Those of you in your early 20s (Gen Z), may be thinking of getting your first credit card, as it allows you freedom to spend the way you want to. However, it’s also a major step in handling your own finances.

Credit cards offer easy access to credit, and is also a convenient way of establishing a credit history. Cashless transactions, reward points, no-cost equated monthly instalments (EMIs), and discounts on shopping and dining are some of the benefits these cards offer.

Yash Verma, a 22-year-old salaried professional, has been using his credit card for a year and views it as an essential tool for managing his finances. He uses it for paying his bills, and for shopping and expenses at petrol stations, particularly when his bank balance is low. Says Yash, “Using a credit card is an advantage, as it offers solution and flexibility when I feel financially stretched.” He seems to manage his debt in a way that the rewards and other benefits outweigh the risk of debt.

But along with the flexibility and convenience comes the risk of falling into a debt trap or overspending. Says Gaurav Goel, founder, Lamoksh Investments and a Securities and Exchange Board of India-registered investment advisor (Sebi-RIA), “Easy access to credit can lead to overspending, and credit card loans carry a high rate of interest of 30-40 per cent annually. Hidden fees, late payment penalties, and high credit utilisation can impact your credit score, making future loans harder to secure. Also, the lure of rewards, fraud risks, and minimum payment trap can lead to financial strain.”

Chirag Chauhan, a 23-year-old self-employed individual, has experienced some of these hiccups. He started using a credit card in late 2022. At first, it felt like a great tool, offering cashback, discounts, and other perks. But before he knew it, he was spending more than he realised. “I kept swiping my card, thinking I had everything under control, but when the debt piled up beyond what I could manage, I knew I had made a mistake,” he admits.

Given the risk of falling into a debt trap, it’s important to keep few things in mind and assess your repayment capacity before applying for a credit card.

Build Healthy Financial Habits

The first step is to assess whether you can handle a credit card at all. Experts advise against getting a credit card too early in life, because handling debt can be difficult if you haven’t already built healthy financial habits, such as not overspending and then asking your parents for more money, or landing in debt at the end of every month.

Says Goel: “The right time to get a credit card depends on your financial habits and stability. If you have a steady income, pay bills on time, and understand how credit works, it can help build your credit score, whereas if you struggle to maintain financial discipline, a credit card may be more detrimental than beneficial.”

If you spend beyond your means just because you have easy access to credit, you may fall into trouble like Chirag did. It is important to distinguish between your needs and wants, and act accordingly.

One of Chirag’s biggest mistakes was using credit for things he didn’t really need. Now, he has adopted healthy financial habits, wherein he prioritises spending within his means. He has gone a step ahead and avoids using credit cards entirely, ensuring that he never falls into the same trap again.

Evaluate Your Income Stability

Ensure you have a reliable source of income so that you can repay on time each month. A debt trap could result from relying on erratic income or borrowing to pay off credit card debt. A steady income helps build financial discipline.

But do banks offer a credit card to people who do not have a steady income? Says Madhupam Krishna, Sebi-RIA and chief planner at WealthWisher Financial Planner and Advisors, “While banks prefer salaried individuals for credit cards, those without a steady income still have options.”

For instance, individuals can apply for a supplementary card linked to a family member’s account, secure a credit card against a fixed deposit where the credit limit is usually a percentage of the deposit amount, or have a co-signer with a strong credit profile, says Krishna.

“Some banks also consider freelancers and gig workers by assessing bank receipts or alternative income sources for verification,” Krishna adds.

Maintain Credit Card Hygiene

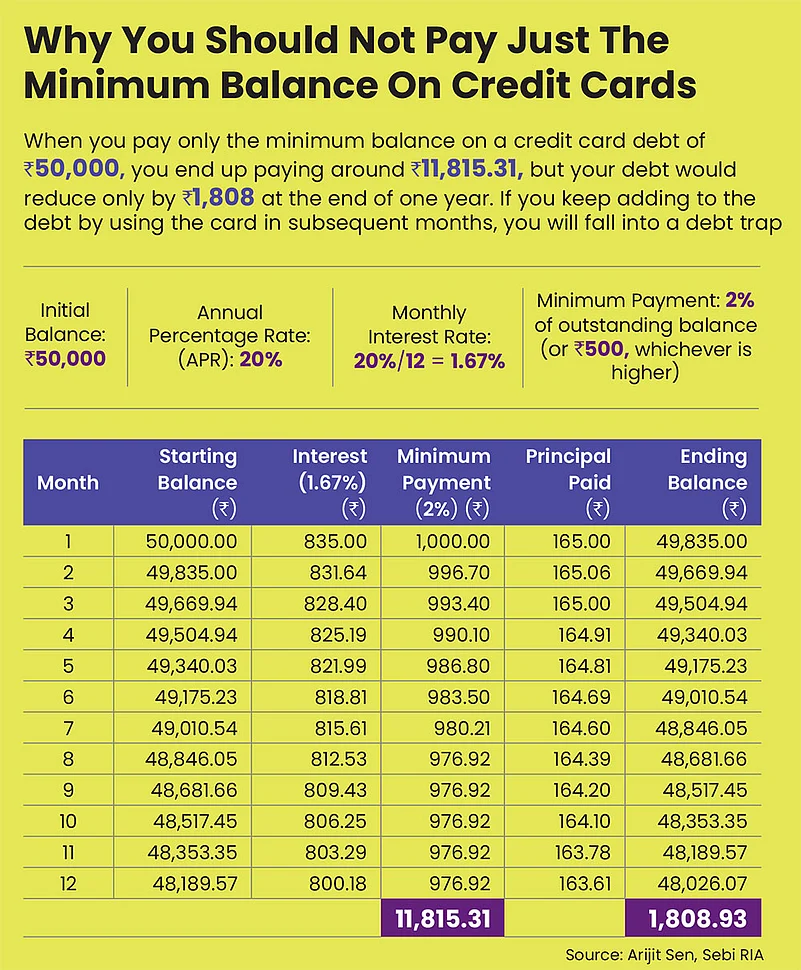

Repay On Time: Responsible use of a credit card involves paying your dues in full and promptly to prevent excessive interest charges. Chirag’s other mistake was only paying the minimum due amount. The interest and late fees kept adding up, making it harder to catch up. Eventually, the financial strain forced him to cut back on his lifestyle and negotiate with creditors to find a way out.

Says Vishal Dhawan, Sebi-RIA and founder, Plan Ahead Wealth Advisors: “Since credit cards have very high interest rates charged on outstanding balances, paying only the minimum due can spiral your outstandings to a very high level rapidly, making it very challenging to repay.” (See Why You Should Not Pay Just The Minimum Balance On Credit Cards)

Remember that credit card debt is like a loan, and defaults will affect your credit score.

Credit cards carry a high interest rate of 30-40 per cent annually. Experts advise honing financial discipline before using them for convenience

Says Krishna: “Any delay in payment will incur interest charges of somewhere between 24 per cent to 48 per cent per annum. As a credit card is a pre-sanctioned loan limit, the history is reported to the credit bureaus. Any adverse entry will spoil your credit score and, in turn, hamper your future credit-taking ability.”

Borrow Well Within The Credit Limit: All credit cards come with a credit limit up to which you can borrow. However, that doesn’t mean you use up all of it. Instead of spending the entire credit limit, aim to spend a maximum of 30 per cent of your limit, say experts.

Says Krishna: “Credit card limits are typically decided based on a multiplier of income, for example, two times of the cost-to-company (CTC), existing debt, as companies prefer less debt, and credit score. A better credit score (above 700) helps you get more limit. While a higher limit gives you more purchasing power, it also comes with the risk of overspending, leading to high-interest debt and financial strain.”

Choose The Right Card

If you think you are disciplined enough to handle debt and have enough income, the next step is to select the right card. This should be more about choosing one that suits your lifestyle.

If you don’t travel much, a travel card won’t help you, and if you do most of your spending on food and groceries, a cashback card would suit you better. Younger people may not travel much, especially for work, so focusing on cards with rewards for everyday expenses, such as food, groceries, or online shopping may be a better option. For those who already have a car, fuel related cards may also make sense, like in Yash’s case. Also, if you enjoy entertainment or streaming services, look for cards that offer rewards or discounts for related expenses. Or, if you’re someone who uses their card primarily for larger one-time purchases, a card offering instalment options or low-interest rates might suit you better.

Says Krishna: “Gen Z prefer banking and digital experiences associated with their card services. They demand advanced security features like contactless payments, digital wallets, and real-time fraud alerts. They want their credit card to integrate seamlessly with digital wallets like Apple Pay or GPay.”

Read The Terms and Conditions

Credit cards have lengthy terms and conditions that most individuals disregard. Interest charges, grace periods, late fees, and redemption rules for rewards can all impact what you truly pay.

Experts insist that understanding these is crucial.

Says Krishna: “You need to check the fees attached—these can be monthly, annual, or based on your usage. Make sure you understand the interest rates, fees, and any penalties for late payments.”

Several first-time consumers fall victim to hidden charges or penalty fees that they are not aware of. Spending time to read and know these terms will prevent you from experiencing financial pain later. Another example is the terms and conditions related to benefits like reward points and discounts.

Having a credit card may appear a fancy thing to do, but remember that it requires a lot of financial responsibility on your part.

manas.malhotra@outlookindia.com