The bi-annual Payment System Report, December 2024 from the Reserve Bank of India (RBI) highlights the trends in India's payment system. Retail digital payments in India surged from 162 crore transactions in the financial year (FY) 2012-13 to over 16,416 crore transactions in FY 2023-24, marking an almost 100-time increase over 12 years. Since the launch of the Unified Payments Interface (UPI), it has steadily captured a larger share of the digital payment landscape.

According to the data, UPI payments have outgrown all other modes of payment in terms of volume. The total digital transactions grew at a compound annual growth rate (CAGR) of 45.9 per cent over the last five years since 2019. CAGR indicates the annualised growth over any given period. In comparison to this, UPI has shown a CAGR of 74 per cent over the last five years since 2019.

This tremendous volume growth in UPI-supported payments may be attributed to various new features in UPI offerings, its easy availability, the enhanced limit for certain transactions like tax payments, the introduction of variants like UPI123, Hello! UPI, UPI Circle, UPI Lite X, etc., to cater to the varied needs of users, and to link with Rupay credit cards, among others.

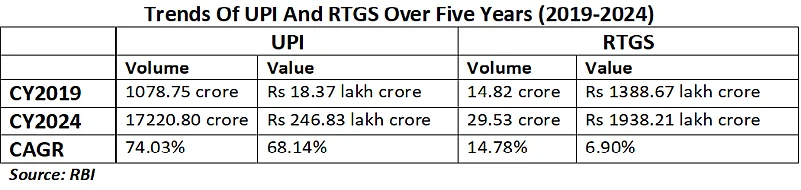

Here is the growth trend of UPI and RTGS.

UPI Leads In Payment Volume:

According to the H2 (second half of 2024) data, UPI led with more than 80 per cent of the total digital payments with around Rs 9324 crore, compared to the total Rs 11130 crore worth of all digital payments in H2.

RTGS Leads In Payment Value:

In terms of value, Real-time gross settlement (RTGS) remained on top with transactions worth Rs 1007 lakh crore, surpassing National Electronic Funds Transfer (NEFT) and UPI with Rs 222 lakh crore, and Rs 130 lakh crore, respectively.

Trends In UPI Payments:

UPI payments have grown from 34 per cent in calendar year (CY) 2019 to 83 per cent in CY2024, reflecting a CAGR rate of 74 per cent over these five years. The trend shows the growing popularity of UPI for retail transactions and a decline in other payment modes, including RTGS, NEFT, credit cards, debit cards, Immediate Payment Service (IMPS), etc.

These have declined from 61 per cent to a mere 17 per cent in these five years.

UPI has certainly changed the digital transaction landscape over these years and more people are willing to use UPI now than ever before. The ease of use in transactions, including both peer-to-peer (P2P) and peer-to-merchant (P2M) makes UPI the first choice among small users.

Trends In RTGS Payments:

RTGS holds the largest share in terms of value, but it is because it is meant only for high-value transactions, with a minimum of Rs 2 lakh. Though RTGS volume has also more than doubled over the last five years, value-wise, the growth came in at 39.6 per cent to Rs 1938.21 lakh crore.