United Spirits Share News: Shares of major domestic liquor manufacturers such as United Breweries, Allied Blenders & Distillers, Radico Khaitan and United Spirits declined in early trade on May 11. United Spirits shares declined the most among the pack, falling nearly 8 per cent to trade at Rs 1482.6 apiece on the NSE. Shares of Allied Blenders & Distillers also fell over 6 per cent to trade at an intraday low of Rs 417 apiece and shares of Radico Khaitan declined over 4 per cent to trade at an intraday low of Rs 2533 apiece. Shares of United Breweries slipped over 1 per cent to trade at an intraday low of Rs 2,035.2 apiece.

Shares of these domestic liquor manufacturers declined after the Maharashtra government announced an increased excise duty on the sale of Indian Made Foreign Liquor (IMFL), country liquor, and imported alcohol. An increase in the excise duty is likely to impact sales and turnovers for companies amid an anticipated in the Maximum Retail Price (MRP) of Indian Made Foreign Liquor (IMFL). Presently Maharashtra comprises 10- 12 per cent of the India’s total liquor industry volume.

Amit Agarwal, Senior Vice President Fundamental Research at Kotak Securities told Outlook Money that the introduction of the new excise policy has reawakened investor concerns regarding the alcobev segment. Agarwal also added that the hike in excise is expected to significantly earnings and valuation.

“This development could reawaken investor concerns regarding potential regulatory headwinds, resulting in some valuation de-rating. It contradicts the emerging view that the state governments were leaning towards a more measured approach to taxation aimed at supporting industry growth. Instead, it now appears that the Alcobev sector may once again be bearing the brunt of populist electoral promises. Significant impact on earnings and potential risk to valuation,” Agarwal said.

The Maharashtra Government has hiked the excise duty on IMFL by 50 per cent, according to a report by the Press Trust of India (PTI). The revised duty which will be levied will be 4.5 times the manufacturing cost as opposed to a previously imposed duty of three times the manufacturing cost. The duty imposed on the sale of IMFL liquor in Maharashtra will be up to Rs 260 per bulk litre. On the other hand the sale of country liquor will attract an excise ranging between Rs 180 to Rs 205 per proof litre.

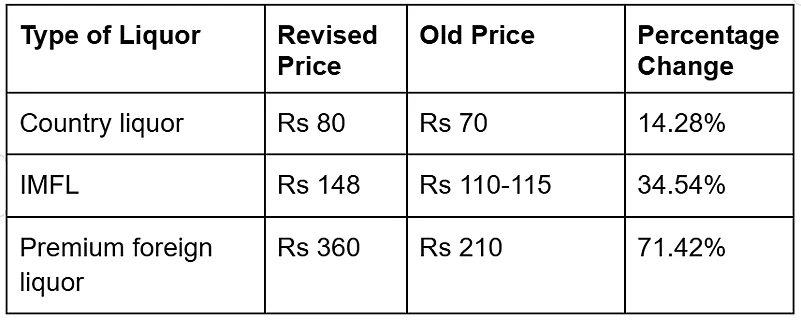

The Maharashtra Government has also shared a list of revised prices of 180 ml of different alcohol categories. The price of country liquour has witnessed an increase of 14 per cent and the IMFL and premium foreign whiskies have witnessed price changes ranging from 34.54 per cent to 71.42 per cent. Notably premium foreign liquor has witnessed the steepest price rise.

The Maharashtra Government has also announced the introduction of a Maharashtra Made Liquor (MML) category, according to the report. Notably this is the first revision of the excise policy by the state government after 2011. The report added that the new excise is likely to add Rs 14,000 crore to the government’s revenue annually in excise duties and related taxes.

What Should Investors Do?

Sebi Registered Investment Advisor and CFA, Manasvi Garg told Outlook Money that investors should exercise a cautious and selective approach while investing in alcobev stocks. He added that investors should focus on companies with a wider national footprint or growing export presence.

“In light of this development, investors should adopt a cautious and selective approach. Preference should be given to companies with a wider national footprint or growing export presence, as they are better positioned to absorb regional shocks. At the same time, it’s wise to trim exposure to firms heavily dependent on Maharashtra or similarly volatile states,” Garg said.

However Garg added that while the excise hike is likely to lead to margin compression for domestic liquor makers, the impact may be absorbed in the medium term depending on how the companies pass on the added costs and shift focus to other geographies.

“In the near term, liquor companies are likely to grapple with softer demand, constrained pricing power, and margin compression, especially in high-contribution markets like Maharashtra. However, over the medium term, the extent of the impact will depend on how effectively these companies can absorb or pass on the added costs and expand into other states,” Garg said.

Sula Vineyards, Som Distilleries And GM Breweries Shares Gain

Amid selloffs in domestic liquor manufacturing stocks, shares of Sula Vineyards, Som Distelleries and Breweries and GM Breweries bucked the trend to gain up to 13.09 per cent. The stocks surged amid expectations that these companies may benefit from the new excise policy. Notably the excise hike applies to sales of liquor via retail vends and bars and restaurants. According to a report by the Hindustan Times, the Maharashtra has exempted beer and wine from the duty hike which has contributed to the surge in the stock prices of companies in these sectors.

As per the report the exemption has been given as beer has relatively lower alcohol content when compared to hard liquor. The exemption for wine comes on account of Maharashtra government’s plan to promote the industry, since a significant portion of wineries are located in Maharashtra.

“Beer and wine companies such as Sula Vineyards and GM Breweries rallied today, as consumers may move to lower-taxed alternatives. Yet, this kind of volatility underscores a deeper concern that the liquor industry in India lacks consistent policy support. In contrast to other consumer goods sectors, alcohol remains one of the most heavily taxed and politically sensitive industries,” Garg said.