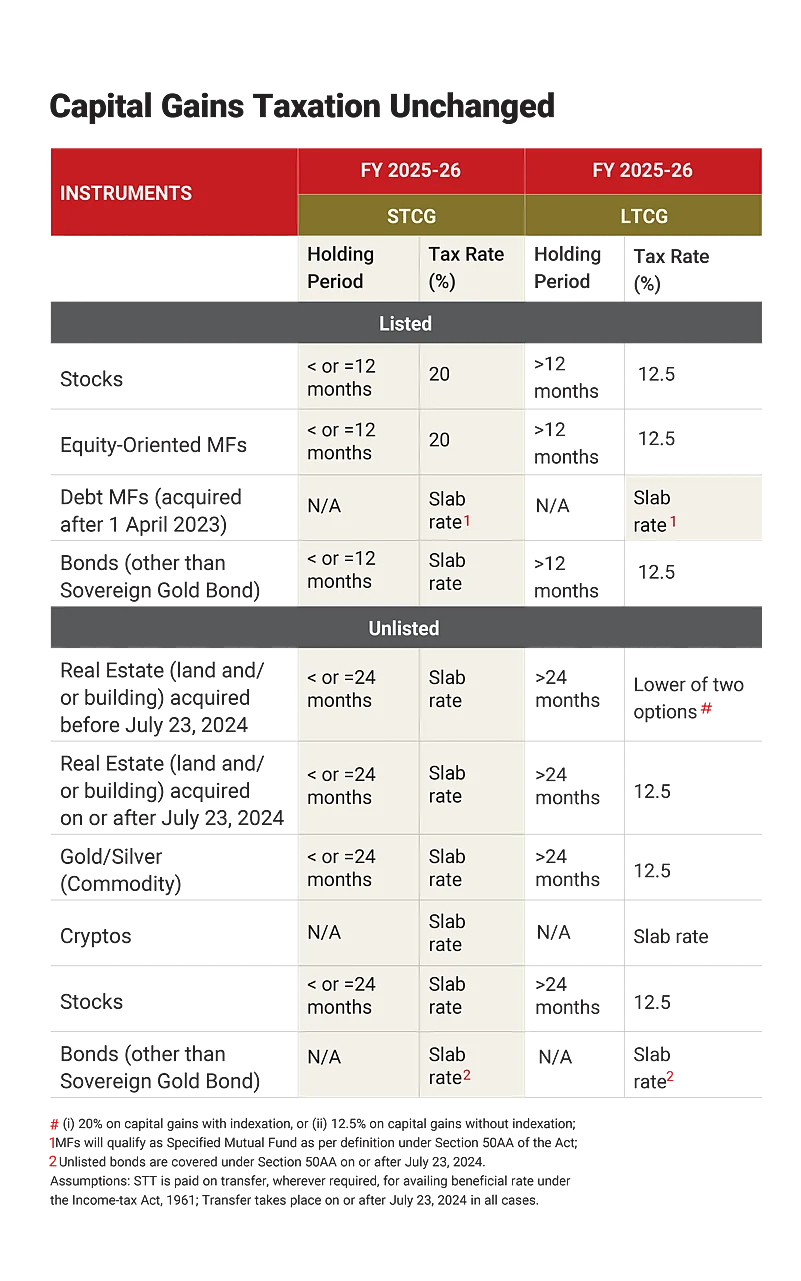

By now, all of you would know that there is no tax applicable on incomes up to Rs 12 lakh, other than income such as capital gains on which a special rate is applicable. This will effectively mean a limit of Rs 12.75 lakh, including the standard deduction of Rs 75,000 for the salaried. The Rs 12 lakh limit is up from Rs 7 lakh, which was announced in 2023 for the new tax regime.

Says Parveen Kumar, partner – direct tax, Dewan P N Chopra & Co: “According to the earlier tax rate under the new regime, taxpayers having income up to Rs 7 lakh were paying nil tax after taking a rebate of Rs 25,000 under Section 87A of the Income-tax Act, 1961. Now that rebate has been increased, taxpayers having income up to Rs 12 lakh (excluding special rate income) will pay nil tax, thus saving Rs 80,000.”

The other big relief were the changes in the tax slabs (see Income Tax Slabs, Page 72). They have not just been lowered, but directly benefit another chunk of people with an income between Rs 15 lakh and Rs 24 lakh. Earlier the highest slab rate of 30 per cent was applicable to anyone earning above Rs 15 lakh; now this rate is applicable to people earning above Rs 24 lakh, reducing the tax burden dramatically for people falling in the range, especially on the lower side.

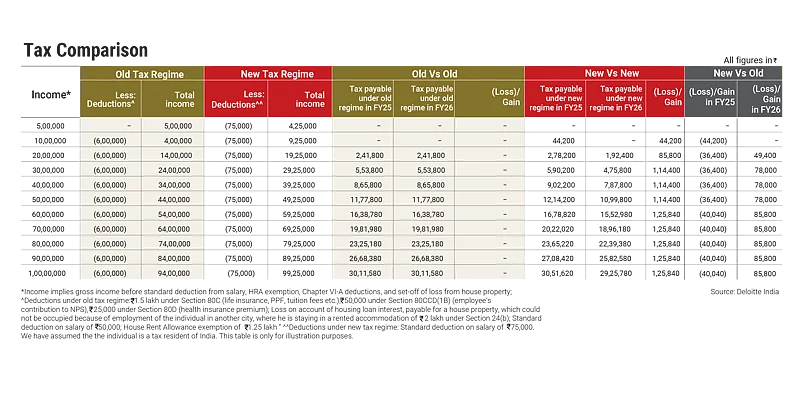

Even for incomes above Rs 24 lakh, it’s better. A person earning Rs 30 lakh will have to pay a tax of Rs 4,75,800 in financial year 2025-26 (FY26) compared to Rs 5,90,200 in financial year 2024-25 (FY25), a saving of Rs 1,14,400, under the new regime. The tax payable under the old regime remains the same at Rs 5,53,800, assuming you avail of deductions of Rs 6 lakh per year (see details of the deductions in Tax Comparison). However, apart from common deductions, we have taken a house rent allowance (HRA) exemption of Rs 1.25 lakh. Those paying much higher rents may come up with different outcomes.

There will be no tax applicable on annual incomes up to Rs 12 lakh, other than income, such as capital gains. This will effectively mean no tax up to Rs 12.75 lakh for the salaried class

Says Poorva Prakash, partner, Deloitte India, “Enhancement of rebate, resulting in nil taxation for income up till Rs 12 lakh under the new tax regime will result in substantial reduction of taxes for the middle class. This will increase their spending power, resulting in enhanced household consumption, savings and investment.”

Another relief for individual taxpayers has been the extension of the timeline for filing ‘Updated’ tax return. It has been proposed to increase it from 24 to 48 months post the relevant assessment year.

New Regime Beats Old

All the changes the FM announced were to do with the new tax regime and, as expected, the old tax regime did not find a mention at all.

In fact, calculations show that even with deduction of Rs 6 lakh under various sections of the Income-tax Act, 1961, you will be better off in the new tax regime. This effectively renders the old tax regime irrelevant from FY26 for most.

That is not the case in the current FY25 under which we will be filing our income returns in the middle of this year. In our calculation, with the same amount of deduction of Rs 6 lakh, you would have fared better under the old tax regime in FY25 if your income was Rs 10 lakh and above. But largely, the middle class is set to benefit.

Calculations by Outlook Money’s Budget partner Deloitte India shows that there is an inflexion point at Rs 8.50 lakh of deductions, where the tax payable under the old and new tax regimes will be equal, but how many common people will be able to avail that much in deductions and exemptions or have that many opportunities are big questions. Only HNIs paying a rent above Rs 3.75 lakh and eligible for that much HRA exemption will gain. For Deloitte’s column on the details of this inflexion point, see Page 98.

Focus On Senior Citizens

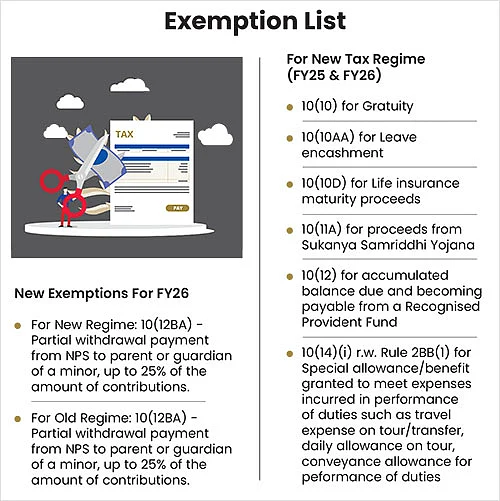

The government has been focusing on senior citizens and retirement savings for some time now. In the last budget, the government announced the NPS Vatsalya scheme, which can be opened in children’s names for their retirement savings.

This year, it has taken a step ahead and made NPS Vatsalya deductible under Section 80CCD (IB).

It has also expanded the tax deduction at source (TDS) benefit for seniors. “The limit for TDS on interest for senior citizens is being doubled from Rs 50,000 to Rs 1 lakh,” the Budget document mentioned.

This means that the banks will not deduct TDS from interest earned up to Rs 1 lakh from deposits. A large number of senior citizens still prefer to keep their retirement corpus in their savings account.

Says Prakash, “This is a welcome move, particularly for senior citizens having nil tax liability, as enhanced threshold will ease their compliance burden, potentially saving them from the requirement of furnishing Form 15H to the banks/financial institutions or claiming refund of the TDS in their income tax returns.”

Another common cash flow source for seniors, rental income, has also got relief from TDS. “The annual limit of Rs 2.40 lakh for TDS on rent is being increased to Rs 6 lakh. This will reduce the number of transactions liable to TDS, thus benefitting small taxpayers receiving small payments,” announced the FM.

Withdrawals from very old accounts of National Savings Scheme (NSS), mostly held by senior and very senior citizens, have been made tax-exempt. “As interest is no longer payable on such accounts, I propose to exempt withdrawals made from NSS by individuals on or after the 29th of August, 2024,” the FM announced in her Budget Speech.

Even the move to have no tax for incomes up to Rs 12 lakh will benefit many senior citizens who manage with lower cash flow.

Says Anuj Kesarwani, a certified financial planner, chartered trust and estate planner, and founder of Zenith Finserve, “The changes in Budget have brought some much-needed relief to senior citizens. This addresses the safety and post-tax returns concerns from investments. With the proposal of no tax up to an annual income of Rs 12 lakh, a senior citizen can invest in government schemes like Senior Citizen Savings Scheme, Post Office Monthly Income Scheme, and bank deposits.”

Other Focus Areas

Homeowners: There is relief for those stuck in stressed projects under the affordable scheme, and for owners of two self-occupied or vacant properties.

In November 2019, the government had announced a stress fund called SWAMIH to complete housing projects that are stuck across the nation. “Under the special window for affordable and mid-income housing (SWAMIH)… 40,000 units will be completed in 2025, further helping middle-class families who were paying equated monthly instalments (EMIs) on loans taken for apartments, while also paying rent for their current dwellings,” the FM said. The government also announced a fund of Rs 15,000 crore for expeditious completion of another 100,000 units.

There will be no tax liability on owners of two self-occupied houses. Earlier, this was allowed only on one self-occupied house.

But this could pose larger risks. B. Jagannath Rao, general secretary, Credai, an industry body, says: “Although this change aims to stimulate the ‘second home’ market, it risks exacerbating existing inequalities. Wealthier individuals with the means to purchase multiple properties may benefit disproportionately, potentially leading to speculative buying and driving up property prices. Additionally, this could divert investment away from affordable housing initiatives in tier-II and tier-III cities.”

At the same time, the Budget acknowledges diverse housing needs of families and encourages real estate investment. “The move aligns with the broader focus on financial empowerment and ease of living, strengthening the middle class,” Rao adds.

Remittance And Education Loans: This Budget has also raised the threshold of foreign remittance under the liberalised remittance scheme (LRS) from Rs 7 lakh to Rs 10 lakh. This move will bring relief to those who make smaller foreign exchange remittances mainly as expenses for education, travel, medical expenses, and investments.

More importantly, the tax collected at source (TCS) on foreign education loans has been removed when it is from specific financial institutions. This will provide relief to children studying abroad.

“The TDS provisions currently rationalised do provide some easing out on the compliance and administrative burden,” says Rohit Garg, partner, Shardul Amarchand Mangaldas and Co.

With the tax burden reduced, people will now have more money in their hands, which is likely to boost consumption and investments, which in turn will benefit the economy. It’s a thumbs up from the middle class.

nidhi@outlookindia.com

With inputs from Anuradha Mishra, Meghna Maiti, Shivangini Gupta and Versha Jain