Bank of India (BoI) has reduced the lending rate for its floating rate retail loans, effective July 1, 2025. This public sector bank is among those that have recently lowered their lending rates following a cut in the Reserve Bank of India (RBI) repo rate. BoI has reduced its marginal cost of fund-based lending rates (MCLR) across all tenures, starting from overnight loans to 3-year loans.

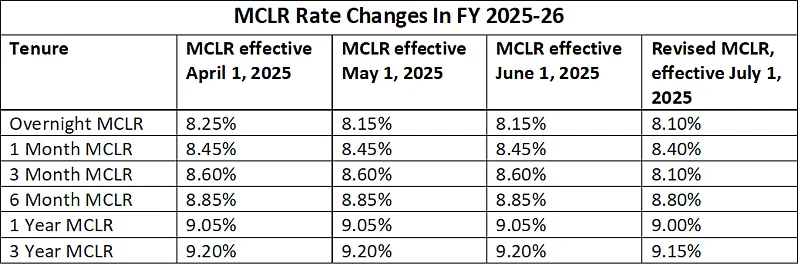

As of July 1, 2025, the revised MCLR rates are as follows: the one-month rate is set at 8.10 per cent, while the rates for 1-month, 2-month, and 3-month tenures are 8.40 per cent, 8.55 per cent, and 8.80 per cent, respectively. The revised one-year MCLR, typically used as a benchmark for floating-rate loans, now stands at 9 per cent, and the 3-year MCLR at 9.15 per cent after the revision.

Here are the MCLR rate changes in FY 2025-26:

Source: Bank Website

The bank has also revised rates for its fixed rate loans by reducing the fixed rate spread. The fixed rate spread implies the margin a bank charges over the benchmark interest rate like treasury rates, or so. Now, the bank has reduced this to 1.50 per cent for its fixed rate loans.

The bank uses its 3-year MCLR as a benchmark for its fixed rate retail loans. So, the interest rates, including 3-year MCLR and spread, stand at 10.65 per cent, at the minimum. However, the effective rate of interest depends on the borrower’s Cibil score. For instance, if a borrower’s Cibil score is 825 and above, the rate of interest will be 10.65 per cent and for a lower Cibil score, the rate of interest can be more than 12 per cent.

Notably, it has not made any changes in the repo-based lending rate (RBLR). This RBLR was last changed on June 6, 2025. At present, it is 8.35 per cent, including a mark-up of 2.85 per cent over the repo rate of 5.50 per cent.

Here are the RBLR rates in 2025:

Source: Bank Website

The lending rate cut is in alignment with the change in repo rate, cash reserve ratio, and overall liquidity conditions.