Loans, whether they are borrowed for education, home buying, vehicles or even for personal consumption, are a reality in today’s time.

A home loan is among the most common type of loan people usually take for buying a home. Typically, people pre-plan their home loan and its repayment schedule in order to keep themselves prepared for any financial ups and down they may face during repayment. Prepaying home loans or a part of the loan from any unexpected gains is one of the common ways people reduce their outstanding debt on their unpaid home loan.

While financial prudence suggests that one should get rid of the liabilities at the earliest, benefitting you from financial obligation as well as saving on interest outgo on the outstanding loan amount, experts suggest weighing the pros and cons before deciding on prepaying a home loan with surplus gain.

Should You Prepay a Home Loan?

Sameer Mathur, managing director and founder Roinet Solutions says while, “prepaying a home loan can be a strategic financial decision, but it’s essential to weigh the pros and cons before committing”.

Interest on a loan is calculated on the principal amount one borrows, and repaying the loan early can help in saving money on the interest, which is calculated on the principal amount that remains unpaid.

Mathur says that one of the key benefits of prepaying a home loan is the potential for significant interest savings. He says: “Since home loan repayments follow an amortisation structure where interest payments are front-loaded in the initial years, making a prepayment at the right time can substantially lower the overall cost of borrowing. Additionally, it provides financial stability by reducing future liabilities and improving cash flow.”

On the flipside, you might face a fund crunch after prepaying the loan which may prove as a difficulty in emergencies and you might lose some investment opportunities, too.

“Prepayment also comes with certain drawbacks. Liquidity is a crucial factor—once the funds are used to prepay the loan, they become tied up in the property, limiting access to cash for emergencies or investment opportunities,” Mathur adds.

He says that if the loan carries a low rate of interest, while alternative investments offer higher potential returns, it is more beneficial to invest the money elsewhere.

“In a dynamic economy like India, avenues, such as equity markets and business expansion often present better long-term wealth creation opportunities than early loan repayment,” he adds.

When is it Ideal To Prepay Your Loan

According to Mathur, there are three situations that warrant you to prepay your home loan. First, if the home loan carries a high rate of interest, it is a smart move to pay your loan early, as prepayment minimises the total interest outflow. Second, one should prepay where the surplus at your disposal has no potential to generate better returns anywhere else. Lastly, he says “reducing outstanding debt enhances credit scores, thus improving the eligibility for future loans at better rates of interest”.

How Prepayment of Loan Reduces EMIs

According to Mathur, borrowers should consider two options while prepaying a home loan – lowering the EMI or reducing the tenure.

Prepaying will reduce the principal amount outstanding on your home loan, thus leading to lower EMIs, which in turn will reduce your monthly financial burden while simultaneously improving your cash flow management. This could also lead to lowering of your home loan tenure.

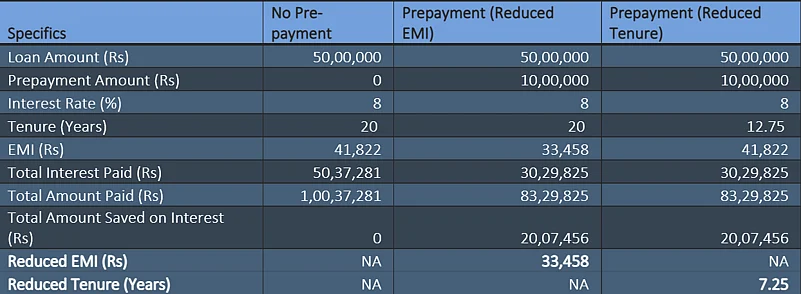

Here is a detailed analysis under three scenarios.

The table shows the calculation of how pre-payment of a home loan is affects the loan tenure, EMI and interest savings. The example is given by considering a Rs. 50 lakh home loan at 8% interest for 20 years, with an EMI of Rs. 41,822 and a prepayment of Rs 10 lakh after 5 years

There are two cases to consider; one where the loan is paid at its normal tenure without any prepayment, and second, where the person has made a prepayment of a certain amount and where the tenure of the loan and EMI are altered in two different scenarios.

In the first case, there are no savings made by the borrower on interest, and the loan tenure also remains the same, leading to continued financial obligation on the borrower till the loan is fully repaid.

In case of a prepayment of Rs 10 lakhs, you have two options:

Option 1: Lower EMI – Your EMI reduces to approximately Rs. 33,458, while the tenure remains the same.

Option 2: Shorter Tenure – Keeping your EMI unchanged, your loan tenure reduces by around 7.25 years, making your tenure 12.75 years and leading to significant interest savings.

Mathur adds: “From a financial perspective, reducing the loan tenure maximises overall savings, while lowering the EMI enhances monthly affordability. The ideal choice depends on individual financial goals.”

There are many banks that discourage prepayments and often levy prepay fee of a certain amount, while the Reserve Bank of India (RBI) has banned such practice formally on loans up to 7.5 crore on fixed rate loans.

How Does Your Chosen Tax Regime Affect Prepayment

Mathur says that while prepaying a home loan can lead to significant interest savings and improved financial stability, the decision should be based on factors, such as tax benefits, liquidity, and investment opportunities.

The old tax regime allows for deduction up to Rs 1.5 lakh under the overall limit allowed under Section 80C of the Income-tax Act, 1961 on repayment of the principal amount on the home loan. There’s also a separate deduction of Rs 2 lakh allowed on interest payments on home under section 24(b) of the Act.

“If these deductions are fully utilised, prepayment could reduce overall tax savings, making it financially viable to continue with EMIs.”

However, if one files income tax return (ITR) under the new tax regime, then it is advisable to prepay your loan as there are no deductions (tax benefits) available for home loan repayment.

“The borrower bears the full interest cost, which can be saved through prepayment which is an effective way to reduce long-term financial outflow,” he says.

Conclusion

As each borrower has different financial goals, it is advisable they consider the benefits before deciding to prepay their home loan.

Age also plays a huge factor in this, as a retiree would want to become debt-free, while a young borrower has more time to absorb the loan.

“Loan prepayment should align with an individual’s financial goals, liquidity needs, and tax efficiency. If alternative investments offer better returns than the loan’s interest rate, retaining liquidity may be beneficial. However, for those prioritising debt-free financial security, prepayment remains a strategic option,” adds Mathur.