When the government introduced the new tax regime (NTR) in 2020, it was pitched as a simpler and clearer alternative to the old tax regime (OTR). No more chasing exemptions, less paperwork, and easier compliance – it was hailed for its lower tax rates.

But for salaried individuals, the choice was not that straightforward as most of the exemptions allowed in OTR was not allowed in NTR.

Now, some new slab revisions have been introduced in NTR in Union Budget 2025. However, even with the latest slabs for financial year 2025-26, taxpayers might still be pondering about deductions and exemptions while planning for their income tax returns (ITRs) to be filed next year (before June 31, 2026). Many might be asking which regime actually works better for them.

What NTR Offers

At a glance, NTR offers lower tax rates and promises a smoother filing experience. You also don’t need to submit proof for investments under Section 80C of the Income-tax Act, 1961, no rent receipts for house rent allowance (HRA), and no medical insurance papers for 80D.

Tax Rates Under NTR For FY 2025-26

Up to Rs 4 lakh: Nil

Rs 4-8 lakh: 5 per cent

Rs 8-12 lakh: 10 per cent

Rs 12-16 lakh: 15 per cent

Rs 16-20 lakh: 20 per cent

Rs 20- 24 lakh: 25 per cent

Above Rs 24 lakh: 30 per cent

Therefore, for those earning up to Rs 12 lakh annually, the new regime is especially attractive, they will have to pay nil tax by taking the benefit of rebate Section 87A.

In fact, even taxpayers with income up to Rs 12.75 lakh can potentially pay nil tax if they opt for the new regime and do not have significant deductions. That includes the benefit of the new Rs 75,000 standard deduction, which has been included for salaried employees and pensioners under this regime.

Says Suresh Surana, a Mumbai-based chartered accountant: “The new tax regime suits individuals with fewer deductions or those who may lack motivation for long-term savings, such as Public Provident Fund (PPF), National Savings Certificate (NSC), or tax-saving fixed deposits (FDs) and prefer to invest in other investment instruments, such as equities and exchange-traded funds (ETFs), among others.

What’s Not Available

This simplicity comes at a cost. The new tax regime does not allow major exemptions or deductions, including:

Section 80C: No tax benefit on PPF, equity-linked savings scheme (ELSS), life insurance premiums, or principal repayment of housing loan.

Section 80D: No deduction on health insurance premiums

Moreover, HRA, leave travel allowance (LTA), interest on home loan, all also not available under the new regime.

This is one of the reasons why the term ‘new tax regime exemptions’ is being widely searched wherein taxpayers want to know what is left, and the answer is, not much.

The few benefits that are allowed include:

The Rs 75,000 standard deduction (newly introduced under the regime)

Employer’s contribution to National Pension System (NPS) under Section 80CCD(2)

Tax-free gratuity, leave encashment, and retirement benefits (unchanged for both regimes)

So, if you are someone who uses deductions as part of your financial planning, whether for insurance, investments, or rent, the old tax regime still gives you more room.

How Much Do You Actually Save

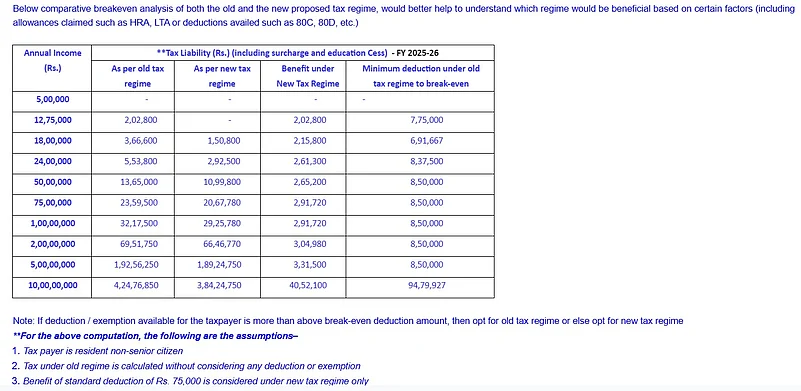

The breakeven point depends on how much you can claim in deductions. The table shows that at most income levels above Rs 18 lakh, if your deductions under the old tax regime are above Rs 8.5 lakh, it still remains more beneficial.

For instance, someone earning Rs 24 lakh annually would pay Rs 5.53 lakh under OTR and Rs 2.92 lakh under NTR, but only if they have no deductions. Add housing loan interest, health insurance, and PPF contributions, and the balance could tip back.

Who Should Choose What

1] Opt for the New Regime If You:

Don’t have many deductions to claim

Don’t pay rent or housing loan EMIs

Prefer a simplified tax process

Invest in equities, mutual funds, or other instruments not tied to tax-saving benefits

2] Stick with the Old Regime If You:

Have a home loan, pay rent, or invest regularly in PPF, ELSS, etc.

Have a health insurance policy and claim 80D deductions

Are comfortable with tax planning and documentation

Claim total deductions exceeding Rs 6.9 to Rs 8.5 lakh (depending on income slab)

However, it is important to know that there is no one-size-fits-all answer. The new regime is definitely simpler and has lower slab rates, but doesn’t give tax benefits of deductions and exemptions on some investments and financial products. The old one gives you more flexibility, but only if you use it right.

Before you lock in your tax choice for FY 2025-26, calculate your deductions, understand what you are giving up, and then decide. If your deduction under the new tax regime is close to nil, you may be better off switching. But if you are using exemptions to their full extent, staying with the old might save you more in the long run.

Says Surana, “Individuals with significant deductions and a structured salary may find the old regime more beneficial, while those who prefer a simpler system with lower tax rates and minimal compliance may opt for the new regime. An annual review of tax liability under both regimes should be made for the purpose of.”