Top Picks

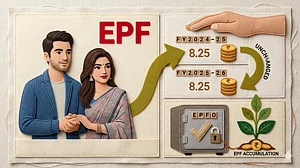

EPF Rates Unchanged At 8.25 Per Cent For 2025-26, Announces EPFO

The Employees’ Provident Fund Organisation’s (EPFO) Central Board of Trustees (CBT) approved the EPF interest rates at 8.25 per cent for the financial year 2025-26. The CBT kept the rates unchanged for the third consecutive year. In the last 10 years, the rates have ranged between 8.10 per cent and 8.80 per cent

What Iran War Means For Indian Investors: The past weekend witnessed one of the most dramatic developments in West Asia’s geopolitics in decades, unnerving market participants across the globe, including in India. Here’s what it means for markets and your investments

Stock Market Today: Equity markets started lower as trade resumed on Monday after Iran strikes over the weekend

POPULAR

Calculate & Plan your future with ICICI Prudential Life's retirement calculator

Yield to maturity is a key metric used by bond investors. Learn how important it is and what the calculation is to arrive at it

Treatments such as laser hair removal, anti-aging procedures, chemical peels, pigmentation correction, or cosmetic mole removal are usually excluded. Insurers draw a clear line between “restoring health” and “enhancing appearance.”

The Income Tax Act requires people to pay taxes on gifts too, except when these gifts meet the specific requirements for exemption.

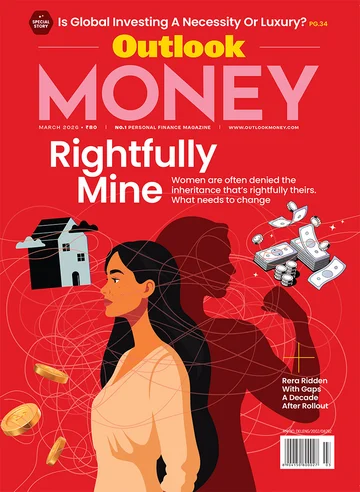

Editor’s Note: Why I Want To Be ‘Sassy’ And ‘Selfish’

To start with, be aware of your rights. Then, tear apart your own reactions and get to the root cause. Next, open up talk within the family on why change is important

Daughters’ Inheritance Rights: Equality On Paper, Obstacles On The Ground

Despite the Hindu Succession Law allowing daughters a share in the ancestral property and father’s property, most of them forego their inheritance rights in favour of their brothers due to societal pressure and to avoid the emotional fallout of being demonised and isolated from their own families. What needs to change is the social mindset to let the law play out like it should

Gold Streedhan 2.0: From Consumption To Investment

For centuries, women have flocked to physical gold, but now they can leverage options like gold ETFs, gold mutual funds, and so on to create and compound wealth

Is Global Investing A Luxury Or Necessity?

Global investing is not about replacing your domestic investments. It is about complementing your portfolio with global exposure to build a diversified and resilient portfolio

Your Portfolio Choice Is The Key

The difference in expenses between direct and regular plans of mutual funds makes a difference to your portfolio returns, but your fund choices make an even bigger difference

Booking A Train Or Flight Ticket? Review Your Insurance Policy

Bundled travel insurance is usually inexpensive, but its coverage is patchy with sub-limits and exclusions. Check before buying whether it’s worth it

Rera Ridden With Gaps A Decade After Rollout

Rera was introduced to fix long-standing issues in the real estate sector, but it has fallen short on many counts. Here’s how homebuyers can make the most of Rera and the recourses they can pursue outside of Rera

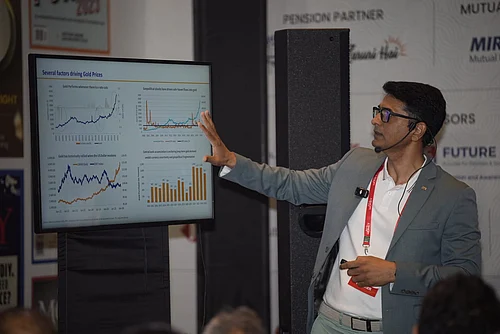

Outlook Money 40After40: Invest Today For A Secure Tomorrow

Policymakers, regulators and industry leaders chart a new roadmap for financial security in an ageing India at the fourth edition of IDFC FIRST Bank presents Outlook Money 40After40 Retirement and Financial Planning Expo

Retire Smart, Not Sorry

Retirement planning is now the predominant financial priority for Indians. However, readiness for retirement has declined sharply. The key is to not procrastinate, but start planning today

Debt MFs Invest In G-secs, Offer More Liquidity Than Direct Bonds

Debt MFs Invest In G-secs, Offer More Liquidity Than Direct Bonds

What Is A Fresh Issue Vs An Offer For Sale In An IPO?

When a company raises funds through an initial public offer (IPO), it can either issue new shares (fresh issue) or allow existing shareholders to sell a portion of their stake, also known as offer for sale (OFS). Understanding the difference between a fresh issue and an OFS can help investors see what the company wants to achieve from its offering.

Sips For Children’s Education: Funding A Future Without Loans

For most parents, a child’s education is not just a financial goal; it is an emotional promise. The aspiration is clear—to offer the best possible opportunities without burdening the child, or the family, with long-term debt. Yet, education costs rarely announce themselves gently.

Hybrid Long Short For Uncertain Markets

Mix equity debt and hedges to reduce drawdowns while staying invested through choppy phases and shocks

Let The Fund Do The Rebalancing

When small caps cool and large caps stabilise, a flexi cap mandate can rotate allocation fast

Why Business Cycle Investing Matters Today

With inflation and geopolitics reshaping cycles, portfolios need rules to shift sectors without chasing headlines

The Structure Behind Thematic Investing

Use macro to spot themes, then apply valuation discipline and measurable growth checks before committing capital

Previous Magazine Issue

The Employees’ Provident Fund Organisation’s (EPFO) Central Board of Trustees (CBT) approved the EPF interest rates at 8.25 per cent for the financial year 2025-26. The CBT kept the rates unchanged for the third consecutive year. In the last 10 years, the rates have ranged between 8.10 per cent and 8.80 per cent